Self Employed Health Insurance Deduction 2019 Form, Https Www Guidestone Org Media Guidestone Corporate Ministry Tools Mintaxguide 2112 Mintaxguidesec4 Pdf La En

Self employed health insurance deduction 2019 form Indeed lately has been sought by users around us, maybe one of you personally. Individuals are now accustomed to using the net in gadgets to see image and video data for inspiration, and according to the title of this article I will talk about about Self Employed Health Insurance Deduction 2019 Form.

- Gig Workers Self Employed Disregarded Llc

- Fill In The Missing Information And Or Fix The Inf Chegg Com

- What Is Self Employment Tax And Schedule Se Stride Blog

- For The First Five Months Of The Year Jose Was Em Chegg Com

- Modified Adjusted Gross Income Under The Affordable Care Act Updated With Information For Covid 19 Policies Uc Berkeley Labor Center

- Instructions For Form 8995 A 2019 Internal Revenue Service

Find, Read, And Discover Self Employed Health Insurance Deduction 2019 Form, Such Us:

- Sba Ppp Guidelines For Sole Proprietors And Independent Contractors

- I M Self Employed Can We Deduct My Husband S Medicare Premiums Healthinsurance Org

- Re How To Deduct My Health Insurance Premiums Wit

- Section 80ddb Of Income Tax Act Diseases Covered Paisabazaar Com

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctzu6hiedct3hivqj27jbfrdumefvctn0jtjfopc4vaseqjmipk Usqp Cau

If you are looking for Government Competitive Exams After 12th Commerce 2020 you've reached the right place. We ve got 104 images about government competitive exams after 12th commerce 2020 adding pictures, pictures, photos, wallpapers, and more. In such page, we also provide variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Can I Write My Health Insurance Off As A Business Expense Finance Zacks Government Competitive Exams After 12th Commerce 2020

Health Insurance Tax Deduction Fy 2019 20 Ay 2020 21 Section 80d Government Competitive Exams After 12th Commerce 2020

This is not a business deduction.

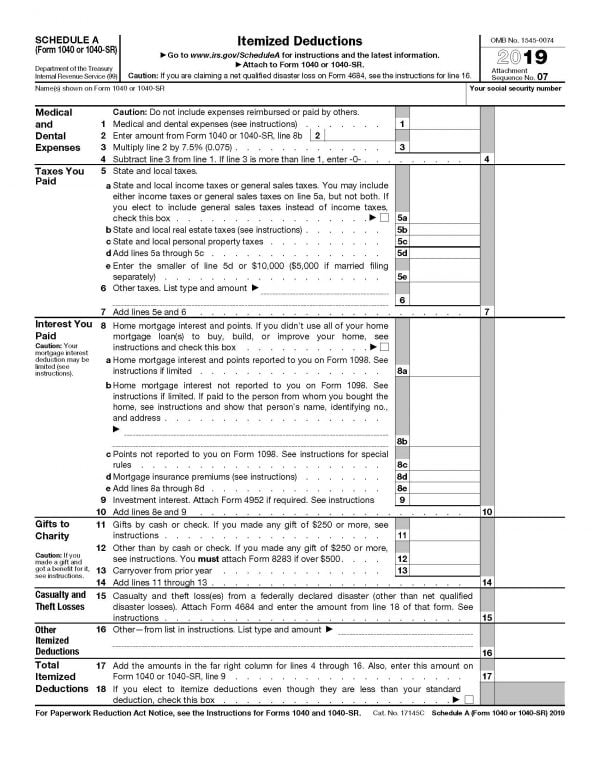

Government competitive exams after 12th commerce 2020. Read on if you wish but no need to come to my rescue as the issue is no longer an issue. The deduction which youll find on line 16 of schedule 1 attached to your form 1040 allows self employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year. Deducting health insurance premiums if youre self employed accessed dec.

