Self Employed National Insurance Percentage, The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk

Self employed national insurance percentage Indeed lately has been hunted by consumers around us, maybe one of you. People now are accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of this post I will talk about about Self Employed National Insurance Percentage.

- Https Www Ilo Org Wcmsp5 Groups Public Ed Protect Soc Sec Documents Publication Wcms 645692 Pdf

- Self Employment Tax Rises Economics Help

- Can I Be Employed And Self Employed At The Same Time Dns Accounting

- Self Employed National Insurance Contribution Rates Poland Unraveled

- Are You Employed Are You Self Employed Kbm Financial Focus Facebook

- National Insurance Threshold Contributions Will Be Raised For 2020 Personal Finance Finance Express Co Uk

Find, Read, And Discover Self Employed National Insurance Percentage, Such Us:

- Income Tax Wikipedia

- United Kingdom National Insurance Income Tax Paper Abolition Graphic Transparent Png

- 10 Options For Increasing Tax Summary

- Budget 2020 National Insurance Threshold To Rise From April Financial Times

- Are You Employed Are You Self Employed Kbm Financial Focus Facebook

If you are looking for Furlough Extension September you've come to the right location. We ve got 100 graphics about furlough extension september adding images, photos, photographs, backgrounds, and much more. In such page, we additionally provide variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

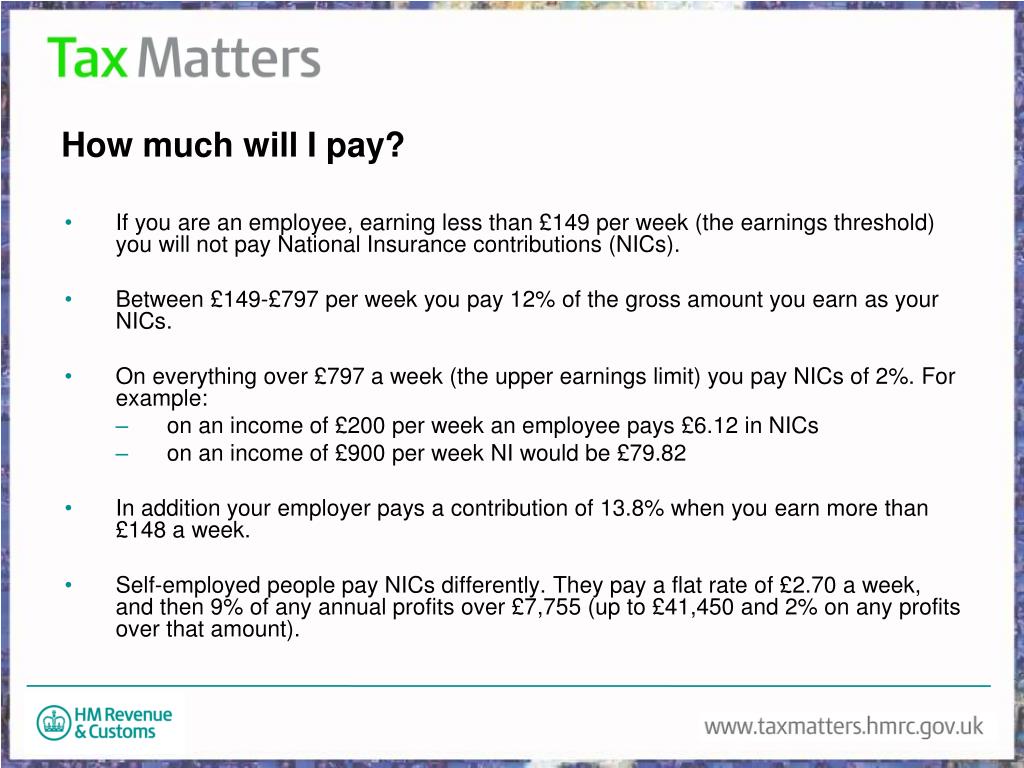

As of january 2020 self employed national insurance contributions nics will be categorised as class 2 when profits are between 6365 and 863199 a year.

Furlough extension september. Class 2 contributions are charged at 300 per week and are usually paid by direct debit. What is class 2 national insurance. If youre over this limit you will pay 3 a week or 156 a year for the 201920 tax year and 305 a week or 15860 a year for the 2020.

