Self Employed Vs Employed Calculator, Catering Insight New Tool Enables Self Employed To Calculate Government Grant Entitlement

Self employed vs employed calculator Indeed lately is being sought by consumers around us, perhaps one of you. Individuals are now accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the name of the article I will talk about about Self Employed Vs Employed Calculator.

- Self Employment Tax Calculator 2020 Zrivo

- How Do I Pay Tax On Self Employed Income Low Incomes Tax Reform Group

- Blogger Tax Tips That Make You Want To Celebrate Healthy Savvy Wise

- Self Assessment Tax Return A Guide For The Self Employed

- Employed And Self Employed Tax Calculator Taxscouts

- Self Employment Tax Calculator

Find, Read, And Discover Self Employed Vs Employed Calculator, Such Us:

- Calculating Your Tax With Self Employment Tax Calculator Is Safe Providing Details Is Just What People Need To Do Every Self Employment Employment Income Tax

- Self Employed Tax Calculator Calculate Self Employment Deductions 2012 2013 Youtube

- Self Employed Unemployment And Coronavirus Stimulus Package Everything You Need To Know Honeybook

- Comprehensive Income Tax Calculator Solid Tax

- Blogger Tax Tips That Make You Want To Celebrate Healthy Savvy Wise

If you are looking for Government To Government Examples you've reached the perfect place. We have 104 images about government to government examples including pictures, photos, photographs, wallpapers, and much more. In such page, we also have variety of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctw7rwjhqvgpuzhoimbk04bp1 H 6gjv1nh Btkch8o6odh0gpz Usqp Cau Government To Government Examples

It is not possible to use it for amounts over the higher rate threshold.

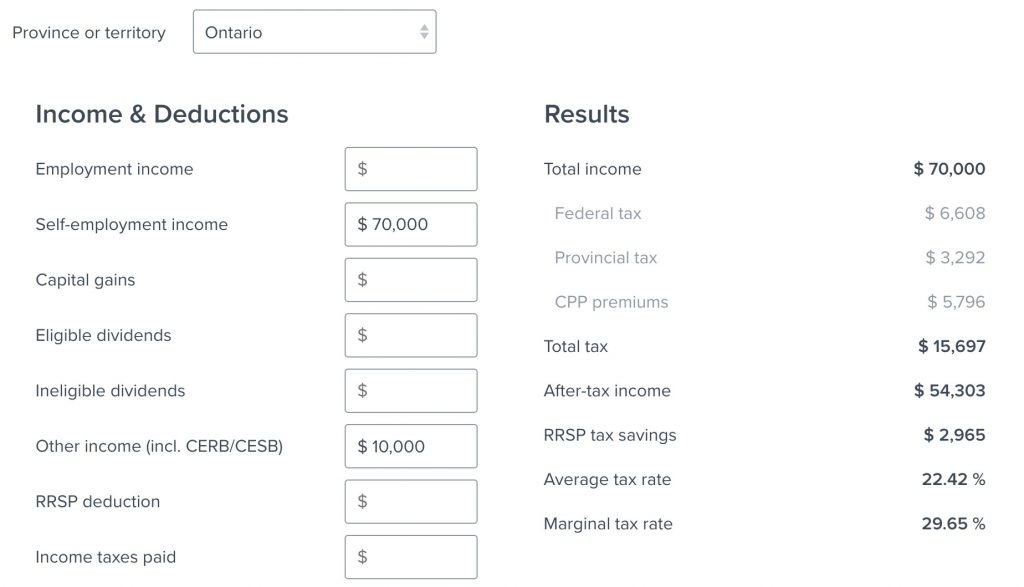

Government to government examples. If youre self employed you are responsible for paying your own taxes to the internal revenue service irs and to your state tax department. There are countless different ways to be self employed. More information about the calculations performed is available on the details page.

This calculator assumes that. Well start splitting hairs here if we go much farther. You will need to submit a self assessment tax return and pay these taxes and contributions yourself.

See what happens when you are both employed and self employed at the same time with uk income tax national insurance student loan and pension deductions. You can start your own business work as a freelancer providing services to lots of different clients or be a contractor like freelancing except you work for one employer for a set period of timeyou can also do any of these things at the same time as being employed by someone else the gig economy has. The deadline is january 31st of the following year.

You are the only director of the company and will take a salary up to the national insurance ni threshold. More information about the calculations performed is available on the details page. Please note that the self employment tax is 124 for the federal insurance contributions act fica portion and 29 for.

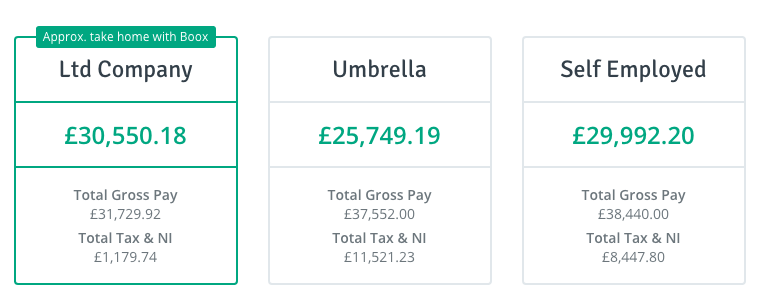

In terms of withholdings the biggest difference between employed vs. Employed v self employed there isnt a formula as such but heres a few figures that will help you to work out the answer to your conundrum. If you are self employed use this simplified self employed tax calculator to work out your tax and national insurance liability.

You pay 2000 20 on your self employment income between 0 and 10000. You do not have any other income. Employed and self employed uses tax information from the tax year 2020 2021 to show you take home pay.

The profit amount is limited to the basic rate threshold ie. Figures are based on a full tax year. Firstly of your 30k income through your limited company you would have to set aside 1207 to cover the holiday pay entitlement if you were an employee.

The calculator uses tax information from the tax year 2020 2021 to show you take home pay. Use this calculator to estimate your self employment taxes. The confusion surrounding what constitutes an intermediary group under ir35 will likely lead to a change in the primary legislation according to the association of independent professionals and the self employed ipse director of policy and external affairs andy chamberlain.

Self employed is that youre on the hook for all of it when youre self employed. You pay 7200 40 on your self employment income between 10000 and 28000. Fri 23 oct 2020 off payroll ir35 reforms.

However if you are self employed operate a farm or are a church employee you may owe self employment taxes.

More From Government To Government Examples

- Majority Government Example

- Government Administration Jobs Are All Patronage This Is Considered As

- Self Employed Furlough Scheme Apply Hmrc

- Government Furlough Scheme Announced

- Government Monopoly Economics Definition

Incoming Search Terms:

- How To Calculate And Pay Quarterly Self Employment Taxes Government Monopoly Economics Definition,

- Calculating Your Tax With Self Employment Tax Calculator Is Safe Providing Details Is Just What People Need To Do Every Self Employment Employment Income Tax Government Monopoly Economics Definition,

- Self Employed Coronavirus Grant Extension Calculator Government Monopoly Economics Definition,

- Mortgage Lenders Income Requirements For The Self Employed Niche Government Monopoly Economics Definition,

- How Do You Calculate Lost Wages If You Re Self Employed News Government Monopoly Economics Definition,

- Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Jessica Moorhouse Government Monopoly Economics Definition,