What Is Furlough Rate In August, Job Retention Schemes During The Covid 19 Lockdown And Beyond

What is furlough rate in august Indeed lately is being sought by users around us, perhaps one of you personally. People now are accustomed to using the net in gadgets to view image and video information for inspiration, and according to the title of this post I will discuss about What Is Furlough Rate In August.

- Factcheck Has Coronavirus Destroyed More Jobs Than The Great Recession Channel 4 News

- Furlough Scheme Replacement Extended Sunak The Independent

- Uk Firms To Be Asked To Pay Part Of Furloughed Staff S Wages From August Economic Policy The Guardian

- Small Business Workforce Trends During Covid 19 August 2020 Gusto

- Niesr Press Release Premature End To Furlough To Push Jobless Rate To 10 National Institute Of Economic And Social Research

- Analysis More People Got Back To Work In August But Outlook Dims For Those Still Looking For Jobs Morning Consult

Find, Read, And Discover What Is Furlough Rate In August, Such Us:

- X2w3wke4chzg8m

- Rishi Sunak New Ways To Protect Jobs My Priority Bbc News

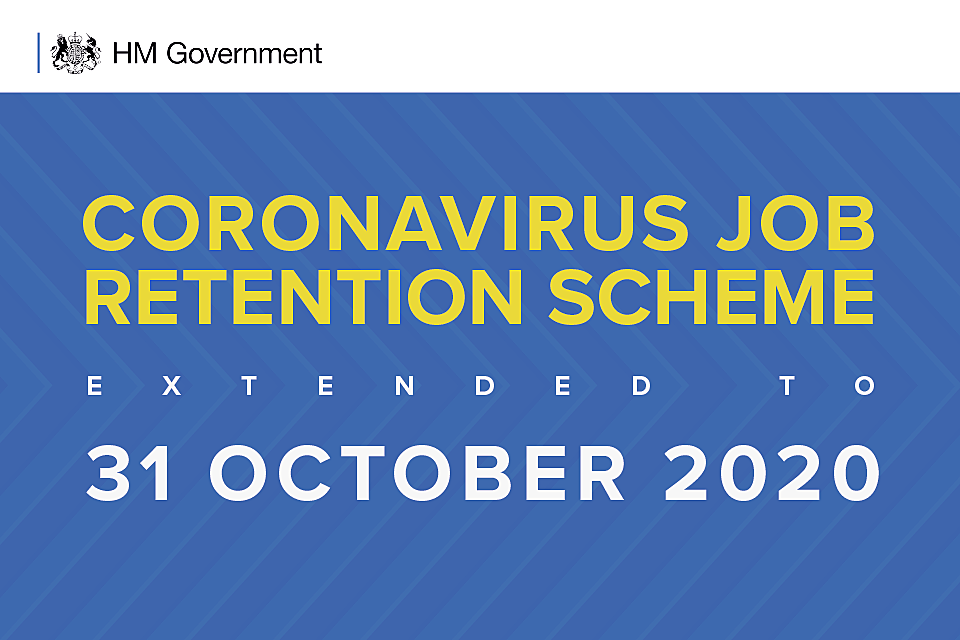

- U K Coronavirus Job Retention Scheme Will Change In August Eater London

- Coronavirus Job Retention Scheme Statistics August 2020 Gov Uk

- 90 Of Furloughed Workers Back At Old Workplace In August Figures Show

If you re searching for Self Employed Tax Form Uk you've arrived at the right location. We have 100 graphics about self employed tax form uk including pictures, photos, pictures, wallpapers, and much more. In these page, we additionally have variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Coronavirus Job Retention Scheme How To Furlough Workers The Legal Partners Self Employed Tax Form Uk

Https Www Gov Scot Binaries Content Documents Govscot Publications Statistics 2020 09 Bics Weighted Scotland Estimates Data To Wave 12 Documents Bics Weighted Scotland Estimates Data To Wave 12 Report Bics Weighted Scotland Estimates Data To Wave 12 Report Govscot 3adocument Bics 2bweighted 2bscotland 2bestimates 2b 2bdata 2bto 2bwave 2b12 2b 2breport Pdf Self Employed Tax Form Uk

Hours before the furlough scheme was due to end the government announced it would be extended until december to cover a further lockdown in england.

Self employed tax form uk. The government will continue paying the remainder of. For periods starting on or after 1 september you will need to calculate the. The furlough scheme will come to an end on october 31 august changes.

The daily rates for furlough published on govuk are based on an individual working every single day of the month which is of course completely ludicrous. Employees must have completed the minimum furlough period of three weeks before being able to go on flexible furlough. It will start slowly withdrawing support and asking employers to pay more.

In order to introduce the new flexible furlough scheme those wanting to sign up to the old scheme must do so by 30 june. This was originally going to be introduced on 1 august but has been brought forward. From september businesses who continue to furlough employees will have to stump up 10 per cent of their wages and 20 per cent in october.

The government is making changes to the coronavirus furlough scheme from august. The government will pay 80 per cent of wages up to a cap of 2500 from august 1 but firms will need to make certain. Currently the government is paying 80.

Under the coronavirus jobs retention scheme. Changes from august businesses will start picking up the furlough bill in august when they have to pay national insurance ni and pension contributions. This represents about 5 per cent of.

The average person is likely to work five days a week maybe 23 days on average in a month in fact there are 22 working days in march 2020 22 working days in april 2020 and 21 working days. The amount the state pays will be reduced each month with employers expected to contribute towards furloughed employees employment costs.

More From Self Employed Tax Form Uk

- Government Shutdown History List

- Self Employed On Resume

- Government Employees Insurance Company Code

- Government Relations Officer

- Government Transfer Payments Examples

Incoming Search Terms:

- The Government Is Not Paying Nine Million People S Wages Resolution Foundation Government Transfer Payments Examples,

- Report Highlights High Rate Of Furlough Fraud Grunberg Co Government Transfer Payments Examples,

- Niesr Press Release Premature End To Furlough To Push Jobless Rate To 10 National Institute Of Economic And Social Research Government Transfer Payments Examples,

- End Of Furlough In 2020 Could See Rise In Redundancies Government Transfer Payments Examples,

- Furlough Scheme Extended To End Of October Rishi Sunak Says But Employers To Share Burden With Government From August Itv News Government Transfer Payments Examples,

- Job Retention Schemes During The Covid 19 Lockdown And Beyond Government Transfer Payments Examples,

/cdn.vox-cdn.com/uploads/chorus_asset/file/20009052/1212829574.jpg.jpg)