Furlough Leave During Notice Period, How To Approach Redundancy As The Furlough Scheme Winds Down Personnel Today

Furlough leave during notice period Indeed lately has been hunted by users around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of the post I will talk about about Furlough Leave During Notice Period.

- Furlough Leave And Notice Pay Kemp Little

- Notice Pay When On Furlough Under The Cjrs Covid 19

- 2

- September Guidance For Shutdown Furloughs Pdf Free Download

- Dsd Guidance On A Potential Shutdown

- Redundancy And Furlough Notice Pay

Find, Read, And Discover Furlough Leave During Notice Period, Such Us:

- Https Www Southtexascollege Edu Emergency Pdf Furlough Faqs Pdf

- Redundancy And Furlough Notice Pay

- Notice Pay During Furlough Leave Woodfines Solicitors

- Covid 19 Job Retention Scheme Lexology

- The Uk S Coronavirus Furlough Scheme Explained Wired Uk

If you are looking for Sole Trader Self Employed Invoice Template Uk you've arrived at the right place. We ve got 104 graphics about sole trader self employed invoice template uk adding pictures, photos, pictures, backgrounds, and more. In such webpage, we additionally have number of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

If they usually work fixed hours they must be paid their full normal pay while theyre on statutory notice not their reduced furlough rate.

Sole trader self employed invoice template uk. Furlough and statutory notice pay. However an employee with normal working hours who is entitled to contractual notice of at least one week more than statutory notice will not benefit from the terms of section 88. Are those with statutory minimum notice sick or ready and willing to work.

So during furlough leave we believe there are three options. Some employees may therefore be entitled to furlough pay during their notice period and some may be entitled to full pay. Is a furloughed employee ready and willing to work.

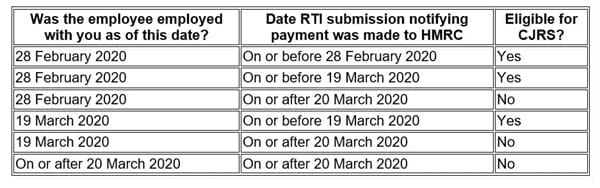

Albeit that if they remain on furlough leave during their notice period the employer will still be able to recover their notice pay up to the usual 802500 cap. Employers can use furlough scheme during contractual notice periods by louron pratt 20th july 2020 1109 am 21st july 2020 430 pm guidance updated by hm revenue and customs hmrc confirms that employers can still claim for furlough payments if an employee has been put on a full notice period. Under the employment rights act 1996 notice pay entitlement varies according to the length of the employees notice period and the type of working hours.

I will continue to demonstrate this using the above example. If the employee leaving has been on furlough temporary leave during the coronavirus covid 19 pandemic they may have received reduced pay in the 12 weeks leading up to their statutory notice period. Accordingly unless the furlough agreement or employment contract says otherwise the employee is only be entitled to their 80 pay during their contractual notice period.

Pay the notice pay at 100 of contractual pay and recover the 80 2500 cap while it is available for all of the contractual notice period ie. Working out the answer is not as easy as it sounds. You need to look at why they are on furlough leave.

This means that the employer will be able to reclaim some or quite possibly all of the notice pay under the furlough scheme. You still have these rights even though you were furloughed when you. There is another complication in relation to furlough and notice pay.

This is deemed the no risk strategy.

Furlough Effects On Redundancy Explained Will You Still Be Entitled To Annual Leave Pay Personal Finance Finance Express Co Uk Sole Trader Self Employed Invoice Template Uk

More From Sole Trader Self Employed Invoice Template Uk

- Government Furlough Scheme Apply

- Cayman Islands Government Administration Building

- Government Office

- What Is Furlough Scheme Means

- October Month Government Holidays 2020 In Tamil Nadu

Incoming Search Terms:

- Furlough To Redundancy What Are The Correct Procedures To Follow October Month Government Holidays 2020 In Tamil Nadu,

- Https Home Treasury Gov System Files 266 Frequently Asked Questions For Furloughed Employees 2018 12 20 Pdf October Month Government Holidays 2020 In Tamil Nadu,

- Redundancy And Furlough Notice Pay October Month Government Holidays 2020 In Tamil Nadu,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcto Otwjqvyzi2hge67fuhwchktmocdewdbms2o0ufpjvhbadc1 Usqp Cau October Month Government Holidays 2020 In Tamil Nadu,

- Https Www Southtexascollege Edu Emergency Pdf Furlough Faqs Pdf October Month Government Holidays 2020 In Tamil Nadu,

- Can I Walk Out Of My Job Without Working My Notice Slater Gordon October Month Government Holidays 2020 In Tamil Nadu,