Furlough Scheme Uk Employer Contribution, The Coronavirus Job Retention Scheme Is Changing

Furlough scheme uk employer contribution Indeed lately has been sought by users around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of this post I will talk about about Furlough Scheme Uk Employer Contribution.

- T Ukbhcji1dy8m

- Kllsf53i7ni2fm

- Detail Needed On Employers Furlough Contribution Graeme Dey

- Covid 19 Chancellor Announces New Job Support Scheme To Follow Furlough Scheme Clyde Co

- Uk Coronavirus Record 6 634 New Cases Reported Chancellor Announces Job Support Scheme As It Happened Politics The Guardian

- Coronavirus Job Retention Scheme 10 June Cut Off And Flexible Furloughing From July Lexology

Find, Read, And Discover Furlough Scheme Uk Employer Contribution, Such Us:

- Coronavirus Furlough Scheme To Finish At End Of October Says Chancellor Bbc News

- Insights Into Flexible Furloughing And The Updated Job Kpmg United Kingdom

- Covid 19 Key Uk Employment Issues Guidance Note White Case Llp

- Important Updates To The Covid 19 Job Retention Scheme Menzies

- New Furlough Explained How Job Support Scheme Extension Will Pay Two Thirds Of Wages If Businesses Have To Close

If you re searching for Furlough Extension Till June you've reached the perfect place. We have 100 graphics about furlough extension till june adding pictures, photos, photographs, backgrounds, and much more. In these page, we additionally provide number of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

The evolution of the furlough scheme.

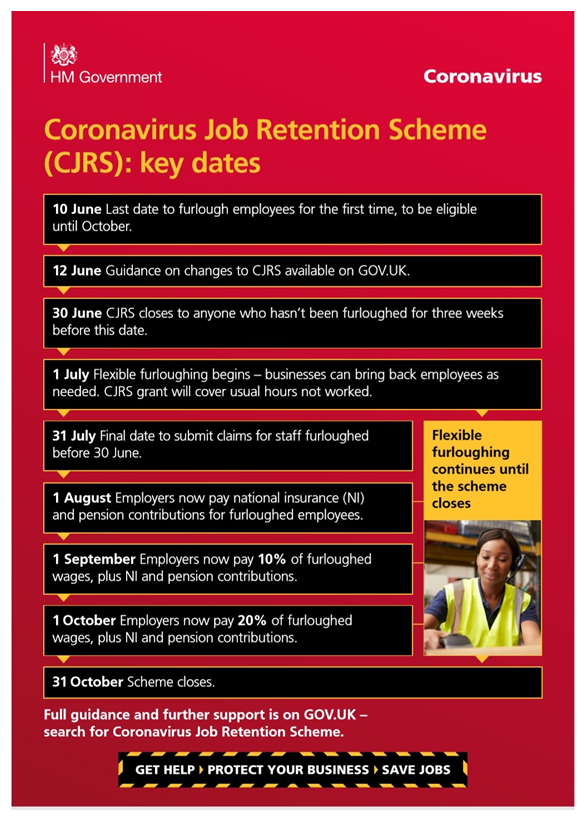

Furlough extension till june. Scheme to new employers and new employees closes 30th june so the last date you can put an employee not previously furloughed on furlough will be the 10th june when you factor in 3 weeks of furlough status to be eligible. Under the coronavirus jobs retention scheme to give furlough its official title employees placed on leave receive 80 of their pay up to a maximum of 2500 a month. Furthermore from september 2020 the government will begin to phase out the furlough scheme by decreasing payments by 10 and decreasing the maximum payment by 313.