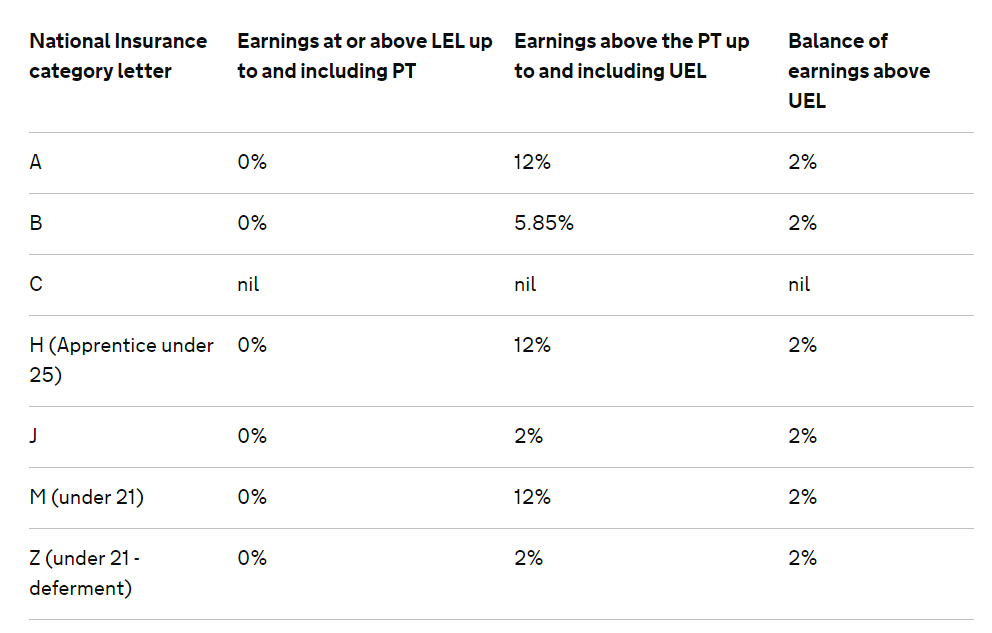

Employed persons who earn less than 60 per week pay contributions at the rate of 17 percent of their wages. Class 4 contributions are charged as a percentage of your profits. What is needed to be registered with national insurance as a self employed person.

The rate changes with each tax year. Do self employed workers pay national insurance. The class 2 national insurance contribution is a fixed amount of 305 a week and its only charged if your annual profits are 6475 or more.

In this case your employer will deduct your class 1 national insurance from your wages and you may have to pay class 2 and 4 national. At the time of writing the rate for class 4 contributions is 9 on profits between 9501 and 50000 and 2 on. You might be an employee but also do self employed work.

