Self Employed Home Loan Eligibility, Va Loan Checklist Download Aligned Mortgage

Self employed home loan eligibility Indeed lately has been sought by consumers around us, perhaps one of you. Individuals now are accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the name of this article I will discuss about Self Employed Home Loan Eligibility.

- Getting A Mortgage When You Are Self Employed

- 10 Factors Banks Consider Before Approving Your Home Loan By Chqbook Issuu

- Home Loan Eligibility Calculator Housing Loan Eligibility2020

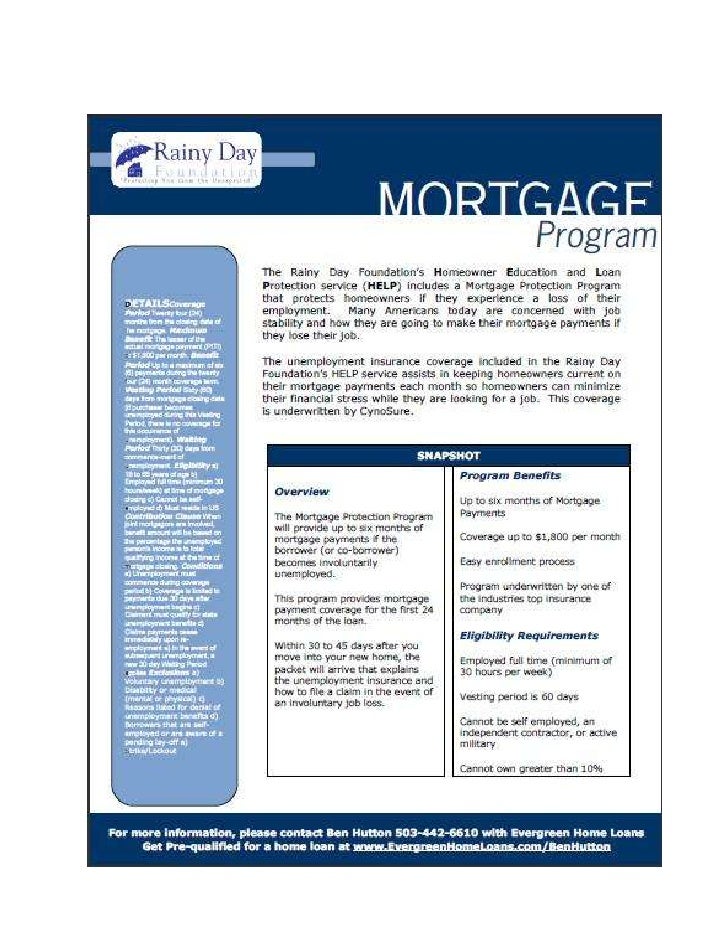

- Evergreen Home Loans And The Rainy Day Foundation Job Loss Protecti

- Home Loan

- Mortgage Loan Company In Maharashtra On Vimeo

Find, Read, And Discover Self Employed Home Loan Eligibility, Such Us:

- Banking Booklet V 4 0 Pages 51 100 Flip Pdf Download Fliphtml5

- Bank Statement Loan Mortgage Options For Self Employed Homebuyers Angel Oak

- Self Employed With Income And Getting Approved For A Home Mortgage Loan In Kentucky Kentucky First Time Home Buyer Loan Programs For Fha Va Khc And Usda Mortgage Loans In Kentucky

- Overcoming The Challenges Faced By Self Employed Individuals In Availing Home Loan By Imgc India Medium

- Home Loan For Self Employed Eligibility Procedure Documents Required

If you re looking for Furlough Scheme Rules For October you've come to the perfect place. We ve got 104 graphics about furlough scheme rules for october adding images, pictures, photos, backgrounds, and more. In these web page, we also have number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

The eligibility criteria for home loans differ slightly for salaried and self employed employees.

Furlough scheme rules for october. Home loan eligibility criteria. Yes self employed people are also eligible for personal loans. Personal loan eligibility criteria for self employed people.

The complexity of home loan eligibility calculation for self employed is simplified and and options of choosing product specific repayment options of added. The self employed loan eligibility. Eligible age min max the applicants age should be minimum 24 years and maximum 65 years at the time of applying for a home loan if the applicant is a self employed professional.

Are usually the same for both salaried and self employed employees. The number of self employed workers in the uk has risen dramatically in recent years and there were over 5 million registered by the fourth quarter of 2019 up from 32 million back in 2000. Home business advice the self employed loan eligibility.

The applicant should be resident of india. Making income reports all the time will help your situation a lot and so youll be able to buy a house. Self employed individuals who apply for a personal loan from a bank have to go through a rigorous documentation process.

A self employed home loan can be obtained as long as you can prove that you are able to make constant payments thanks to a stable job and income. Know more about home loan eligibility terms and conditions for salaried and self employed individuals from india. Company or a company as a trustee for a trust.

If you are a self employed individual and are planning to apply for a personal loan heres what. Our only requirement from our self employed customers is a steady source of income good credit history to ensure that you can pay the emi installments without an issue. To prove your income when you have a company or a company as a trustee for a trust then generally need.

For most lenders the requirement in regard to the age bracket residential status credit score etc. Get your home loan eligibility calculated with this simple self employed home loan eligibility calculator which helps you in choosing the right set of options for a hassle free repayment of your home loan. The eligibility required differs from bank to bank and the given below is the general eligibility criteria that are required for the sanction of the personal loan.

Paperwork required to apply for a self employed home loan. The self employed have. What are the eligibility conditions for a home loan for the self employed.

More From Furlough Scheme Rules For October

- Self Employed Resume Sample

- Government Yojana 2020 Pdf

- Self Employed Maternity Pay Northern Ireland

- Letter Of Income Verification Self Employed

- Self Employed Jobs Ideas Uk

Incoming Search Terms:

- Do You Have All These Items Ready Mortgage Loan Credit Refinance Loans Financing Banking Realestate Mortgages U U S Mortgage Corporation In 2018 Self Employed Jobs Ideas Uk,

- Hdb Concessionary Loan Know Your Eligibility How To Apply For Hle Self Employed Jobs Ideas Uk,

- How Does Eligibility Calculation Work Square Capital Self Employed Jobs Ideas Uk,

- Akiva Advisors Home Self Employed Jobs Ideas Uk,

- Home Loan Types Different Home Loan Options In India Bank Of Baroda Self Employed Jobs Ideas Uk,

- Self Employed Home Loan How To Get A Mortgage Self Employed Jobs Ideas Uk,