Self Employed Health Insurance Tax Deduction S Corp, Can I Write My Health Insurance Off As A Business Expense Finance Zacks

Self employed health insurance tax deduction s corp Indeed recently has been sought by consumers around us, maybe one of you personally. People now are accustomed to using the net in gadgets to see video and image information for inspiration, and according to the name of this post I will discuss about Self Employed Health Insurance Tax Deduction S Corp.

- Instructions For Form 8995 A 2019 Internal Revenue Service

- An Introduction To Taxation Ppt Video Online Download

- What Are Some Self Employed Tax Deductions In Canada

- Is A Health Insurance Premium Tax Deductible With Llc Legalzoom Com

- How Much Does A Small Business Pay In Taxes

- Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Find, Read, And Discover Self Employed Health Insurance Tax Deduction S Corp, Such Us:

- Self Employed Health Insurance Deduction

- What Is The Self Employed Health Insurance Deduction Ask Gusto

- How Does An S Corporation Treat Health Insurance Paid On Behalf Of A Greater Than 2 Shareholder Robert Loe And Associates

- Staying On Top Of Changes To The 20 Qbi Deduction 199a One Year Later Wffa Cpas

- How The New Tax Plan Affects The High Income Physician Passive Income M D

If you are searching for Mp Government Job Vacancy 2020 you've come to the ideal place. We have 104 graphics about mp government job vacancy 2020 adding images, photos, photographs, wallpapers, and much more. In such webpage, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

Https Apps Irs Gov App Vita Content Globalmedia Teacher Self Employed Health Insurance 4012 Pdf Mp Government Job Vacancy 2020

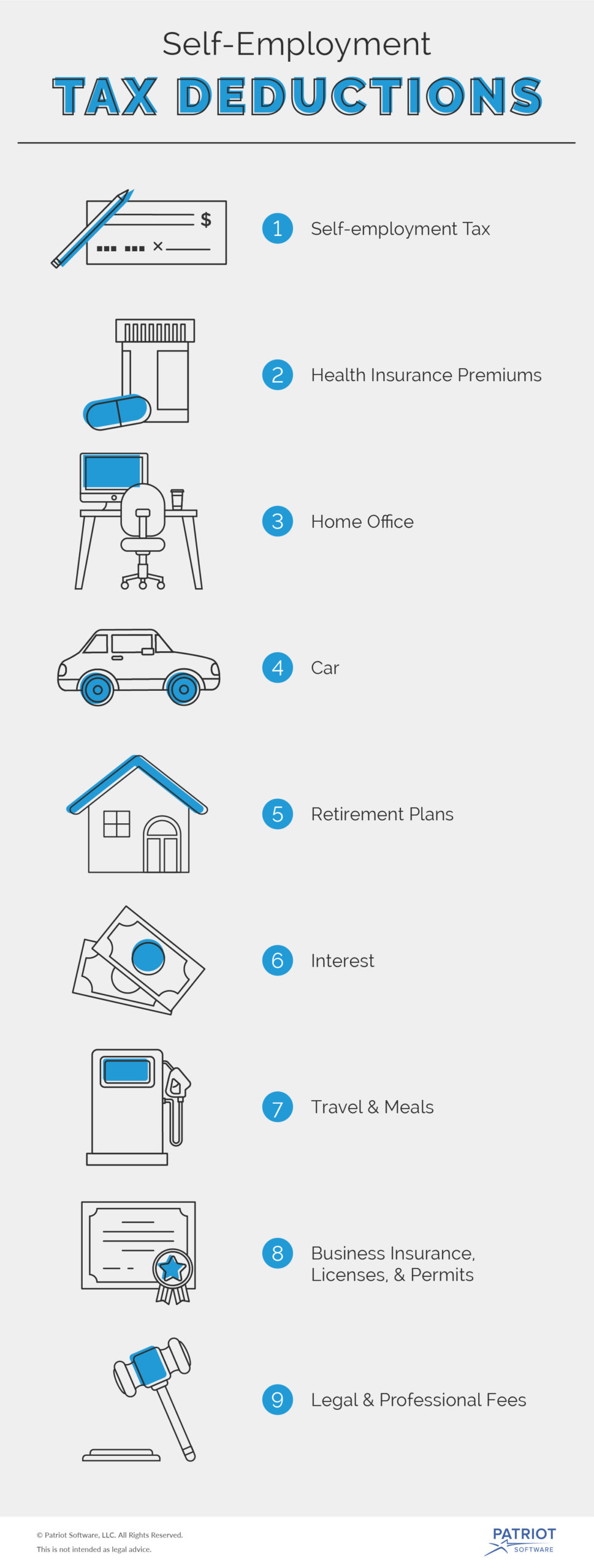

Below are the necessary steps to ensure the self employed health insurance deduction can be taken.