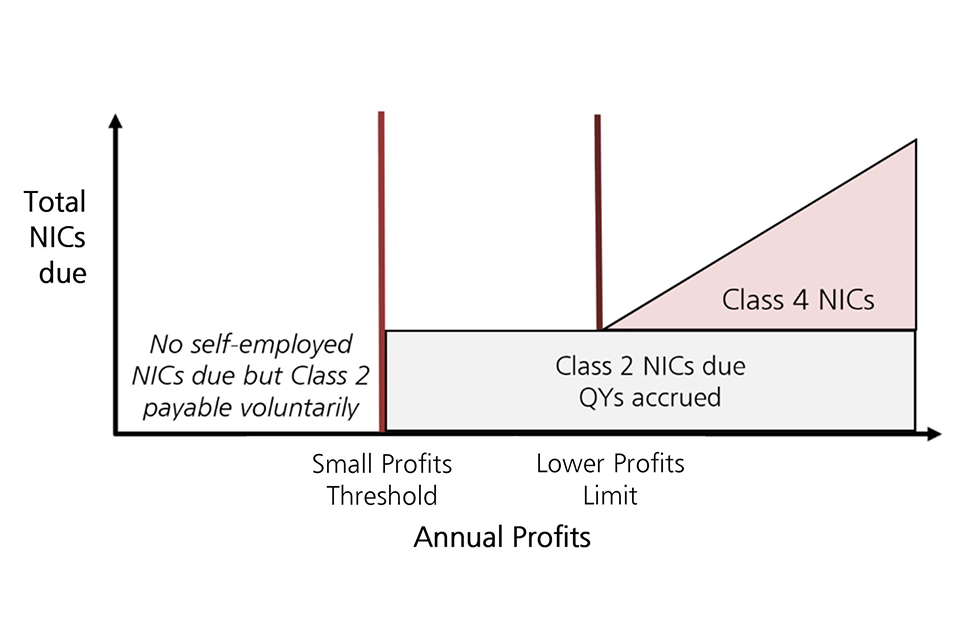

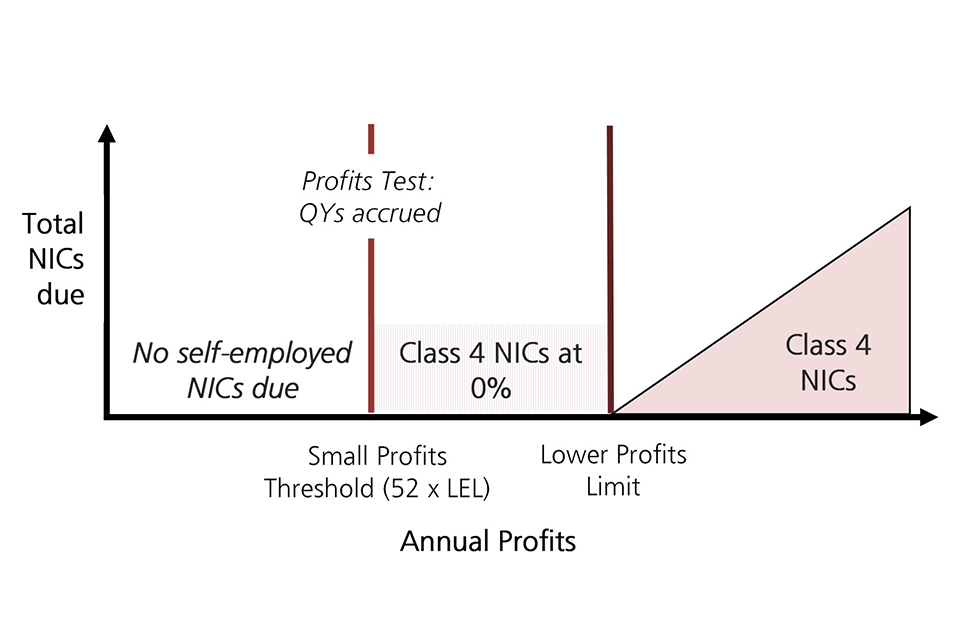

Class 2 and class 4 nics are charged at different rates. Class 4 national insurance contributions are only charged if your profits are above 9500 a yearthe rate is nine per cent of profits between 9501. If a self employed worker earns 8632 or more a year they will be categorised as class 4.

Yes most self employed people pay class 2 nics if your profits are at least 6475 during the 202021 tax year or 6365 in the 201920 tax year. Employed persons who earn from 60 per week up to the weekly. You usually pay 2 types of national insurance if youre self employed.

Self employed people who are sole traders pay national insurance based on how much profit they make from their business. National insurance unlike income tax is only payable by people who aged 16 years or over and are below the state pension retirement age. During the period march 23 2020 to october 16 2020 the national insurance scheme nis paid 1232 million to 32003.

Their employers contribute 71 percent on their behalf for a total of 88 percent. Class 2 if your profits are 6475 or more a year. Class 2 and class 4 national insurance self employed there are 2 types of national insurance for people who work for themselves depending on their profits.

The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk Furlough Extension September

More From Furlough Extension September

- Self Employed Furlough Uk Gov

- Self Employed Furlough Scheme Requirements

- Indonesian Government

- Self Employed Home Loan Rates

- Indian Government Bonds Capital Gains Tax

Incoming Search Terms:

- Selfemployment Tax Transparent Background Png Cliparts Free Download Hiclipart Indian Government Bonds Capital Gains Tax,

- Can I Be Employed And Self Employed At The Same Time Dns Accounting Indian Government Bonds Capital Gains Tax,

- Tax News Factsheet National Insurance And The Self Employed Indian Government Bonds Capital Gains Tax,

- The Abolition Of Class 2 National Insurance Introducing A Benefit Test Into Class 4 National Insurance For The Self Employed Gov Uk Indian Government Bonds Capital Gains Tax,

- Http Researchbriefings Files Parliament Uk Documents Cbp 7918 Cbp 7918 Pdf Indian Government Bonds Capital Gains Tax,

- Levelling The Tax Playing Field For Workers Taxation Indian Government Bonds Capital Gains Tax,