Freelance Vs Self Employed Uk, Johnson Urgently Pressed To Cover Self Employed Income Wiped Out By Coronavirus Freelance Uk

Freelance vs self employed uk Indeed lately has been hunted by consumers around us, perhaps one of you personally. Individuals now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of the post I will talk about about Freelance Vs Self Employed Uk.

- Rate Increases For Self Employed Construction Workers Continues To Outstrip The Wage Rises Of Their Employed Counterparts Building Products

- Covid 19 Useful Resources For Freelancers Regional Theatre Young Director Scheme Rtyds

- Self Employment Wikipedia

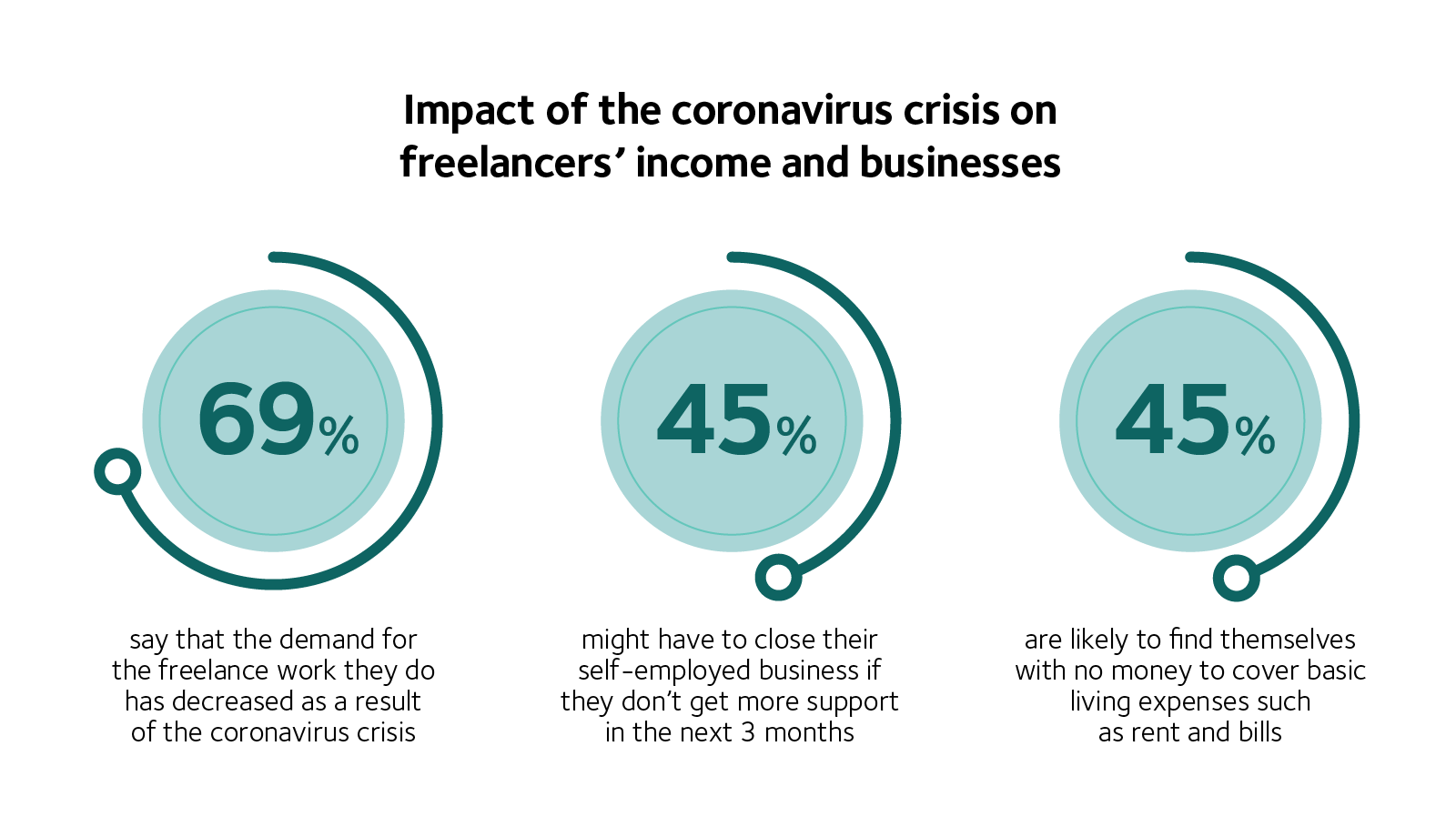

- Coronavirus Report Ipse

- Self Employed Accounts Template Goselfemployed Co In 2020 Small Business Bookkeeping Small Business Finance Bookkeeping Business

- The Difference Between Employed Self Employed And Freelance Grooms

Find, Read, And Discover Freelance Vs Self Employed Uk, Such Us:

- Petition Allow Paye Freelancers To Receive The Uk Government S Covid 19 Self Employed Grant Change Org

- Trends In Self Employment In The Uk Office For National Statistics

- Freelancer Vs Contractor What S The Difference

- Freelancing Or Self Employed Brunel University London

- Covid 19 Government Responds To Open Letter For Temporary Income Protection Fund For The Uk S Self Employed Design Council

If you re searching for Extension Of Furlough Uk you've arrived at the perfect place. We have 100 graphics about extension of furlough uk including images, photos, pictures, backgrounds, and more. In these web page, we also have variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Freelancing During Coronavirus Top Tips For Self Employed People To Trade Through Covid 19 Freelance Uk Extension Of Furlough Uk

Ive been self employed and giving business advice since 2000 but ive never called myself a freelancer.

Extension of furlough uk. The contingent workforce consists of many people from consultants to temps freelance workers to independent contractors and employees. Novel coworking breaks down the main differences. You can start your own business work as a freelancer providing services to lots of different clients or be a contractor like freelancing except you work for one employer for a set period of timeyou can also do any of these things at the same time as being employed by someone else the gig economy has.

