Self Employed Grant Claim August, More Than Half Of Western Isles Self Employed Workers Claimed Government Support Stornoway Gazette

Self employed grant claim august Indeed lately has been hunted by users around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of the post I will discuss about Self Employed Grant Claim August.

- Coronavirus Advice For The Self Employed And Freelancers Ipse

- Self Employed Can Now Receive The August Grant Patterson Hall Chartered Accountants

- Applications For The Second Final Grant Will Open On 17 August Youtube

- Second Self Employed Income Support Scheme Grant Is Now Open For Applications Avanti Tax Accountants

- 2

- Self Employed Income Support Scheme 2nd Grant Sjb Co Chartered Accountants

Find, Read, And Discover Self Employed Grant Claim August, Such Us:

- You Can Claiming The Second Grant Under The Seiss From The 17th August

- Agl Chartered Accountants Publications Facebook

- Seiss Reckoner

- How To Claim Self Employed Grant Who Can Apply For Second Hmrc Payment And How Seiss Works

- Covid 19 2nd Grant Seiss Now Open Finlayson Co Uk Ltd Facebook

If you are searching for Central Government Scholarship For College Students you've come to the perfect place. We ve got 101 images about central government scholarship for college students including pictures, photos, photographs, wallpapers, and much more. In these webpage, we additionally provide number of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

%20HMRC's%20Claims%20Portal%20for%20the%20Second%20Grant%20Opens%20in%20August%202020.jpg)

Covid 19 Self Employment Income Support Scheme Seiss Hmrc S Claims Portal For The Second Grant Opens In August 2020 Steemit Central Government Scholarship For College Students

Covid 19 Update 17 August News From And About Ott Online Travel Training Ott Central Government Scholarship For College Students

The deadline for making a claim for a grant under the original seis scheme is 13 july 2020.

Central government scholarship for college students. The deadline for claiming the second seiss grant is 19 october 2020. This is a significant change with previous grants there were broader criteria and you could claim for any adverse impact. Self employed traders need not have claimed a grant under the old scheme to qualify for the august payment and are required to confirm that their business continues to be adversely affected by covid 19.

How much can be claimed. If an individual has claimed a seiss grant and any of these apply they need to notify hmrc and pay back the full amount received. Eligible self employed people have been able to claim a second seiss grant since 17 august.

This is necessary even if the claim was made due to an inadvertent error or innocent misunderstanding of the rules. Now that the scheme is being extended eligible self employed workers will be able to make a claim for a second and final grant in august 2020. 12th august 2020 130 pm.

Self employed can claim up to 6570 as a second grant to cover lost income in june july and august. With the self employed now able to claim a third grant from the government. Self employed people adversely affected by coronavirus can claim a taxable grant.

The next self employment income support scheme grant will be doubled and will now be worth up to 3750 but crucially youll need to have been affected by reduced demand to claim. At the time of making the claim the individual did not intend to continue to trade. 28 july 2020 information about what to do if you were not eligible for the grant or have been overpaid has been added.

Its not yet possible to apply for the second and. The self employment income support scheme claim service is now open. On 17th august the application to make the claims became available.

Below we answer the most popular questions regarding this second and final grant for the self employed. This is a taxable grant worth 70 of their average monthly trading profits for three months paid out in a single instalment and capped at 6570 in total. Self employed individuals or a member of a partnership as long as certain eligibility criteria are met see belowlimited companies and trusts are not entitled to claim.

