Government Intervention Graph, Maximum Prices Definition Diagrams And Examples Economics Help

Government intervention graph Indeed lately is being sought by users around us, maybe one of you. Individuals are now accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of the post I will talk about about Government Intervention Graph.

- 6 3 Market Failure Principles Of Economics

- The Corresponding Graph Shows The Relevant Curves In The Paper Production Market Specify Your Numerical Answers To Two Decimal Places In The Absence Of Government Intervention How Many Rearms Of Pap Study Com

- Deadweight Loss Wikipedia

- Solved Consider Graph 4 In The Absence Of Government In Chegg Com

- Externalities In Depth Boundless Economics

- Government Intervention In The Market Revisionguru

Find, Read, And Discover Government Intervention Graph, Such Us:

- Market Failure And Government Intervention

- Solved The Effects Of Government Intervention Part 1 Ch Chegg Com

- Econ 150 Microeconomics

- Positive Externalities Economics Help

- Government Intervention In Markets Economics Help

If you are searching for New Furlough Scheme In Scotland you've come to the perfect location. We ve got 104 images about new furlough scheme in scotland including pictures, pictures, photos, backgrounds, and much more. In these webpage, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

The main aim of introducing minimum wages is to reduce poverty and the exploitation of workers who have little or no bargaining power with their employers.

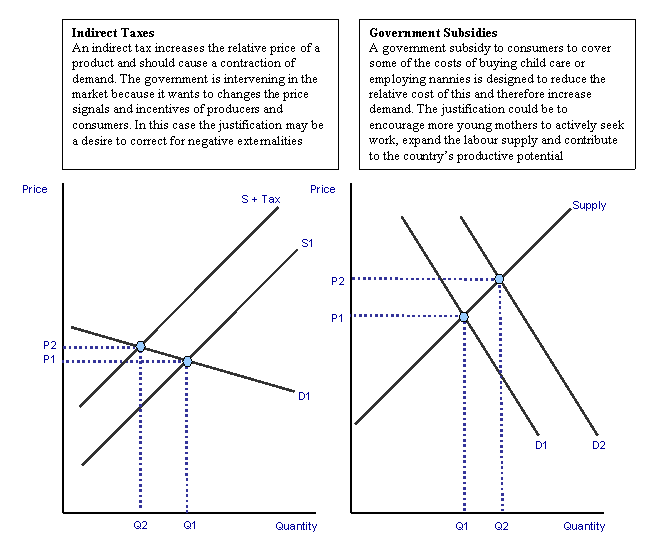

New furlough scheme in scotland. The equilibrium price ensures that all sellers who are willing to sell at that price and all buyers who are willing to buy at that price will get what they want. Government intervention through minimum wages. Examples of indirect taxes.

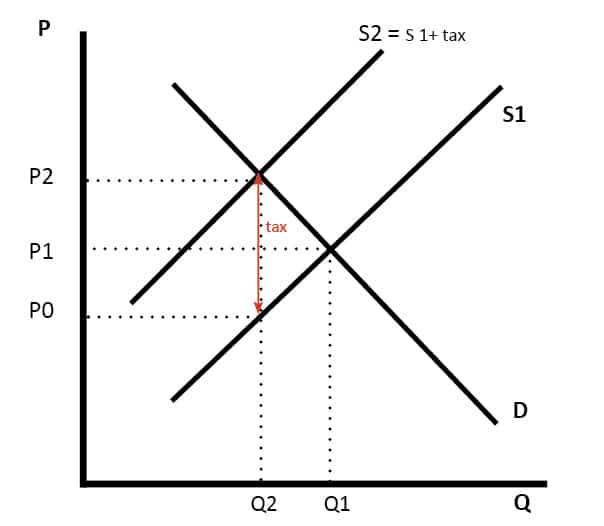

If the maximum price is set above the equilibrium price then it will have no effect. Vat is a tax placed on the expenditure a tax set as a percentage of the price of a good a tax increases the costs of production causing an inward shift in the supply curve. If the government decreases the price of the flu vaccine the demand would rise due to lower prices.

First we must consider the graph for the market for kidneys. Definition a maximum price occurs when a government sets a legal limit on the price of a good or service with the aim of reducing prices below the market equilibrium price. Companies are aware that people will find substitutes.

