Self Employed Furlough Taxable, Tax Laws A Grenade About To Go Off Under The Self Employed

Self employed furlough taxable Indeed recently is being sought by consumers around us, perhaps one of you. Individuals now are accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the name of the article I will discuss about Self Employed Furlough Taxable.

- U K Government Unveils Package To Pay Self Employed 80 Of Income But The Money Won T Be Available Until June Marketwatch

- Ask Icas Webinar 1 Covid 19 Employed And Self Employed Support Icas

- Coronavirus Self Employed Small Limited Company Help

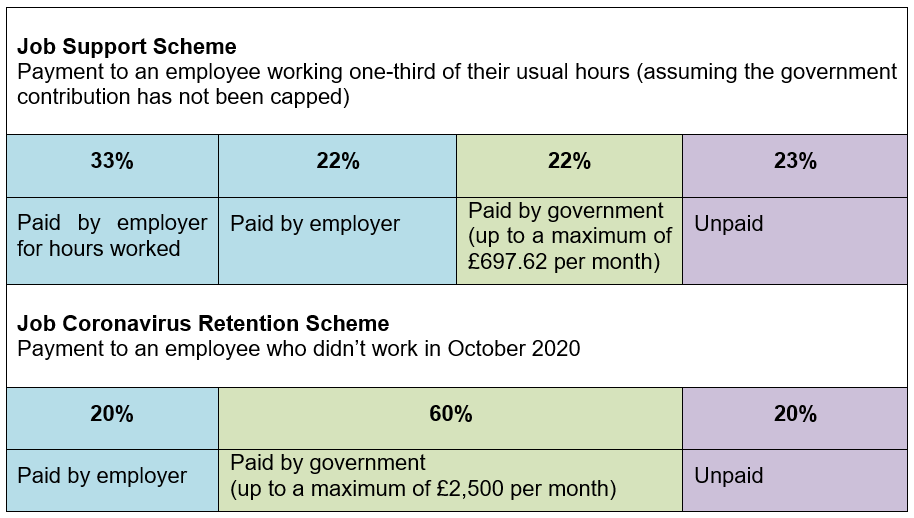

- Coronavirus Job Support Scheme The Details And What It Might Mean For Employers

- Flexible Furloughing And Self Employed Covid 19 Update Qasss

- Coronavirus Support For Small Businesses The Self Employed

Find, Read, And Discover Self Employed Furlough Taxable, Such Us:

- Coronavirus Q A What Help Is There For Self Employed Workers Affected By The Pandemic

- Ask Icas Webinar 1 Covid 19 Employed And Self Employed Support Icas

- Government S Monetary Support To The Self Employed Taxation

- Self Employment Wikipedia

- How Will Sunak S Support Plan For The Self Employed Work Financial Times

If you are looking for Furlough Scheme Uk Taper you've come to the perfect location. We have 100 images about furlough scheme uk taper adding pictures, photos, photographs, wallpapers, and much more. In such web page, we also provide number of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Are You Eligible For The Self Employment Income Support Scheme Seiss Knights Lowe Furlough Scheme Uk Taper

The self employed could face financial calamity if the government does not expand its support scheme further bringing them closer in line with the latest furlough changes it has been claimed.

Furlough scheme uk taper. If youre not eligible based on the 2018 to 2019 self assessment tax return we will then look at the tax years 2016 to 2017 2017 to 2018 and 2018 to 2019. Last month it was confirmed that self employed workers whose businesses have been negatively hit by coronavirus would be able to claim a second and final grant in august. The main differences are when theyre available how much theyre worth and stricter eligibility criteria for the third grant compared to the previous two more on this below.

Intend to continue to trade in the tax year 2020 21. 8am to 8pm monday to friday. Tax help for self employed and businesses hmrc has set up a dedicated coronavirus helpline for self employed workers and business owners who are concerned about making tax payments.

Traded in the tax year 2019 20. 8am to 4pm saturday. There is wide flexibility in the arrangements permitted between employer and employees as to the number of days hours worked or furloughed subject to agreement between the parties no minimum of 3 weeks as per the existing pre 1 july scheme although an employee going on furlough before 1 july still has to do the minimum 3 weeks full.

Are trading when you apply or would be except for covid 19. The government has announced a five month extension of the furlough scheme while the self employed will be eligible for a third grant worth up to 7500. You can apply if youre a self employed individual or a member of a partnership and you.

Find out how we will work out your. The self employment income support scheme seiss is made up of four taxable government grants for self employed individuals. Where your salary varies you can claim for.

Self employment income support scheme. The four grants are similar. The original furlough scheme was due to end in october but it was extended to cover the second lockdown period in england through to 2 december.

These workers can apply for the first grant 80 of average monthly profits up to 2500 a month for three months until 13 july.

More From Furlough Scheme Uk Taper

- Economics Government Intervention Cartoon

- Self Employed Maternity Pay

- What Is Coronavirus Furlough Scheme

- Pyramid Ancient Egypt Government Officials

- How Does The Furlough Scheme Work For Employees

Incoming Search Terms:

- Covid 19 Personal Tax Self Assessment French Duncan Professional Chartered Accountants How Does The Furlough Scheme Work For Employees,

- Sunak Doubles Grants For Self Employed After Criticism Ftadviser Com How Does The Furlough Scheme Work For Employees,

- Self Employment Understanding Universal Credit How Does The Furlough Scheme Work For Employees,

- Partnership Deferral Of Self Assessment Payments Taxation How Does The Furlough Scheme Work For Employees,

- Coronavirus Self Employed Scheme Get The Details Right Accountingweb How Does The Furlough Scheme Work For Employees,

- Grant For Self Employed When Is The Deadline To Claim The Third Installment Of Seiss Grant And How To Apply Through Hmrc The Scotsman How Does The Furlough Scheme Work For Employees,