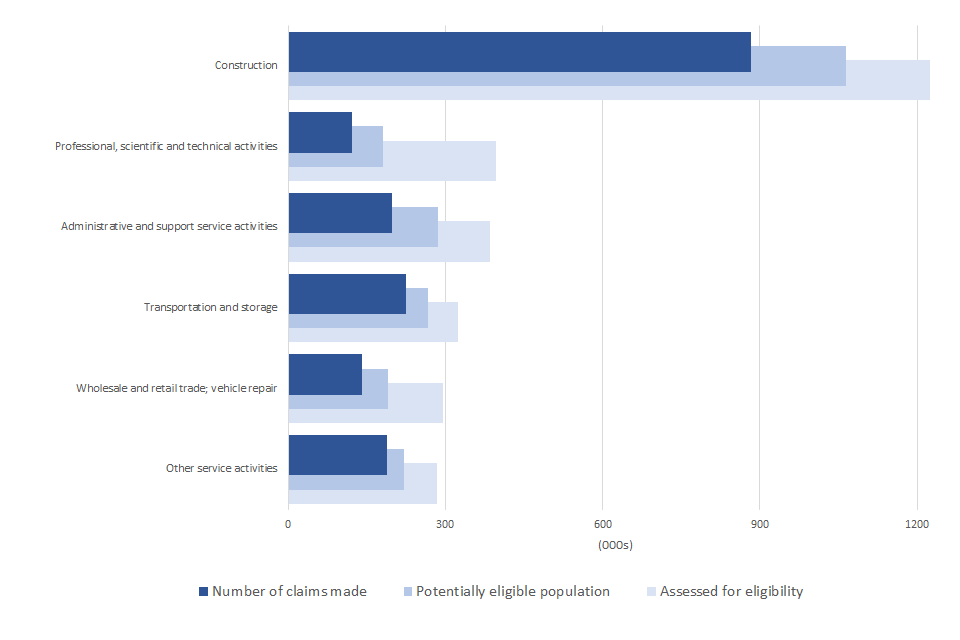

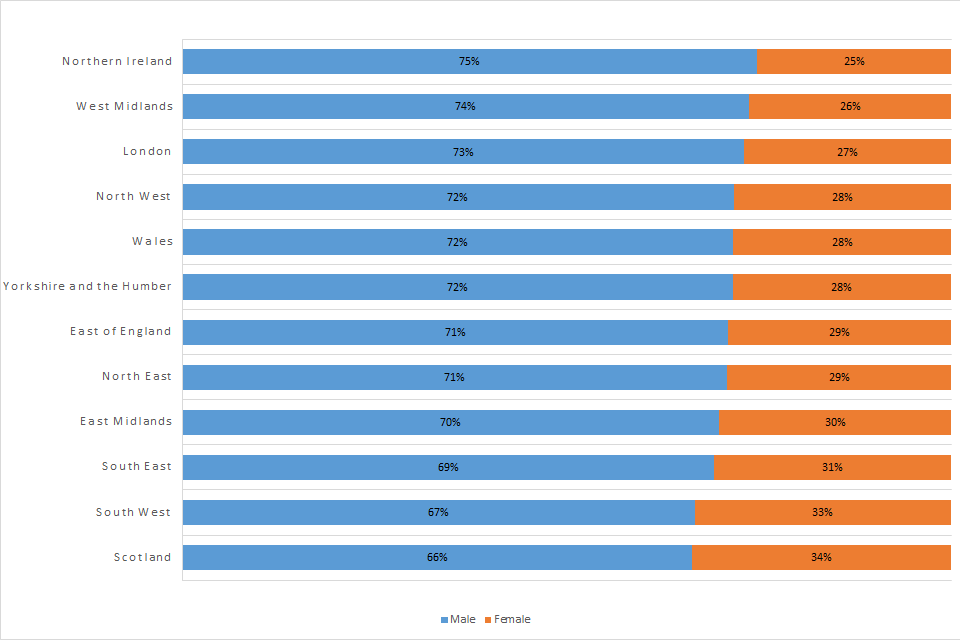

Self Employment Income Support Scheme Statistics August 2020 Gov Uk Central Government Scholarship For College Students

More From Central Government Scholarship For College Students

- Government Gazette 2020 September 20

- Ukraine Government Building

- Self Employed Health Insurance Tax Deduction

- Government Regulation Definition Us History

- Self Employed Tax Rates Uk

Incoming Search Terms:

- Second Self Employed Income Support Scheme Seiss Grant Can Be Claimed From 17th August 2020 Self Employed Tax Rates Uk,

- Buckinghamshire Business First On Twitter Have You Claimed A Self Employment Income Support Scheme Grant You Must Make A Claim For The 1st Grant On Or Before 13 7 20 A 2nd Grant Will Be Self Employed Tax Rates Uk,

- 2 Self Employed Tax Rates Uk,

- Tax Affinity Blog Tax Affinity Accountants Self Employed Tax Rates Uk,

- Self Employment Income Support Scheme Statistics August 2020 Gov Uk Self Employed Tax Rates Uk,

- Https Www Thomasoliveruk Co Uk Newsfuse Uploads Documents 2020 Jul 145 Self Employment Income Support Scheme July 2020 V8 Pdf Self Employed Tax Rates Uk,