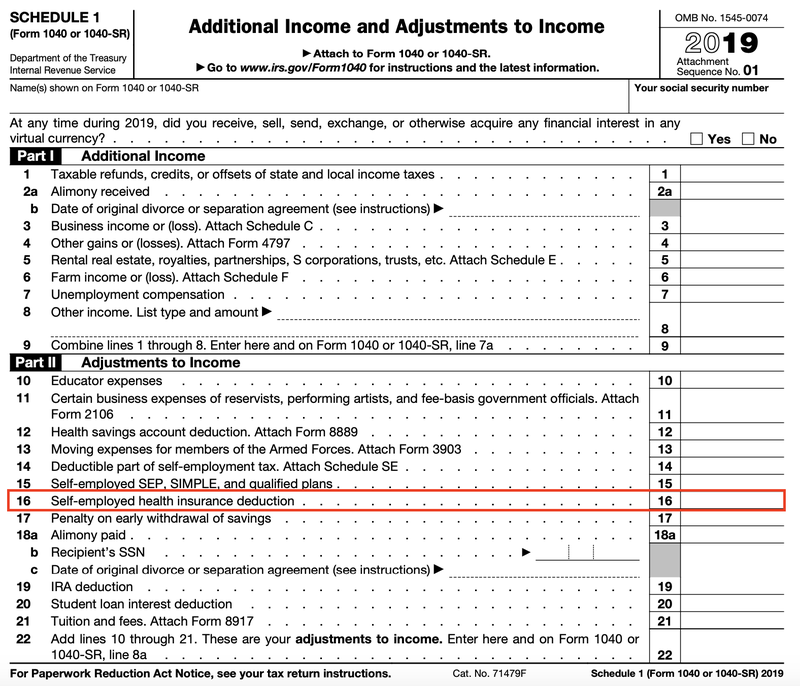

Mp government job vacancy 2020. S corp owners may not have the same access to tax free health insurance as non owner employees but they can still ensure their premiums are tax advantaged. Even though an s corporation shareholder is not technically self employed the irs requires a more than 2 percent s corporation shareholder to report the deduction as if they were self employed and not on the s corporation return. With the rising cost of health insurance a tax deduction can help you pay at least a portion of the premium cost.

S corp self employed health insurance deduction atdmertz you need to enter box 5 not the amount from box 1. Specifically s corp owners can take a personal income tax deduction on the health insurance premiums paid by the business. You need to have other wages on the w 2 which will show up in box 5 besides the health insurance wages which only show up in box 1.

It affects your adjusted gross income a detail upon which several other tax breaks depend. And that will help to keep you healthyand happyin 2020 and beyond. While an s corp has pass through taxation like many other forms of tax elections in respect to health insurance premiums the law gets more complex.

But things arent all bad for s corporation shareholders. You may still be able to take a personal income tax deduction for the health insurance premiums paid by your corporation. Personal income tax deduction for health insurance premiums.

Every dollar you deserve. Personal income tax deduction for health insurance premiums. Notice 2008 1 contains the rules and examples for deducting accident and health insurance premiums by a more than 2 shareholderemployee of an s corporation.

Self employed people are allowed to deduct health insurance premiums including dental and long term care coverage for themselves their spouses and their dependents. S corp owners may not have the same access to tax free health insurance as non owner employees but they can still ensure their premiums are tax advantaged. If you qualify the deduction for self employed health insurance premiums is a valuable tax break.

Health insurance employee benefit for a s corporation one drawback to the s corporation is that employeeowners cannot deduct the cost of health insurance from taxes. Specifically s corp owners can take a personal income tax deduction on the health insurance premiums paid by the business.

More From Mp Government Job Vacancy 2020

- Government Scholarship 2020 Assam

- Government Of Karnataka Logo Black And White

- Government Worker Meme

- Government Office Zoom Background

- Government Official Letter Format In Tamil

Incoming Search Terms:

- Self Employed Health Insurance Deduction Government Official Letter Format In Tamil,

- Health Insurance Self Employed Health Insurance Government Official Letter Format In Tamil,

- S Corp Election Self Employment S Corporation Taxes Wcg Cpas Government Official Letter Format In Tamil,

- I M Self Employed Can We Deduct My Husband S Medicare Premiums Healthinsurance Org Government Official Letter Format In Tamil,

- Rules For Tax Deductibility Of Long Term Care Insurance Government Official Letter Format In Tamil,

- Https Www Irs Gov Pub Irs Wd 201912001 Pdf Government Official Letter Format In Tamil,