Self Employed Expenses Form, 2017 Self Employment Tax Form Brilliant Self Employed Tax Deductions Worksheet Fresh Free Forms 2018 Self Models Form Ideas

Self employed expenses form Indeed lately is being hunted by users around us, maybe one of you personally. Individuals now are accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the title of the article I will talk about about Self Employed Expenses Form.

- Publication 587 2018 Business Use Of Your Home Internal Revenue Service

- Self Employment Form Fill Out And Sign Printable Pdf Template Signnow

- Self Employment Income And Expense Statement Free Download

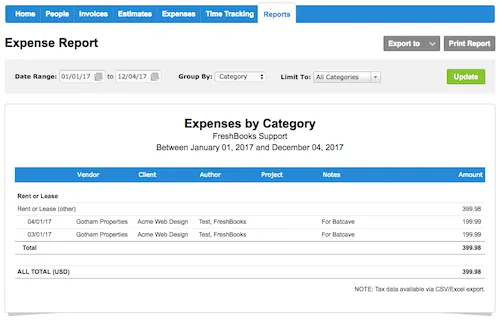

- Self Employed Expenses Spreadsheet Ipad Seld For Template Personal Business Excel Sheet And Income Sarahdrydenpeterson

- Expense Form Template Self Employed Expenses Spreadsheet Free Excel Bookkeeping Sarahdrydenpeterson

- Your Complete Guide To Self Employment Taxes In 2020 Ridester Com

Find, Read, And Discover Self Employed Expenses Form, Such Us:

- 7 Items To Bring For A Successful Individual Tax Consultation Columbia Missouri Accountants Accounting Plus Inc