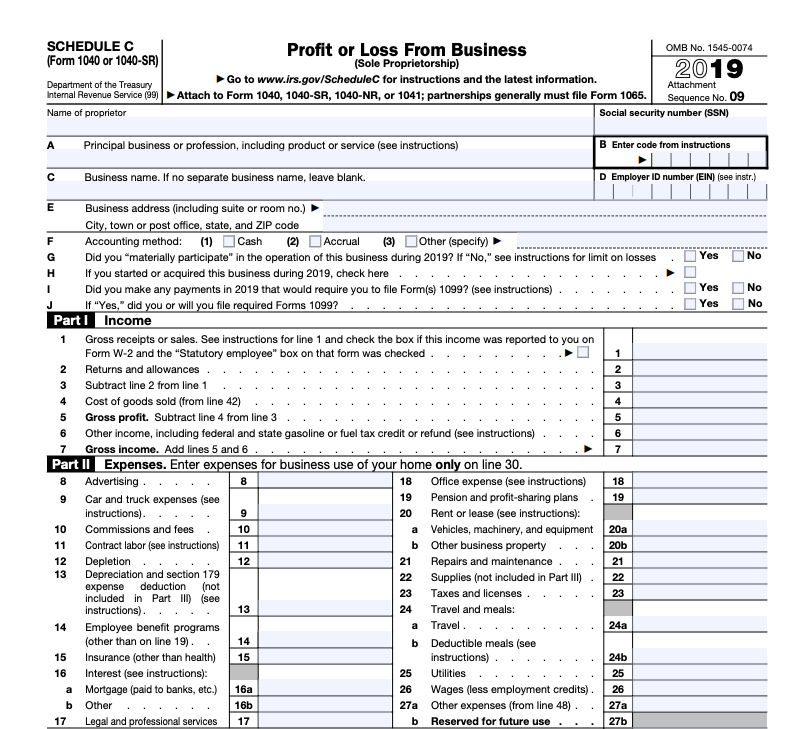

It is a special personal deduction you take on the first page of your form 1040 as self employed health insurance. You will claim this deduction on form 1040 or 1040 sr not on schedule c. Self employed individuals calculating your own retirement plan contribution and deduction accessed dec.

Per the irs instructions for form 1040 starting on page 90. If you have medicare coverage you may deduct your medicare premiums as part of this deductionthis includes all medicare parts not just part b. Self employed health insurance deduction.

And that will help to keep you healthyand happyin 2020 and beyond. The following items highlight some changes in the tax law for 2019. If you are completing the selfemployed health insurance deduction worksheet in your tax return instructions and you were an eligible trade adjustment assistance taa recipient alternative taa ataa recipient reemployment taa rtaa recipient or pension benefit guaranty corporation pbgc payee you must complete form 8885 before.

Selfemployed health insurance deduction worksheet. 2018 self employed health insurance deduction worksheet. The insurance also can cover your child who was under age 27 at the end of 2019 even if the child wasnt your dependent.

Do i enter health insurance premium payments in the expenses section of schedule c for self employed health insurance premium deduction if i already entered data in the personal section. Qualified long term care insurance. If you qualify the deduction for self employed health insurance premiums is a valuable tax break.

With the rising cost of health insurance a tax deduction can help you pay at least a portion of the premium cost. Per the irs instructions for form 1040 starting on page 85. I submitted this query in 2016.

Line 16 self employed health insurance deduction. Its no longer relevant as the process with turbotax has changed. Publication 554 page 2.

The insurance also can cover your child who was under age 27 at the end of 2018 even if the child wasnt your dependent. Trade or business and the unadjusted basis of qualified property held by your trade or business. You may be able to deduct the amount you paid for health insurance for yourself your spouse and your dependents.

Self employed health insurance deduction worksheet form 1040 schedule 1 instructions html.

More From Government Competitive Exams After 12th Commerce 2020

- Government Nursery Near Meenakshi Mall

- Will Furlough Be Extended Past October

- Diagram Branches Of Canadian Government

- Local Government Administration In Nigeria

- Is The Furlough Scheme Likely To Be Extended

Incoming Search Terms:

- Instructions Note This Problem Is For The 2018 Ta Chegg Com Is The Furlough Scheme Likely To Be Extended,

- Staying On Top Of Changes To The 20 Qbi Deduction 199a One Year Later Wffa Cpas Is The Furlough Scheme Likely To Be Extended,

- What Is The Self Employed Health Insurance Deduction Ask Gusto Is The Furlough Scheme Likely To Be Extended,

- The 411 On The Self Employed Health Insurance Deduction Taxact Blog Is The Furlough Scheme Likely To Be Extended,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctzu6hiedct3hivqj27jbfrdumefvctn0jtjfopc4vaseqjmipk Usqp Cau Is The Furlough Scheme Likely To Be Extended,

- Is Health Insurance Tax Deductible Is The Furlough Scheme Likely To Be Extended,