Self Employed Jobkeeper Application, Covid 19 Faq S Optimised Accounting Werribee Vic

Self employed jobkeeper application Indeed recently is being sought by consumers around us, maybe one of you personally. People now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of this post I will discuss about Self Employed Jobkeeper Application.

- Jobkeeper For Sole Traders How To Enrol Airtax Help Centre

- Jobkeeper Payment Package For Doctors Dpm Financial Serivces

- The Key To The Success Of The 130 Billion Wage Subsidy Is Retrospective Paid Work

- Jobkeeper Payment Information For Employers Unlegislated 4front

- Https Www Highview Com Au Wp Wp Content Uploads 2020 04 Jobkeeper Payment Faq Self Employed Covid19 12apr2020 Pdf

- Our Step By Step Guide To Applying For Jobkeeper Payment Businessdepot

Find, Read, And Discover Self Employed Jobkeeper Application, Such Us:

- Jobkeeper Payment What You Need To Know Srj Walker Wayland

- Forsyths Accounting Financial Services Audit Jobkeeper From 28 September 2020

- Jobkeeper And Jobseeker Information For Photographers

- Uber Driver S Guide To Jobkeeper Jobseeker Coronavirus Payments

- Jobkeeper Update

If you are looking for Government And Public Administration Careers you've reached the ideal place. We ve got 100 graphics about government and public administration careers adding pictures, pictures, photos, wallpapers, and much more. In these webpage, we also have number of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

The jobkeeper payment will be available to eligible businesses including the self employed and not for profits until 28 march 2021.

Government and public administration careers. You must have mygov account that is linked to ato tax portal. This summary is for self employed individuals that run a business. At the time of applying.

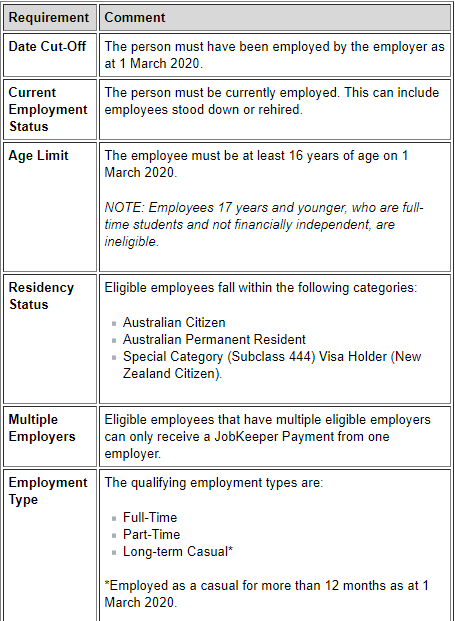

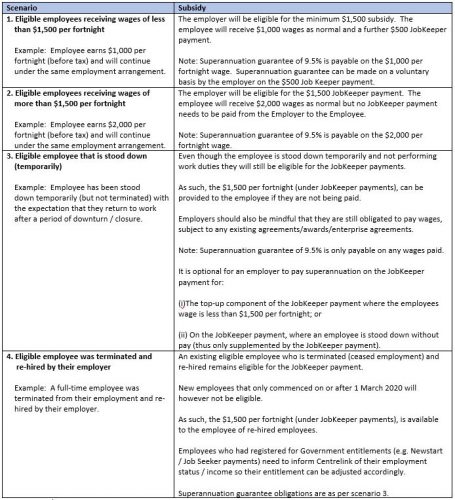

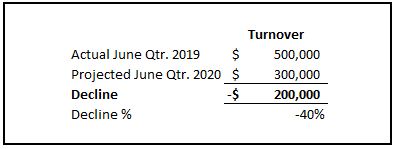

The jobkeeper payment is a scheme to support businesses and not for profit organisations significantly affected by covid 19 to help keep more australians in jobs. There are 5 key steps for this aspect of jobkeeper. From 28 september 2020 employers need to demonstrate that their actual gst turnover has fallen against a comparable period.

Login to mygov and click on ato. The department of treasury has also released updated eligibility criteria for self employed. Ms fish advised self employed workers to keep a reliable account of the records they have that could substantiate the 80 hours working on or in their business during the february period.

