Downloadable 2020 Self Employed Sss Contribution Table 2020, Updated Sss Contribution Table For 2019 Howtoquick Net

Downloadable 2020 self employed sss contribution table 2020 Indeed recently has been hunted by users around us, perhaps one of you. People are now accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the title of the article I will discuss about Downloadable 2020 Self Employed Sss Contribution Table 2020.

- 2019 New And Updated Sss Contribution Table For Ofw S And Other Sss Member

- New Sss Contribution Table 2020

- Complete Guide To Sss Online Registration Contribution Benefits Grit Ph

- Updated Sss Contribution Table For 2019 Howtoquick Net

- Sss Contribution Table 2018 Technobound Review

- Sss Contribution Table Payment Schedule 2020 Bir Tax Information Business Solutions And Professional System

Find, Read, And Discover Downloadable 2020 Self Employed Sss Contribution Table 2020, Such Us:

- Sss Contributions Table And Payment Deadline 2020 Sss Inquiries

- The Complete Sss Contribution Table Guide For 2020 A Couple For The Road

- Sss Contributions Table And Payment Deadline 2020 Sss Inquiries

- 2019 New And Updated Sss Contribution Table For Ofw S And Other Sss Member

- Sss Monthly Contribution Table Schedule Of Payment 2020 The Pinoy Ofw

If you re searching for Government Job Vacancy In Sri Lanka 2020 you've reached the right place. We have 104 images about government job vacancy in sri lanka 2020 including images, pictures, photos, wallpapers, and much more. In these web page, we additionally have variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Click that button to start creating your my.

Government job vacancy in sri lanka 2020. Summary of sss benefits. Sss contribution table 2020. New philhealth contribution table 2020.

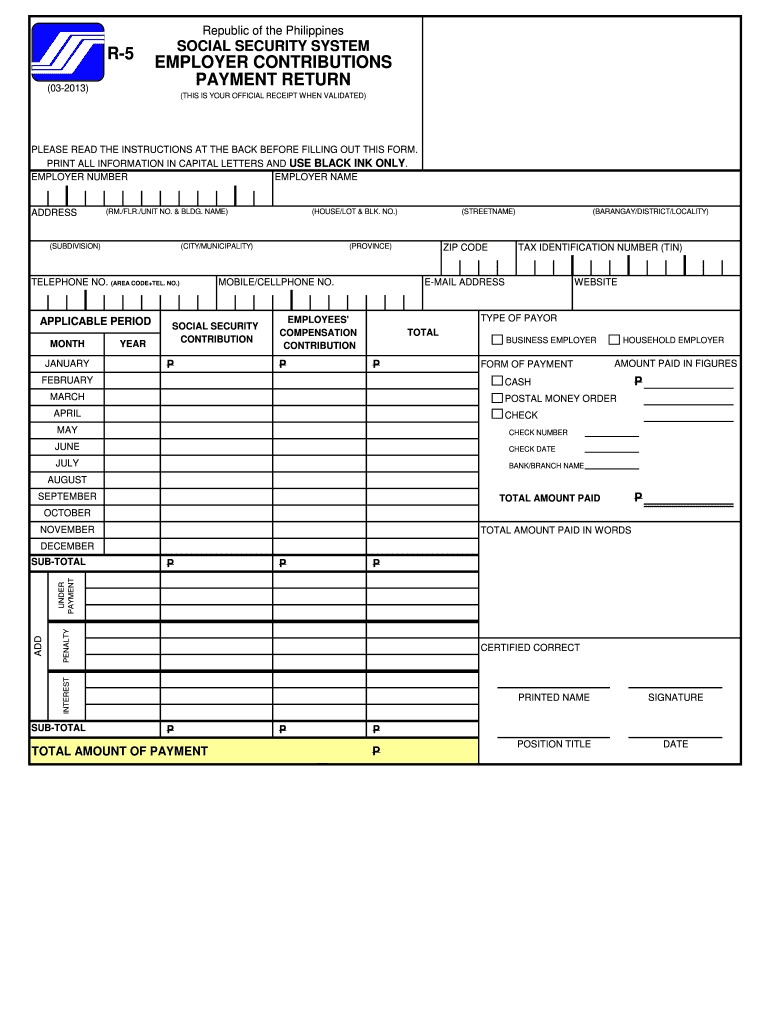

The employer pays 8 while the employee pays 4. Sss contributions of employed self employed voluntary member and non working spouse. The updated sss contribution table starting april 2020 for employees and employers voluntary self employed ofw and kasambahay or household workers to have at least a rough idea on how much contributions are.

The sss contribution table above and the succeeding ones can be used only from april 2019 to the end of 2020 as the contribution rate will increase again in 2021 onwards. The 2020 updated philhealth contribution table take note that the membership category will be applied to those who have formal contracts and fixed terms of employment. Effective april 2019 below is the new sss contribution table for employed self employed voluntary members and non working spouses.

If you are a member of philhealth regardless if you work for the government or not you will share the same premium. The contribution rate for overseas filipino workers ofws earning less than p8250 monthly is p960 and p2400 for those with more than p19750 monthly. 2020 sss contribution table for self employed voluntary or overseas filipino workers.

For employed members the minimum monthly salary credit is php 2000 with a total contribution of php 250 while the maximum monthly salary credit is php 20000 with a total contribution of php 2430. In the table we can see that for a self employed or voluntary member of sss if the salary is p6750 to p7. Employed members are required to pay 12 of their monthly salary credit msc not exceeding p20000.

If you are a worker in the private sector who is earning p2250 or less every month your contribution will be p240 p2000 x 12 240. New sss table of contribution updated 2020 the minimum monthly salary credit or msc is p2000. Explain in detail sss contribution table for 2020 and employed members sss contribution table for ofw voluntary self employed.

There are basically two types of sss members employees and self employed voluntary member or overseas filipino worker sevmofw. If you want to download the sss contributions table 2020 then you may double click this image and save on your phone for your handy reference here is the new sss contributions table for employed self employed voluntary and non working spouse sss members for ofw members.

Philhealth Contribution Table And Payment Schedule For 2020 Tech Pilipinas Government Job Vacancy In Sri Lanka 2020

More From Government Job Vacancy In Sri Lanka 2020

- Furlough Scheme Extended June

- Government Anarchy Picture

- How Does The Furlough Scheme Work For Self Employed

- Government Contractor Jobs Overseas

- Difference Between Self Employed And Hired Workers

Incoming Search Terms:

- New Sss Contribution Table 2020 Sss Answers Difference Between Self Employed And Hired Workers,

- Sss Monthly Contribution Table Schedule Of Payment 2020 The Pinoy Ofw Difference Between Self Employed And Hired Workers,

- Updated Sss Contribution Table 2018 Ph Juander Difference Between Self Employed And Hired Workers,

- 2019 New And Updated Sss Contribution Table For Ofw S And Other Sss Member Difference Between Self Employed And Hired Workers,

- New Sss Contribution Table 2020 Difference Between Self Employed And Hired Workers,

- Sss Contribution Table Payment Schedule 2020 Bir Tax Information Business Solutions And Professional System Difference Between Self Employed And Hired Workers,