Indian Government Bonds Capital Gains Tax, Clarity On Tax Rupee Denominated Bonds

Indian government bonds capital gains tax Indeed recently has been sought by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the title of this post I will discuss about Indian Government Bonds Capital Gains Tax.

- Fpi Fpi Association Urges Government To Reduce Taxes Push Reforms The Economic Times

- What Is Long Term Capital Gains Tax The Financial Express

- Capital Gains For Itr Filing How To Calculate Capital Gains

- Initial Public Offerings Bonus And Rights Issues Will Be Eligible For Concessional Rate Of 10 Long Term Capital Gains Ltcg Tax Even If The Securities Transaction Tax Stt Has Not Been Paid Earlier

- Capital Gains Tax By Basith Abdul Issuu

- Capital Gains Exemption On Sale Of Land How To Save Capital Gains Tax

Find, Read, And Discover Indian Government Bonds Capital Gains Tax, Such Us:

- Tax Free Bonds In India Is This Tax Saving Investment For You The Financial Express

- Http Www Incometaxgujarat Org Pdf Circular11 6of2016 Pdf

- Tax System And Its Structure In India

- What Are Tax Free Bonds And How They Work The Economic Times

- Tax On Mutual Funds In India Capital Gains Divident Income And More Scripbox

If you are looking for Cornerstone Government Affairs Des Moines you've come to the ideal location. We ve got 104 graphics about cornerstone government affairs des moines adding images, photos, pictures, wallpapers, and much more. In such web page, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

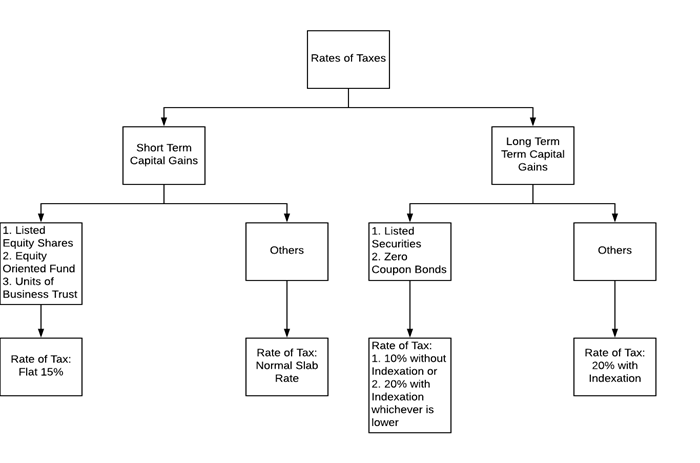

Short term capital gains from sale of tax free bonds on exchanges are taxed at your income tax slab rate while long term capital gains are taxed at 10 without indexation.

Cornerstone government affairs des moines. Board of india act 1992 will always be treated as capital asset hence such securities cannot be treated as stock in trade. As per provisions of income tax act 1961 any long term capital gains arising from transfer of any capital asset would be exempt from tax under section 54ec of the act if. The maximum limit for investing in 54ec bonds is rs.

Check out our capital gains tax calculator. The indexation benefit is not available for bondsncds. Long term capital gains ltcg are taxable under the income tax act.

The entire capital gain realized is invested within 6 months of the date of transfer in eligible bonds. However 54ec bonds can only save long term capital gains taxes and not short term capital gains taxes. Save tax on long term capital gains by investing in 54ec bonds such as rec capital gain bonds nhai capital gain bonds respectively.

In that case the deposit will be viewed as an investment in capital gains bonds in india upon which tax exemption will be available under the capital gains account scheme 1988. However you can get exemption on ltcg tax under sections 54 54f and 54ecwhile the sections 54 and 54f pertain to purchasing a house with the capital gains made section 54ec allows you to claim exemption from ltcg tax on purchase of notified government bonds. As we said above an individual can invest in these bonds after receiving capital gains from selling a property sale of land or.

The capital gains tax is levied on the sale of long term assets and can be saved if the funds are invested in the capital gains bonds as mentioned under section 54ec within six months of the date of sale. Tax exemptions available in respect of long term capital gains arising on bonds the tax payer has an option to avail exemption on the long term capital gains tax under section 54 f by investing the net sale proceeds in buying a residential house subject to fulfilment of certain conditions. V special bearer bonds 1991.

However if such deposit does not convert to an investment within 2 years it will be treated as a short term capital gain in the year of expiry. It is 30 for short term capital gain and 20 for long term capital gain and this is irrespective of tax slab. Tax on long term capital gains.

Unlike indian residents tds tax deducted at source has to be paid by nris. If you sell your bond for a price that is more than the cost then you would have to consider this as a capital gain. Capital gains bonds by nhai and rec help people to save the tax paid on the sale of a long term capital asset.

Nris can waive off their lability to pay tds on the long term capital gain if they choose to invest in another property or capital gain bonds this has.

More From Cornerstone Government Affairs Des Moines

- Clipart Ancient Egypt Government Officials

- Difference Between Government And Governance Venn Diagram

- Self Employed Furlough Scheme Payment

- Government Guarantee Scheme Malaysia

- Charlie Hebdo Cartoon Government Building

Incoming Search Terms:

- Mutual Funds Taxation Rules Fy 2019 20 Mf Capital Gains Tax Chart Charlie Hebdo Cartoon Government Building,

- Capital Gains Tax Wikipedia Charlie Hebdo Cartoon Government Building,

- Tax System And Its Structure In India Charlie Hebdo Cartoon Government Building,

- Tax On Bonds Will Vary Depending On The Type Holding Period Charlie Hebdo Cartoon Government Building,

- Government Securities Varsity By Zerodha Charlie Hebdo Cartoon Government Building,

- Sovereign Gold Bonds Should You Invest Charlie Hebdo Cartoon Government Building,