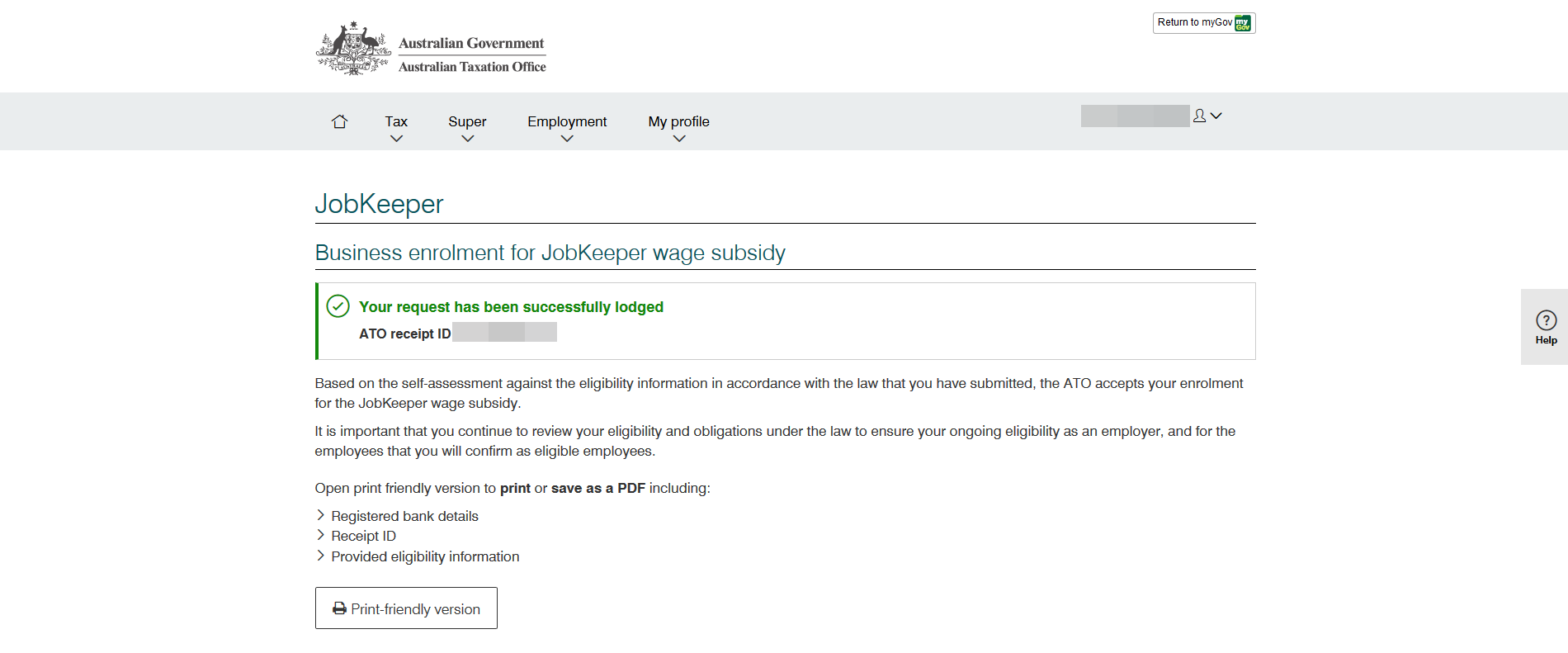

Enrol for the jobkeeper payment. Complete a jobkeeper nomination form other entity form yet to be released. Make a business monthly declaration.

The jobkeeper payment is administered through ato and youve done the right thing by. You can enrol at any time until the program closes and you only need to enrol once. If there are additional checks required or any errors made on your form it may take some additional time for us to resolve.

Payment is administered through services australia so you will need to contact them if you have concerns about your application. Tier 1 and tier 2 jobkeeper rates apply and are generally based on average hours worked by employees. The jobkeeper payment is administered by the australian taxation office ato.

The virtual mybusiness week 2020 continues on 1 october. If you have already enrolled for jobkeeper you do not need to re enrol for the jobkeeper extension. The jobkeeper payment scheme has been extended until 28 march 2021 see jobkeeper extension.

The ato will contact registered businesses and will request evidence of turnover decline and detailed information on employees and their eligibility. Our part 1 summary was for employees of business entities. The system is designed around jobkeeper fortnights.

Login to your mygov account. To view the atos guidance on the jobkeeper payment for sole traders click here. Heres the simple instructions with images how to do that.

Self employed lobby worried audits will result in mayhem. After this you should receive jobkeeper payments within five business days. Identify your eligible employees.

The jobkeeper guide for sole traders will help you through steps 1 3 of your jobkeeper application. If you are sole traderself employed you can apply for jobkeeper payment on ato online portal from april 20 2020. Check actual decline in turnover.

More From Government And Public Administration Careers

- 3 Branches Of Government Quiz 3rd Grade

- Self Employed Relief Loan

- Answer Key Types Of Government Worksheet Answers

- Government Covid 19 Guidelines For Schools

- Furlough Extended October

Incoming Search Terms:

- Updates To The Jobkeeper Payment Plan Workplace Assured Furlough Extended October,

- Jobkeeper Payments The 1500 Jobkeeper Subsidy Dgl Accountants Furlough Extended October,

- The Jobkeeper Payment Explained Everything You Need To Know Taxbanter Furlough Extended October,

- Ato Clarifies Jobkeeper 2 0 Eligibility For The Self Employed Mybusiness Furlough Extended October,

- O Bryan O Donnell Jobkeeper Programme Furlough Extended October,

- Mgr Accountants Group The 1 500 Jobkeeper Package What You Need To Know Furlough Extended October,