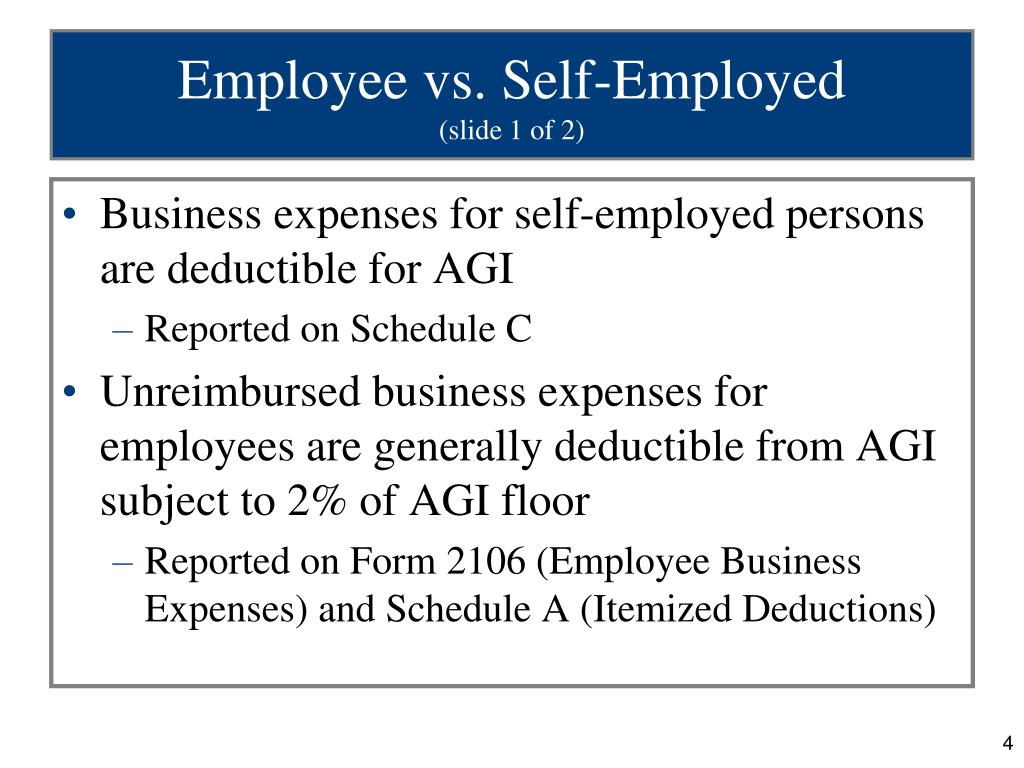

- Ppt Chapter 9 Powerpoint Presentation Free Download Id 526062

- Revenue Form 11 The Ultimate Guide To Your Tax Returns

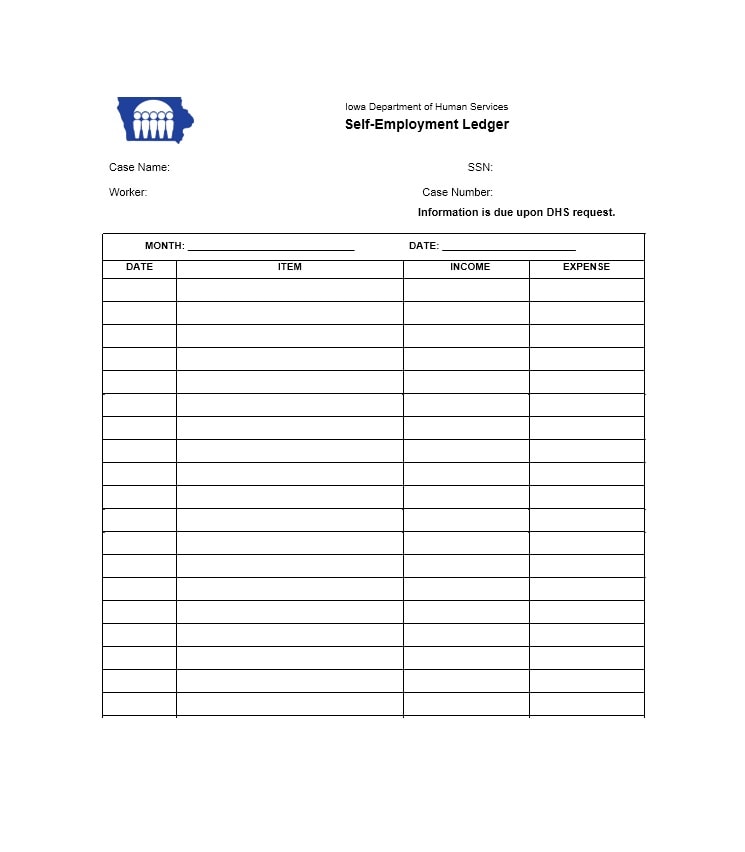

- Self Employment Ledger Fill Out And Sign Printable Pdf Template Signnow

- Https Medquest Hawaii Gov Content Dam Formsanddocuments Client Forms Dhs 1109 Report Of Self Employment Earnings Dhs 1109 11 18 Final 3 Pdf Jcr Content Type Pdf Process

If you are searching for Government Bodies Clipart you've come to the perfect location. We have 104 graphics about government bodies clipart adding images, photos, pictures, wallpapers, and more. In these web page, we also provide number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

This is used to declare the expenses of a self employed person for the purposes of tax deductions.

Government bodies clipart. You receive income in addition to paye eg. Self employed incomeexpense sheet name of proprietor business address business name federal id. It keeps checking the bank figure much easier.

You only need to pay tax on 20000 which is your taxable profit. The self employed bookkeeping template runs from april to march. If your accounting period is 6 th april to 5 th april the best advice is to add the end of the year april figures into march.

Fill out securely sign print or email your self employment income expense tracking worksheet form instantly with signnow. Investment portfolio rental income income from a construction trade capital gains consulting contracting or if you receive any other untaxed income from nixers or work. List on back purchases of.

Your business earns 25000 in a tax year but your allowable expenses add up to 5000. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Expenses spreadsheet for self employed.

Deductible business expenses are those that are considered ordinary and necessary to the operation of your business. Understanding which of your self employed expenses are allowable and calculating your profit accurately is important for making sure you pay the right amount of tax. Whether its for your own accounting or to manage your billable expenses an expenses spreadsheet can help you stay organized and maximize your tax deductions.

Full instructions on using the cash book template are available here. This form is meant to assist clients with properly catagorizing their income and expenses and nothing more. Schedule se form 1040 or 1040 sr self employment tax pdf instructions for schedule se form 1040 or 1040 sr self employment tax pdf schedule k 1 form 1065 partners share of income credits deductions etc.

Youre a contractor or sub contractor. An ordinary expense is one that is common and natural in your field or business. Youre a landlord or host airbnb in ireland.

Number automobile mileage adequate records required. Available for pc ios and android. You must file an irish tax return if any of the following apply.

If youre self employed your business will have various running costs. You can deduct some of these costs to work out your taxable profit as long as theyre allowable expenses. This is an error free detailed record showing self employment cash returns both expenses and incomes.

Start a free trial now to save yourself time and money. Weve built it to help you get peace of mind and get on with your work. Self employed bookkeeping template.

More From Government Bodies Clipart

- Register As Self Employed Uk Hmrc

- Government Vouchers Malta Contact Number

- Furlough Scheme Extended Scotland

- Self Employed Quarantine Pass

- Government Updates Today

Incoming Search Terms:

- Self Employment Page Sole Traders Short Version Freeagent Government Updates Today,

- Who S Required To Fill Out A Schedule C Irs Form Government Updates Today,

- Self Employment Verification Form Child Care Services Templates At Allbusinesstemplates Com Government Updates Today,

- 4 Tax Programs To File Self Employed Taxes Online For Less Than 100 Careful Cents Government Updates Today,

- Self Employment Ledger Fill Out And Sign Printable Pdf Template Signnow Government Updates Today,

- How To Register As A Self Employed Person In Singapore Lancerx Government Updates Today,