Self Employed Health Insurance Tax Deduction, Can I Deduct Short Term Health Insurance From My Taxes If I M Self Employed Shorttermhealthinsurance Com

Self employed health insurance tax deduction Indeed recently has been hunted by consumers around us, perhaps one of you. Individuals are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the name of the article I will talk about about Self Employed Health Insurance Tax Deduction.

- 1

- Guide To Self Employed Health Insurance Deductions

- Insurance Self Employed Deduction

- What Types Of Insurance Do You Need If You Re Self Employed Daveramsey Com

- Https Www Canr Msu Edu Uploads 234 71344 Taxfavored Healthplans2007 Pdf

- Medical Insurance Medical Insurance Tax Deductible

Find, Read, And Discover Self Employed Health Insurance Tax Deduction, Such Us:

- Self Employed Health Insurance Deduction How To Get And Maximize It

- Amazing Way To Take Health Insurance As A Tax Deduction

- Getting A Tax Deduction For Health Insurance As A Small Business Owner Small Biz Tax Guy

- Ppt Employment Based Health Insurance Powerpoint Presentation Free Download Id 6873272

- Tax Deductions For New York Self Employed Health Insurance Plans Nyhealthinsurer Com

If you re searching for Government Deficit Spending Pros And Cons you've reached the ideal place. We ve got 104 graphics about government deficit spending pros and cons including images, pictures, photos, backgrounds, and much more. In these webpage, we also provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Self Employed Health Insurance Deduction Healthinsurance Org Government Deficit Spending Pros And Cons

Self employed health insurance deduction.

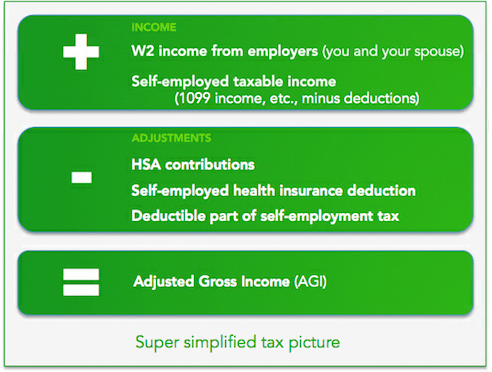

Government deficit spending pros and cons. Self employed people who cant get subsidized health insurance through a spouse can deduct premiums. You may be able to deduct the amount you paid for health insurance for yourself your spouse and your dependents. Do i have to itemize deductions to take this deduction.

If you qualify the deduction for self employed health insurance premiums is a valuable tax break. The self employed health insurance tax deduction is one of the better tax breaks available if you qualify for it. The insurance also can cover your child who was under age 27 at the end of 2019 even if the child wasnt your dependent.

As a self employed business owner you may deduct the cost of health insurance you buy for yourself and your spouse dependents and children under 27 years old as of the end of the tax year. It affects your adjusted gross income a detail upon which several other tax breaks depend. And that will help to keep you healthyand happyin 2020 and beyond.

