Self Employed Income Support Grant Eligibility, Self Employed Urged To Apply For Grants Kcc Media Hub

Self employed income support grant eligibility Indeed lately has been hunted by consumers around us, perhaps one of you. Individuals are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the title of this article I will talk about about Self Employed Income Support Grant Eligibility.

- Uldbc7ho8ilydm

- The Self Employed Income Support Grant How To See If You Are Eligible Grant Jones Accountancy Ltd Camberley

- Self Employed Income Support Scheme Seiss To Be Doubled For November

- Self Employed Income Support Scheme Martin Lewis Says People Have Weeks To Claim Grant As Further Support Announced Hertslive

- Coronavirus Self Employment Income Support Scheme Opens From 13th May Tamebay

- Nuihipbmlp1wem

Find, Read, And Discover Self Employed Income Support Grant Eligibility, Such Us:

- Self Employed Income Support Scheme Seiss Are You Eligible For A Grant Cottons Chartered Accountants

- Zg5nwyyqut41gm

- Seiss Second Claim Goes Live Today Dyke Yaxley Shrewsbury

- Over One Million Self Employed Are Not Eligible For Government S Coronavirus Income Support Scheme

- Covid 19 Support For The Self Employed

If you re searching for 10 Year Government Bond Yield India Chart you've come to the right location. We ve got 100 graphics about 10 year government bond yield india chart including images, pictures, photos, wallpapers, and much more. In these page, we also provide number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

How To Apply For The Self Employment Income Support Scheme Ipse 10 Year Government Bond Yield India Chart

Extended Into 2021 Self Employed Income Support Tide Business 10 Year Government Bond Yield India Chart