Thats never been the way that ive thought about myself. People will be able to receive up to 2500 a month from the government for. People often use freelance and self employed in the same way but are they really similar.

Temps are workers hired by a staffing firm or for seasonal work and employees work year round. To answer this question there are many different factors to consider but the one major factor that is likely to attract freelancers is the tax saving that can be made by trading through a limited company as opposed to becoming self employed. If you start working for yourself youre classed as a sole trader.

Not that theres anything wrong with being a freelancer some of my best friends are freelancers. Freelancers typically operate as their own business. A freelancer could be registered with hmrc as a sole trader but not all sole traders are confined to the definition of a freelancer.

Its important to understand that freelance isnt a formal legal status but a way for you to describe how you work. Freelancer vs independent contractor. How to tell the difference between freelancers and sole traders a sole trader is defined by its business structure but a freelancer may choose how they operate.

From a uk tax point of view freelancers come under the self employed umbrella and so theyre responsible for registering with hmrc as self employed and completing a self assessment tax return each year. There are countless different ways to be self employed. This means youre self employed even if you havent yet told hm revenue and customs hmrcrunning a business.

Instead for tax purposes youre regarded as a sole trader if you run your own business freelancer or otherwise.

More From Extension Of Furlough Uk

- Self Employed Tax Return Uk

- Government Anarchy Examples

- Government Budget Surplus Definition

- Furlough Duration Rules

- Symbol Logo Government Of India

Incoming Search Terms:

- How Ten Years Of Freelancing Has Reshaped The Labour Market Modern Work Magazine Symbol Logo Government Of India,

- How To Avoid Debt If You Re Freelance Or Self Employed Metro News Symbol Logo Government Of India,

- Over Fifties Flock To Self Employment Contractor Tap Symbol Logo Government Of India,

- Petition Uk Government Pay Self Employed 80 Of Their Median Salary During The Coronavirus Pandemic Change Org Symbol Logo Government Of India,

- Freelancer Mobile Phone Usage Stats Self Employed Using Personal Mobile Phones Symbol Logo Government Of India,

- Self Employment Income Support Scheme Grant Extended Symbol Logo Government Of India,