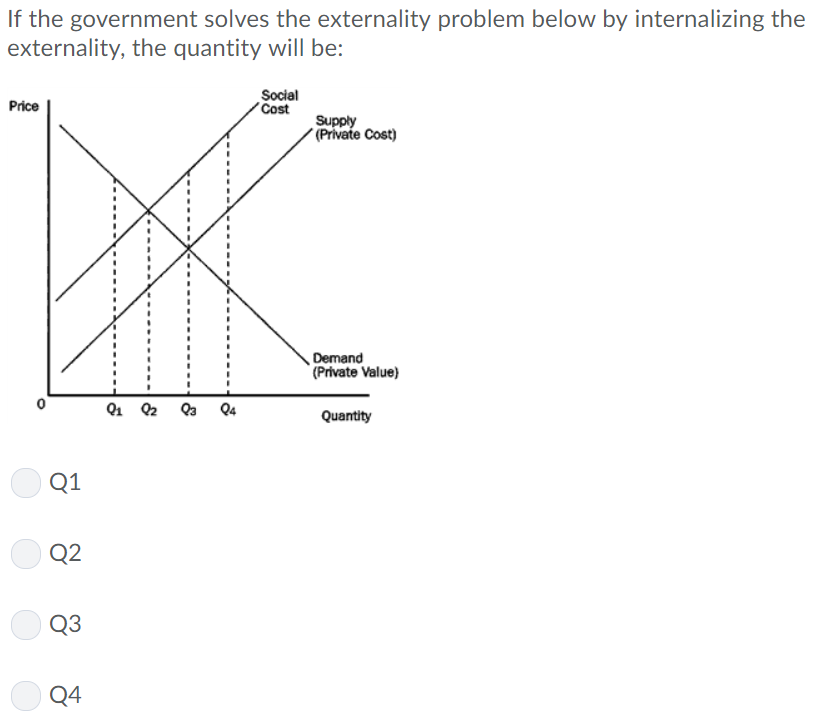

This will lead to the revenue in the firms to increase. The effect of government interventions on surplus. Shown to the left the market for kidneys is made up of a downward sloping demand curve and an upward sloping supply curve.

Therefore the government may feel there is a case to intervene and stabilise prices. Indirect taxes are a form of government intervention in markets. Certain depletable goods like public parks arent owned by an individual.

Ped and indirect taxes short revision video. Example breaking down tax incidence. A buffer stock involve a combination of minimum and maximum prices.

The demand curve in this case represents the aggregate demand for. Taxation and dead weight loss. Percentage tax on hamburgers.

Another example of intervention to promote social welfare involves public goods. For example the government may set a maximum price of bread of 1 or a maximum price of a weekly rent of 150. A minimum wage is the lowest hourly daily or monthly wage that employers may legally pay to employees or workers.

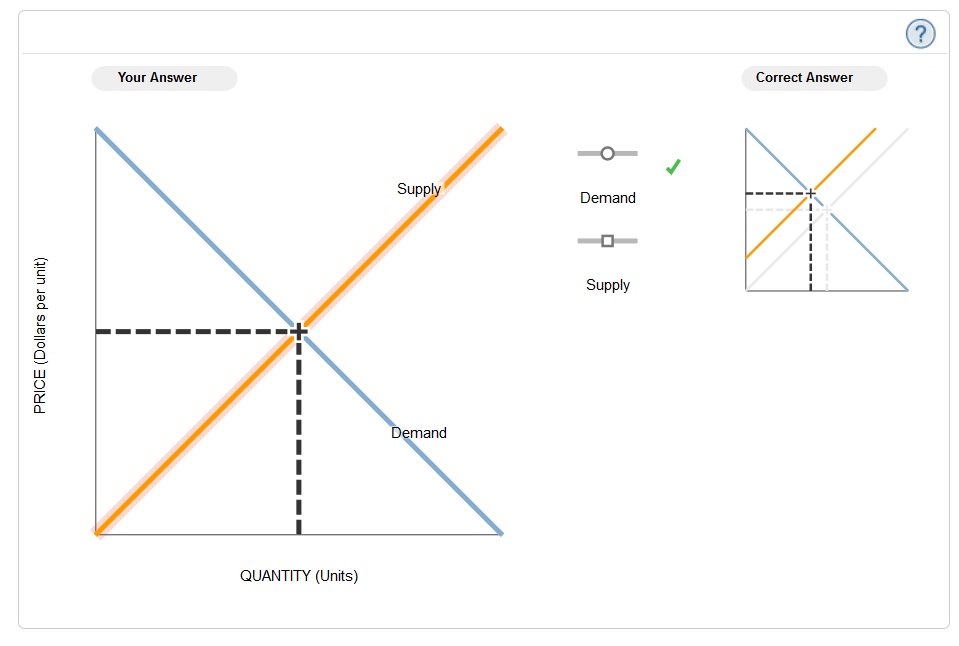

Government intervention with markets summary government intervention with markets theoretically if left alone a market will naturally settle into equilibrium. If a price ceiling is set below the free market equilibrium price as shown where. The idea is to keep prices within a target price band.

This is a different kind of government intervention. Economic efficiency through government intervention and regulation. Taxation and deadweight loss.

It is a government policy to influence demand indirectly. People would purchase more flu shots since the price is much lower than before and it is something they feel like they need to have. Government intervention through regulation can directly address these issues.

More From New Furlough Scheme In Scotland

- Gov Furlough Scheme End Date

- Government Taxes Meme

- Government Intervention In The Market Economy

- Self Employed Businessman Resume

- Furlough Extension Email

Incoming Search Terms:

- Solved The Market For Vaccines In A Small Country Exhibit Chegg Com Furlough Extension Email,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctbah3bskolzn3nuqmb 3xcxmujk3yhhk0xd0tg42n7kjz3azkm Usqp Cau Furlough Extension Email,

- Examples Of How Government Intervention Can Cause Government Failure Economics Help Furlough Extension Email,

- Solved A What Is The Argument For Government Interventio Chegg Com Furlough Extension Email,

- Education Resources For Teachers Schools Students Ezyeducation Furlough Extension Email,

- 1 Furlough Extension Email,