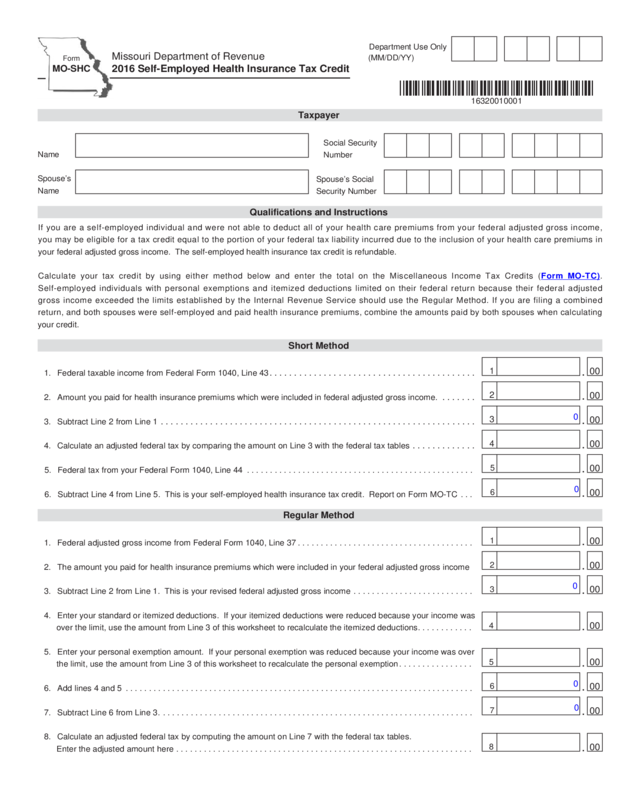

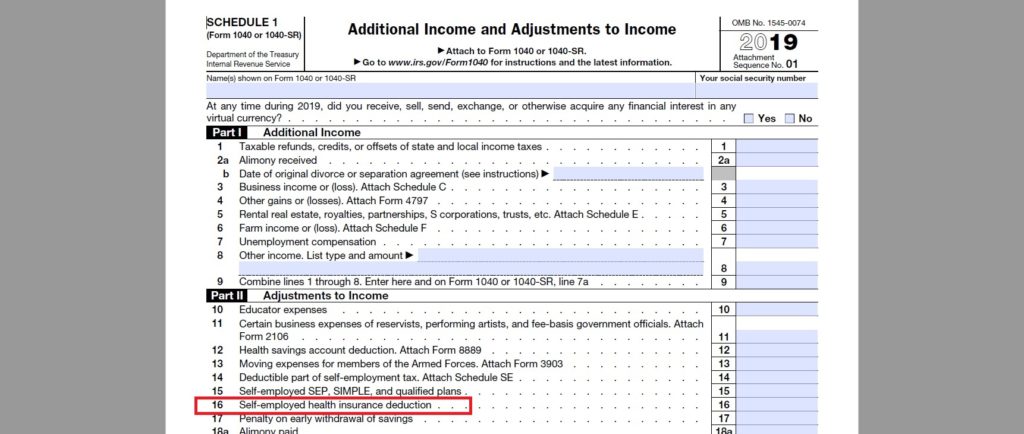

With the rising cost of health insurance a tax deduction can help you pay at least a portion of the premium cost. The deduction which youll find on line 16 of schedule 1 attached to your form 1040 allows self employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year. You could still claim your health insurance expenses as a medical deduction on schedule a if you itemize but the above the line adjustment to income for self employed people is usually more advantageous.

It can be equal to 100 percent of what you pay in premiums and its an adjustment to income so it lowers your agi helping you to qualify for still other advantageous tax breaks. You can then transfer the total of part 2 of schedule 1 to line 10a on your 2020 tax return. You can deduct self employed health insurance premiums directly on line 28 of form 1040.

It can also cover your children under age 27 who may not be your dependents. The plan can cover you your spouse and your dependents. Youll find the deduction on your personal income tax form and you can file for it if you were self employed and showed a profit for the year.

Self employed individuals who meet certain criteria may be able to deduct their health insurance premiums even if their expenses do not exceed the 10 threshold. The deduction applies to your premiums and those of your spouse and dependents. Self employed persons can take a deduction for health insurance premiums they pay for themselves and their dependents directly on line 16 of the 2020 schedule 1.

Who can my self employed health insurance plan cover.

How To Use The Self Employed Health Insurance Deduction Faerie S Medical Science Government Deficit Spending Pros And Cons

More From Government Deficit Spending Pros And Cons

- Self Employed Furlough Scheme Application Form

- Government Zoom Meeting

- Government Clipart

- Furlough Scheme Uk Contact Number

- Quickbooks Self Employed Invoice Payments

Incoming Search Terms:

- Chapter 6 Business Expenses Howard Godfrey Ph D Ppt Video Online Download Quickbooks Self Employed Invoice Payments,

- The Be All End All List Of Small Business Tax Deductions Quickbooks Self Employed Invoice Payments,

- Predicting Covid 19 With Tax Returns Quickbooks Self Employed Invoice Payments,

- Medical Insurance Medical Insurance Tax Deductible Quickbooks Self Employed Invoice Payments,

- Can I Deduct Short Term Health Insurance From My Taxes If I M Self Employed Shorttermhealthinsurance Com Quickbooks Self Employed Invoice Payments,

- The 411 On The Self Employed Health Insurance Deduction Taxact Blog Quickbooks Self Employed Invoice Payments,