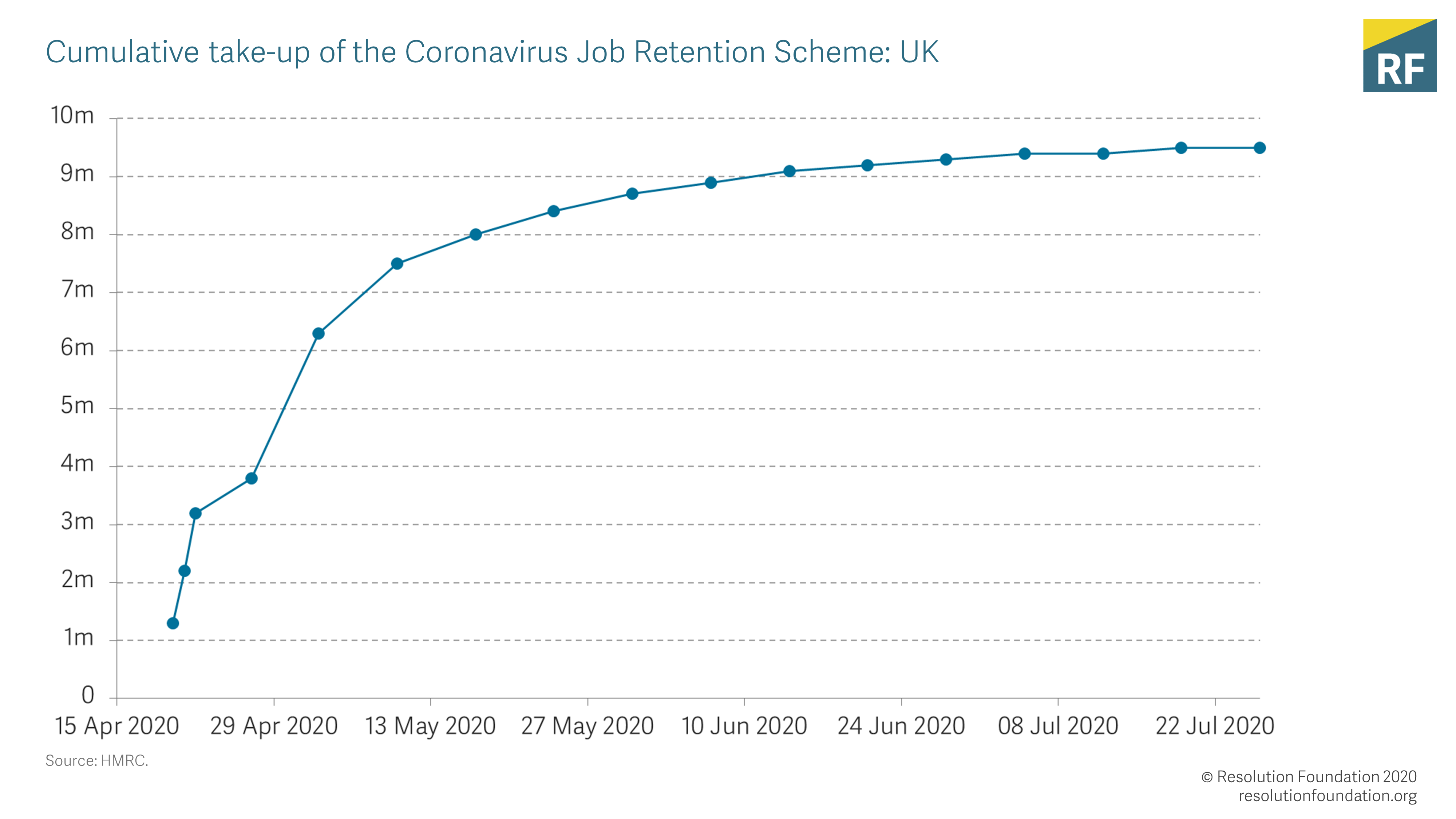

The furlough scheme protected over nine million jobs across the uk and self employed people have received over 13 billion in support. The uncertainty around the employer contribution has caused widespread concern for employers and this uncertainty will remain until further government guidance is provided at the end of may. The scheme remains as it currently is so employers can continue to furlough staff and receive 80 of their pay for the time they are furloughed.

The total employer national insurance contributions due in a pay period should be apportioned on a daily basis with the amount apportioned to any qualifying furlough days forming the basis of the amount that can be claimed through the scheme. The coronavirus job retention scheme cjrs which is commonly known as furlough was first announced on friday 20 march and currently means employers can claim for payments that cover 80 of furloughed employees wages up to a maximum of 2500 per month. Graphic how is it different from the furlough scheme.

The pension scheme rules require a total contribution from the employer of 10 of this notional pre sacrifice pay. The same rules about working apply and employees are not allowed to undertake any work for their employer. The expansion of the job support scheme also does not require any contribution from employers and provides.

August 2020 employers will pay employer national insurance and pension contributions. By mark kaye on 26 may 2020 in furlough collective redundancy. This is in addition to billions of pounds in tax deferrals.

Employers also have the option to top up staff payments.

More From Furlough Extension Till June

- Government Law College Coimbatore Contact Number

- Government And Public Administration Salary Range

- Government Definition Anarchy

- Government Job Updates Whatsapp Group Link

- Government Guidelines For Masks In Shops

Incoming Search Terms:

- Important Updates To The Covid 19 Job Retention Scheme Menzies Government Guidelines For Masks In Shops,

- Job Retention Scheme Next Steps Birketts Solicitors Government Guidelines For Masks In Shops,

- Coronavirus Job Retention Scheme Extension Explained Everything Mobility Leaders Need To Know Thiis Magazine Government Guidelines For Masks In Shops,

- Furlough Timeline Explained What You Need To Know Gc Business Growth Hub Government Guidelines For Masks In Shops,

- The Government Is Not Paying Nine Million People S Wages Resolution Foundation Government Guidelines For Masks In Shops,

- Coronavirus Furlough Scheme To Finish At End Of October Says Chancellor Bbc News Government Guidelines For Masks In Shops,