Furlough And Unemployment Pay, Closing Furlough Could Lead To 10 Unemployment Bbc News

Furlough and unemployment pay Indeed lately is being sought by users around us, maybe one of you personally. People are now accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the title of the article I will discuss about Furlough And Unemployment Pay.

- Nj State Worker Furlough Implementation Cwa Local 1033

- Pandemic Unemployment Benefits Expire Soon But Some Arizonans Still Can T Go Back To Work

- Golden Nugget Officials Say Full Time And Part Time Hourly Employees Will Receive Two Weeks Pay

- Unemployment Insurance Benefits Arizona Department Of Economic Security

- Woman Questions Why She Didn T Get Unemployment Benefits Wcnc Com

- End Of Furlough Scheme In October Will Make 1 2million Brits Unemployed

Find, Read, And Discover Furlough And Unemployment Pay, Such Us:

- Bite The Bullet Or Extend Pretend Unemployment In Europe Wolf Street

- Unemployment Insurance Benefits Arizona Department Of Economic Security

- Client Alert Mcmaster Extends Unemployment Benefits To Furloughed Workers

- Coronavirus Unemployment U K Workers Furloughed And Struggling From Covid 19 Lockdown

- Oelwein To Furlough Classified Staff Starting Monday Professional Development Stipend Expected To Make Up Difference Coronavirus Communitynewspapergroup Com

If you re looking for Self Employed Printable Profit And Loss Statement Template you've reached the right location. We ve got 104 images about self employed printable profit and loss statement template including images, pictures, photos, backgrounds, and much more. In these web page, we also have number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

What Is A Furlough And What Does It Mean For Unemployment Benefits Self Employed Printable Profit And Loss Statement Template

.png)

What Does It Mean To Be Furloughed Topresume Self Employed Printable Profit And Loss Statement Template

Heres what you need to know.

Self employed printable profit and loss statement template. However the new stimulus package that was passed by congress on march 27 declared that all americans who have been furloughed due to the coronavirus qualify for unemployment. Big increase in jobless benefits to give millions of people higher pay temporarily. Furloughed workers will be eligible for the additional 600 per week in federal unemployment benefits that was authorized by the 2 trillion stimulus plan passed by lawmakers last month.

But the first stimulus bill provided expanded coverage so that even furloughed employees could receive unemployment benefits. Because any pay received by an employee who is receiving unemployment benefits for the esd workweek will reduce the employees weekly benefit when operationally feasible managers and employees should make their best efforts to select furlough periods that maximize the esd benefit received by the employee. Unemployment insurance and furloughs raise a host of practical questions for hr.

Economy millions of americans will likely find themselves furloughed in the weeks and months to come. You may be trying to access this site from a secured. The amount paid must be not less than two thirds of the employees regular rate as defined under the fair labor standards act multiplied by the normal scheduled hours for the.

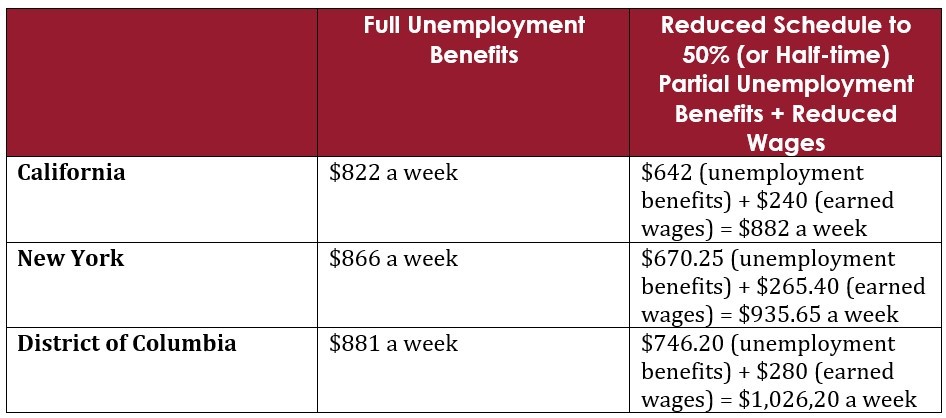

The benefits are generally paid out based on your weekly earning but in the case of furloughed employees the amount will be pro rated based on the length of the furlough. What is a furlough how does it affect employees and can furloughed workers collect unemployment benefits. Unemployment benefits for furloughed employees vary from state to state.

Since unemployment is paid by states not the federal government it will not suffer a budgetary lapse in the. After the first 14 days employers must pay employees during the remainder of the covid 19 fmla eligible leave presumably for up to another 10 weeks of paid leave. A furloughed employee may also take unemployment benefits for their time without pay.

Unemployment compensation is based on a state formula and your regular pay.

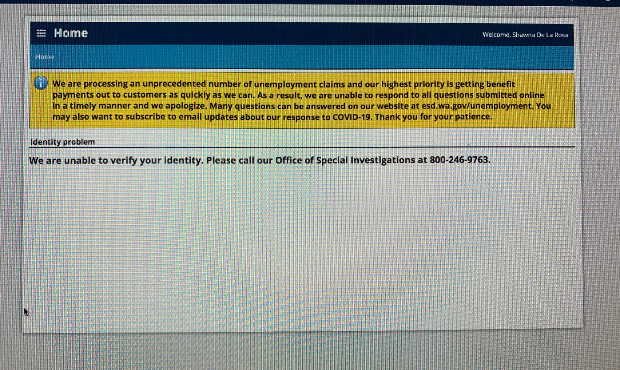

Furloughed Single Mom Details Being Locked Out Of Unemployment Self Employed Printable Profit And Loss Statement Template

More From Self Employed Printable Profit And Loss Statement Template

- Telangana Government Holidays List 2020 Pdf

- South African Government Gazette Death Notices

- Self Employed Benefits California

- New Furlough Scheme Dates

- Government Lockdown Phases Uk

Incoming Search Terms:

- Pandemic Unemployment Benefits Expire Soon But Some Arizonans Still Can T Go Back To Work Government Lockdown Phases Uk,

- Nj State Worker Furlough Implementation Cwa Local 1033 Government Lockdown Phases Uk,

- Coronavirus Relief Often Pays Workers More Than Work Wsj Government Lockdown Phases Uk,

- Future Unemployment Development Still Hard To Predict Nordic Labour Journal Government Lockdown Phases Uk,

- Cooper Signs New Executive Order To Allow People Who Receive Furlough Pay To Get Unemployment News Foxcarolina Com Government Lockdown Phases Uk,

- Furloughed Federal Workers Can Collect Unemployment Government Lockdown Phases Uk,

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/arc-anglerfish-arc2-prod-gmg.s3.amazonaws.com/public/BECSXHG5ZZCY3POQC66C4WTFEM.jpg)