Australian Government Budget 2020 21 Tax Cuts, Extraordinary Budget Focuses On A Jobs Led Recovery

Australian government budget 2020 21 tax cuts Indeed lately has been sought by consumers around us, maybe one of you personally. Individuals are now accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the title of this article I will discuss about Australian Government Budget 2020 21 Tax Cuts.

- Aus Budget 2019 More Less

- Https Www Pwc Com Gx En Services People Organisation Publications Assets Pwc Australian Budget Supporting Individuals During The Recovery Pdf

- Budget 20 21 Rfs Advice

- Budget 2020 21 Shoalhaven Business Chamber

- Tax Cuts Temporary For Low And Middle Earners Permanent For High Earners The Australia Institute

- 2020 Federal Budget Analysis Greentree Financial

Find, Read, And Discover Australian Government Budget 2020 21 Tax Cuts, Such Us:

- Federal Budget 2020 21 Tax Store

- The Australian Federal Budget 2020 What We Understand So Far

- Federal Budget Income Tax Cuts Brought Forward For 11 Million Australians Australia News The Guardian

- Highlights Australia Federal Budget 20 21 Wolters Kluwer Cch

- Australian Budget 2019 20 7 1 Billion Surplus Forecast And More Tax Cuts Austaxpolicy The Tax And Transfer Policy Blog

If you re looking for Gnm Nursing Government College In Gujarat List Pdf you've arrived at the right location. We ve got 101 images about gnm nursing government college in gujarat list pdf including pictures, photos, pictures, backgrounds, and more. In these webpage, we also have number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Budget Winners Are Grinners Tim Carleton Livewire Gnm Nursing Government College In Gujarat List Pdf

Australian Budget 2019 20 7 1 Billion Surplus Forecast And More Tax Cuts Austaxpolicy The Tax And Transfer Policy Blog Gnm Nursing Government College In Gujarat List Pdf

Billions of dollars in fast tracked tax cuts and younger worker wage subsidies underline the federal governments budget recovery pitch as australias recession sends debt and deficits to record.

Gnm nursing government college in gujarat list pdf. Corporate tax entities with an aggregated turnover of less than 5 billion will be eligible. Our 2020 21 federal budget at a glance infographic also displayed below. The tax free threshold remains 18200.

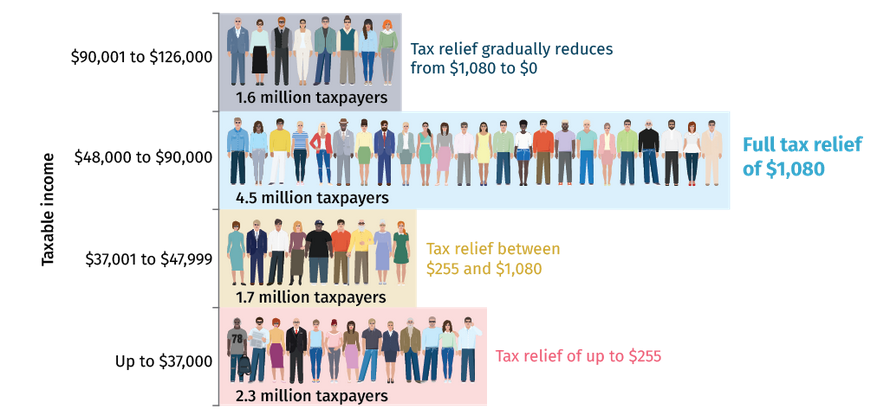

Our 2020 21 federal budget summary. In a bid to drive australia out of its covid 19 recession the federal government pledged 178 billion worth of personal tax cuts in its budget the meat of which is aimed squarely at low to. In the current budget bringing forward personal income tax cuts is seen as a means to stimulate the economy by encouraging spending with the flow on impact of building business confidence.

The federal budget contains income tax cuts for most australians with someone on the average wage set to receive an extra 20 or so each week as soon as the cuts are passed. Federal budget 2020 live blog. Stage 3 will still commence 1 july 2024.

Australian government budget announcement. 178bn package includes permanent cut of 47 a week for high income earners and one off 21 cut for middle income earners. This budget measure will allow eligible companies to carry back tax losses from the 2019 20 2020 21 or 2021 22 income years to offset previously taxed profits in 2018 19 or later income years.

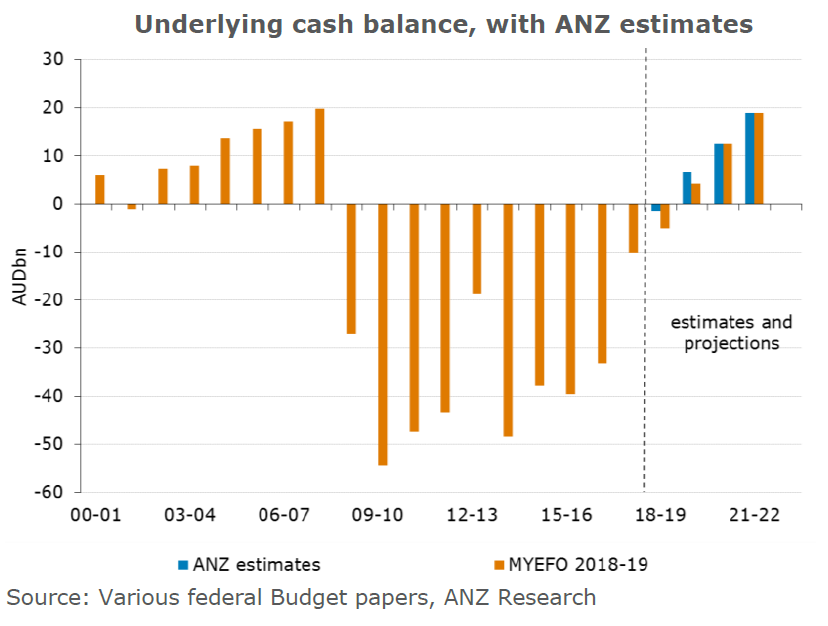

You and your employer clients can use the 202021 tax tables at atogovautaxtables to withhold the right amount of tax for. The underlying cash deficit is estimated to be 2137 billion in 2020 21. The key tax announcements in the budget included the following.

On 6 october 2020 the australian government introduced personal income tax cuts as part of the 202021 budget. These tax cuts bring forward legislated personal income tax cuts from 1 july 2022 to 1 july 2020. After widespread speculation the government has confirmed its.

The government will bring forward personal tax cuts that will see australian workers save up to 2565 in tax this financial year. On tuesday 6 october 2020 the treasurer handed down the governments federal budget 202021.

More From Gnm Nursing Government College In Gujarat List Pdf

- Government Liquidation Hawaii

- Self Employed Workers In India

- Government Forms Pdf

- Self Employed Unemployment Texas

- Top 10 Government Jobs In India

Incoming Search Terms:

- Federal Budget 2020 21 Individuals Rsm Australia Top 10 Government Jobs In India,

- High Income Earners To Reap 88 Of Coalition S Tax Cuts By 2021 22 Australian Economy The Guardian Top 10 Government Jobs In India,

- Budget 20 21 Rfs Advice Top 10 Government Jobs In India,

- Australian Federal Budget 2020 21 Lexology Top 10 Government Jobs In India,

- Https Www Pwc Com Gx En Services People Organisation Publications Assets Pwc Australian Budget Supporting Individuals During The Recovery Pdf Top 10 Government Jobs In India,

- The Budget S Tax Cuts Have Their Critics But This Year They Make Fiscal Sense Top 10 Government Jobs In India,