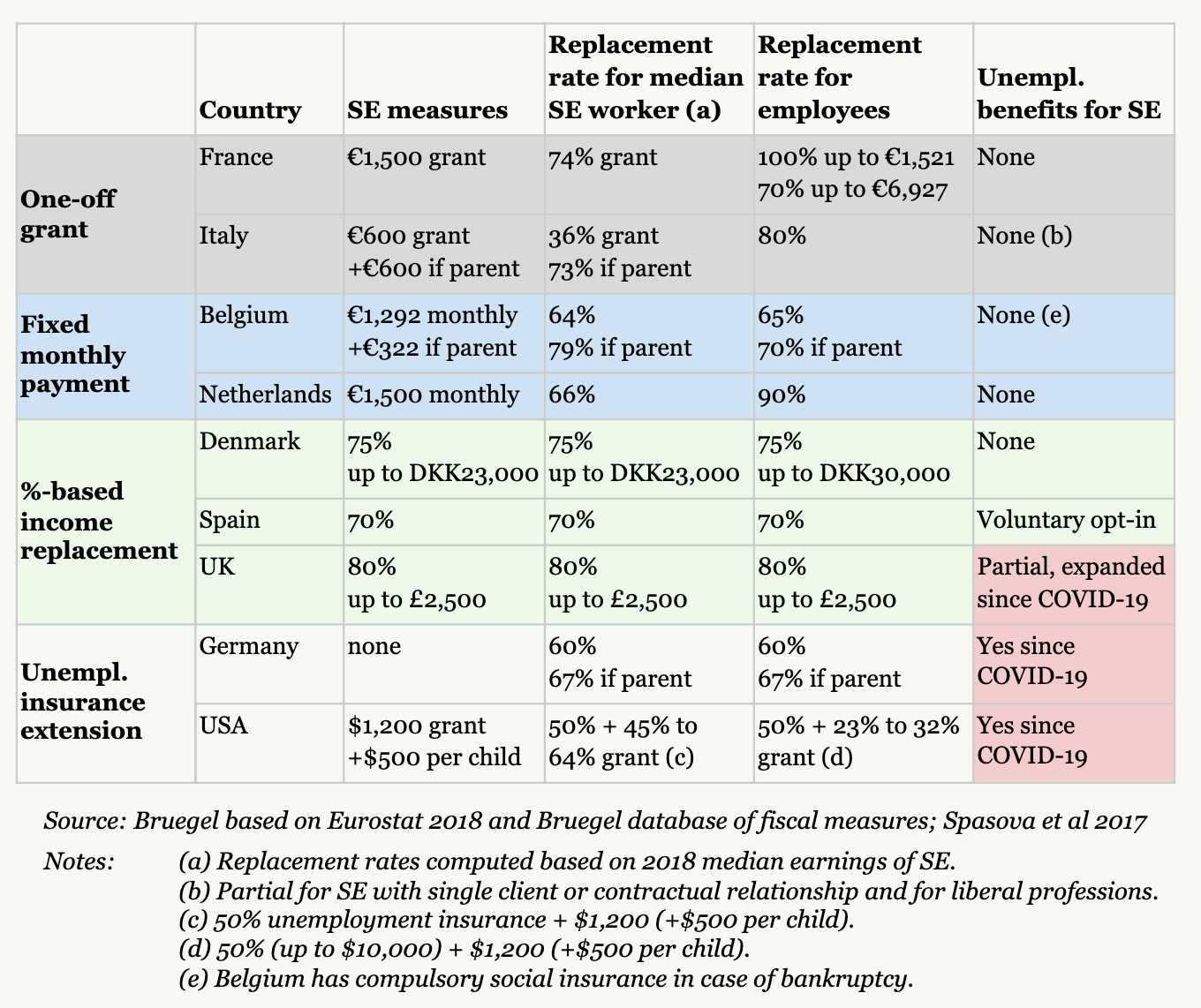

The self employment income support scheme grant extension provides critical support to the self employed in the form of two grants each available for three month periods covering november 2020 to.

10 year government bond yield india chart. Sirs eligibility criteria. Self employed person income relief scheme. A number of self employed people are not eligible for the self employment income support scheme.

For example the seiss grant is not available for people who trade through a limited company or. Potential users of the self employment income support scheme can check their eligibility online from today. Were not eligible for the grant received more than we said you were entitled to when you must.

The self employed income support scheme seiss has already provided relief to 27 million people as the first round of the grants saw the government dish out more than 77 billion. Guidance about the self employment income support scheme grant extension has been updated. 30 october 2020 we have updated the page to tell you when the online service for the next grant will be open.

Self employed invited to get ready to make their claims for coronavirus covid 19 support hmrc will begin contacting customers who may be eligible for the governments self employment income support scheme seiss. Submitted their self assessment tax return for the tax year 201819 by 23 april 2020. Published 4 may 2020.

The second and final self employed income support grant is worth 70 of average trading profits and capped at 6570 in total. If found to be benefitting from both covid 19 support grant and sirs concurrently individuals may be disqualified from the schemes and may be requested to repay the benefits received. Charlie duffield monday 17 august 2020 0914.

How To Claim A Grant Under The Self Employment Income Support Scheme Seiss Low Incomes Tax Reform Group 10 Year Government Bond Yield India Chart

More From 10 Year Government Bond Yield India Chart

- Top Government Jobs In India With High Salary

- Self Employed Resume Examples

- Furlough Scheme Uk Duration

- Furlough Scheme Uk Explained

- Self Employed Home Loan Eligibility

Incoming Search Terms:

- Self Employed Urged To Apply For Grants Kcc Media Hub Self Employed Home Loan Eligibility,

- Further Guidance Extension To The Self Employment Income Support Scheme Ward Williams Creative Self Employed Home Loan Eligibility,

- 4 Things To You Need To Make A Claim Through The Self Employment Income Support Scheme Freeagent Self Employed Home Loan Eligibility,

- Universal Credit How To Claim And How Much You Will Receive Consumer Affairs The Guardian Self Employed Home Loan Eligibility,

- Self Employment Income Support And The Second National Lockdown Institute For Fiscal Studies Ifs Self Employed Home Loan Eligibility,

- Check If You Can Claim A Grant Through The Self Employment Income Support Scheme Lall Ondhia Self Employed Home Loan Eligibility,