Ei For Self Employed Phone Number, Which Unemployed Canadians Will Get Support Behind The Numbers

Ei for self employed phone number Indeed lately has been sought by users around us, maybe one of you personally. People now are accustomed to using the net in gadgets to view image and video information for inspiration, and according to the title of this post I will talk about about Ei For Self Employed Phone Number.

- Https Northernalberta Ymca Ca Cwp Media Ymcaofna Documents P 20and 20c How To Apply For Ei Benefits 1 Pdf

- Self Employed Ei Is Still Possible Ratesdotca

- How To Apply For The Canada Emergency Response Benefit Cerb

- Is This The End Of Canada S Employment Insurance System As We Know It Ipolitics

- Ei Benefits For The Self Employed Million Dollar Journey

- Here S Everything You Need To Know About The Crb Including How It Will Affect Your Taxes Financial Post

Find, Read, And Discover Ei For Self Employed Phone Number, Such Us:

- Timing Is Everything How To Apply And Apply Again For The Canada Emergency Response Benefit Knowledge Bureau

- Step 1 Employment Insurance Benefits Application Process For Those On Lay Off April 24th 2020 Update Unifor Local 707

- Self Employed Slow To Take Up Employment Insurance Cbc News

- Income And Financial Supports Social Planning Toronto

- Cerb Is Transitioning To Ei What Does That Mean Cbc News

If you are searching for Government Organization During The Han Dynasty And The Duties Of Each Division you've reached the right location. We have 100 images about government organization during the han dynasty and the duties of each division adding pictures, pictures, photos, backgrounds, and much more. In these webpage, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Https Northernalberta Ymca Ca Cwp Media Ymcaofna Documents P 20and 20c How To Apply For Ei Benefits 1 Pdf Government Organization During The Han Dynasty And The Duties Of Each Division

Ei Benefits For The Self Employed Million Dollar Journey Government Organization During The Han Dynasty And The Duties Of Each Division

Everyone pays the same rate of ei premiums whether theyre self employed or an employee.

Government organization during the han dynasty and the duties of each division. Resident of canada who is at least 15 years old with a valid social insurance number sin worker is employed or self employed at the time of the application worker earned at least 5000 in 2019 or 2020. Had employment or self employment income of at least 5000 in 2019 or in 2020. This premium rate changes annually.

If you have paid into ei lost your job through no fault of your own and have worked enough insurable hours you are eligible to file for ei benefits. In 2020 youll pay 158 in ei premiums for every 100 you earn. The most youll pay for 2020 is 85636.

Self assessment and self employment information about tax and tax compliance matters for the self employed including how to calculate and pay your tax and file your tax returns. The crb is administered by the canada revenue agency cra. Regardless of your employment activities off the farm you are considered as working a full working week.

Workers including the self employed who are quarantined or sick with covid 19 can apply as can those staying home to take care of a family member with covid 19 who doesnt qualify. In 2020 youll pay 120 in ei premiums for every 100 you earn. If farming is your main means of living whether as a self employed farmer or a part owner of a farming business you normally cannot receive ei benefits during the period of april 1 to september 30.

Youll receive at least 500 per week before taxes or 300 per week before taxes for extended parental benefits but you could receive more. This can make you eligible with as little as 160 hours worked. Canada recovery benefit crb income support if you are self employed or are not eligible for employment insurance ei.

As of september 27 2020 there are some temporary changes to the ei program to help you access ei self employment benefits. The following changes will be in effect for 1 year and could apply to you. Employment insurance ei employment insurance ei has changed to support more canadians through the pandemic.

The canada recovery benefit crb gives income support to employed and self employed individuals who are directly affected by covid 19 and are not entitled to employment insurance ei benefits.

Early Figures For New Aid And Ei Provide Glimpse Of How Post Cerb Supports To Be Used West K News Government Organization During The Han Dynasty And The Duties Of Each Division

More From Government Organization During The Han Dynasty And The Duties Of Each Division

- Us Government Budget Breakdown

- Furlough Scheme Rules And Holidays

- Total Government Jobs In India 2019

- Hp 245 G5 Government Laptop Price

- Government Building

Incoming Search Terms:

- Layoffs Salary Ei And More Your Coronavirus And Employment Questions Answered The Globe And Mail Government Building,

- A Guide To The New Ei And The Government S Three New Benefits For Workers Kamloops This Week Government Building,

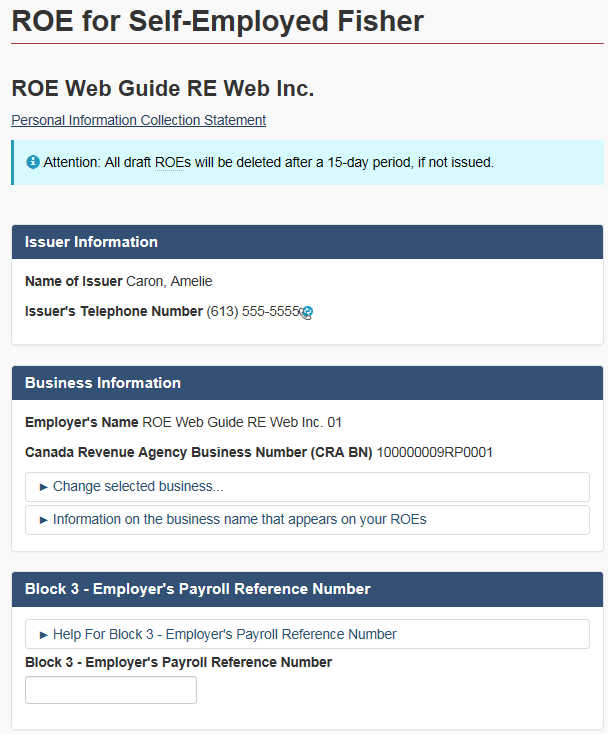

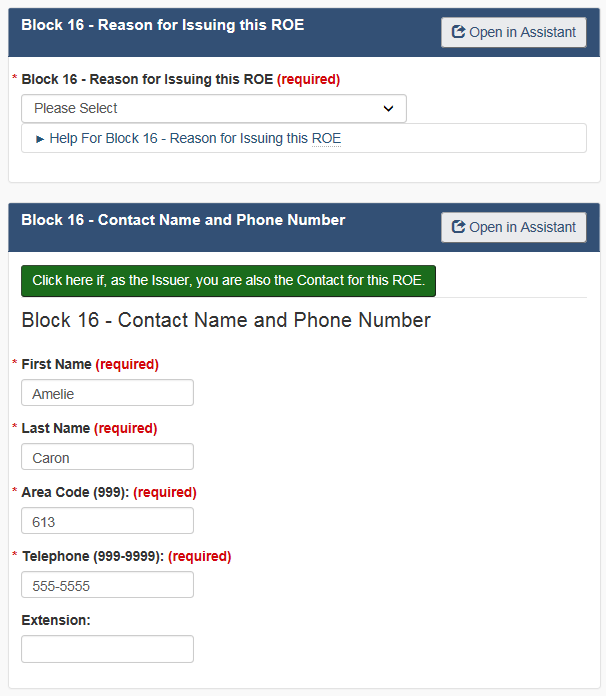

- Roe Web User Guide Canada Ca Government Building,

- Ottawa Unveils 37b Cerb Extension And Transition To Ei New Benefits Ipolitics Government Building,

- Https Schliferclinic Com Wp Content Uploads 2020 03 How To Access Ei For Covid 19 Claims Pdf Government Building,

- Employment Insurance Ei Financial Supports Immigrant Services Calgary Government Building,