Central Government Loans For Bc, Ysr Subsidy Loan Registration Sc St Kapu Obmms Application Status

Central government loans for bc Indeed lately has been sought by users around us, perhaps one of you. Individuals are now accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of this article I will discuss about Central Government Loans For Bc.

- Uk Government Drags Its Feet Over No Interest Loan Scheme World News The Guardian

- Telangana State St Sc Bc Corporation Loans Online Apply 50 Subsidy Loans

- Ap Obmms Subsidy Loan Status Ysr Sc St Bc Kapu Obmms Application Status 2020

- B C S Back To School Plan Province Of British Columbia

- Trudeau Unveils Forgivable Loans For Landlords In Small Business Rent Relief Program Victoria News

- Telangana Government To Provide 100 Subsidy Loans To Bcs V6 News Youtube

Find, Read, And Discover Central Government Loans For Bc, Such Us:

- Canadian Students Owe 28b In Government Loans Some Want Feds To Stop Charging Interest National Globalnews Ca

- Regional Rural Banks In India Consolidation Of Regional Rural Banks On Government Agenda

- The Most Common Student Loan Scams And How To Avoid Them

- Pmegp Loan Scheme Eligibility Pmegp Online Application Subsidy Interest Rate Documentation

- Savings Term Deposits And Loan Products Vikaspedia

If you re searching for Government Clipart Free you've reached the ideal place. We have 103 images about government clipart free adding images, photos, pictures, backgrounds, and more. In such web page, we also have number of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

Drinking water flood control waste management transportation tourism and sports.

Government clipart free. The objective of this loan is for it to be favourable for the borrower to meet the debt equity. On friday central government announced to approved the scheme for granting of ex gratia payment of the difference between compound interest and simple interest for next six months of loans more than rs 2 crore. Read more about eligibility and benefits of this scheme now.

You can visit the nearest branch of the bank or financial institution who will guide you on the loan application process. In practice this means that central government compensates the bank for up to 70 per cent of any loss arising on a loan thus guaranteed. Loans are provided through the banks.

The budget will be used to finance infrastructure constrained by funds especially the service sector. By clicking continue you will be directed to other website outside wwwbcacoid which is not affiliated with bca and may have different security level. The government loan scheme is intended to take forward the government of indias make in india campaign and help micro small and medium enterprises take part in the campaign by taking a loan from a small industry development bank of india.

Meanwhile the loan proposed by the dki jakarta government is rp 125 trillion divided into loan proposals of rp 45 trillion in 2020 and rp. Availing government loans for small scale businesses will not cause you much sweat. Since most government loans are dispensed through banks and financial institutions you can directly approach them to avail loans.

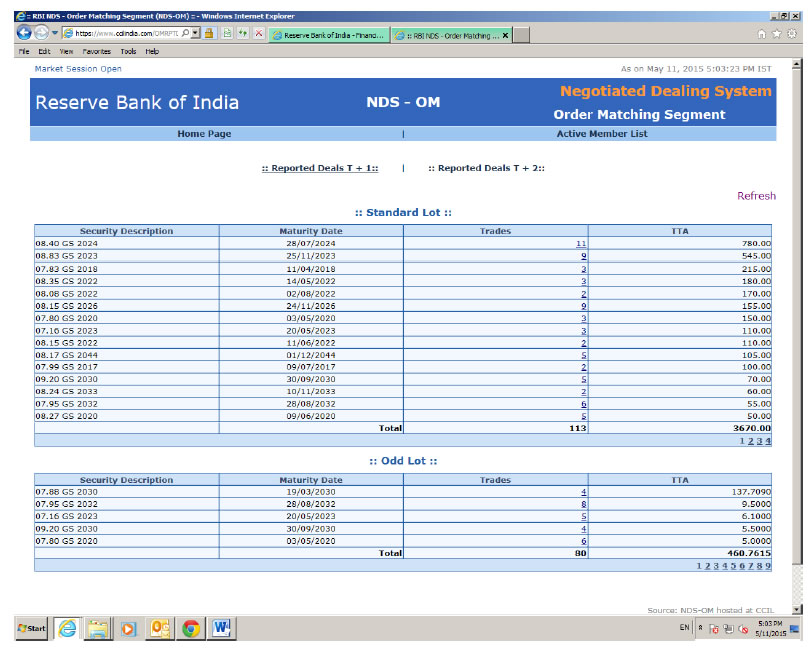

On march 27 the reserve bank of india had announced a three month moratorium on terms loans from march 1.

More From Government Clipart Free

- Government To Citizen Model

- Government Furlough Scheme End Date

- Government Contractor Jobs Richmond Va

- 3 Branches Of State Government And Their Functions

- Furlough Leave June

Incoming Search Terms:

- Andhra Cm To Free Shgs From Debt Under New Scheme Named Ysr Asara Andhra Pradesh Hindustan Times Furlough Leave June,

- B C Government Loans To First Time Homebuyers Available In January Vancouver Sun Furlough Leave June,

- Loans For Women Or Sc St Borrower Bet 10 Lakhs To 1 Cr Under Stand Up India Scheme Icici Bank Furlough Leave June,

- Covid 19 B C Promotes Video Activated Services Card Victoria News Furlough Leave June,

- Scheme For Grant Of Ex Gratia Payment Of Differential Interest For Six Months Loan Moratorium To Borrowers With Faqs Furlough Leave June,

- Central Bank Of India Home Furlough Leave June,