Federal Government Taxes, How The Government Spends Your Tax Dollars Tax Foundation

Federal government taxes Indeed recently has been hunted by users around us, perhaps one of you personally. People are now accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of the post I will discuss about Federal Government Taxes.

- Seven Surprising Tax Facts For 2019 Institute For Policy Studies

- Why Do We Pay Taxes Community Tax

- How Much Of Your Federal Tax Dollar Goes To Education

- Ppt Muddy Points From Tuesday Powerpoint Presentation Free Download Id 5595959

- The Design Of The Tax System

- How Has Federal Revenue Changed Over Time Tax Foundation

Find, Read, And Discover Federal Government Taxes, Such Us:

- Ppt Purpose Of Taxation Powerpoint Presentation Free Download Id 1508222

- About Tax Taxation

- Understanding The Budget Revenue

- The Design Of The Tax System

- Government Debt Vs Deficit Ppt Video Online Download

If you are searching for Quickbooks Self Employed Invoice Payments you've arrived at the ideal place. We ve got 104 images about quickbooks self employed invoice payments adding images, pictures, photos, wallpapers, and more. In these page, we additionally have number of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

They Already Have All The Freaking Information Federal Government Announces Plan To File Some People S Taxes For Them National Post Quickbooks Self Employed Invoice Payments

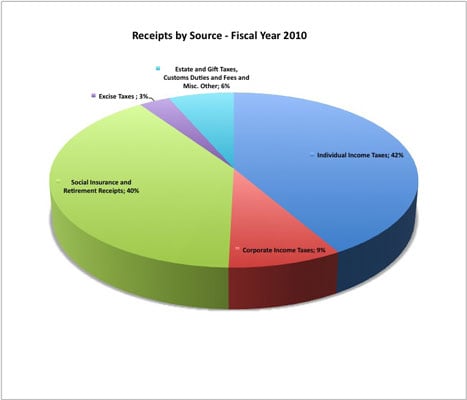

Taxes are levied on income payroll property sales capital gains dividends imports estates and gifts as well as various feesin 2010 taxes collected by federal state and municipal governments amounted to 248 of gdpin the oecd only chile and mexico are taxed.

Quickbooks self employed invoice payments. This provides taxpayers an extra three months due to the coronavirus pandemic. The governments rationale is that we dont generally pay tax on the sale of a principal residence and so there shouldnt be a deduction for interest to buy the place. The federal income tax rates remain unchanged for the 2019 and 2020 tax years.

The united states of america has separate federal state and local governments with taxes imposed at each of these levels. Employers who withhold income taxes social security tax or medicare tax from employees paychecks or who must pay the employers portion of social security or medicare tax. The income tax enables the federal government to maintain the military construct roads and bridges enforce the laws and federal regulations and carry out other duties and programs.

A new law enacted in december 2019 has extended tax breaks but caused delays for many 2019 tax forms instructions and publications. Federal income tax returns are due on july 15 2020. Get information on federal state local and small business taxes including forms deadlines and help filing.

Read on for more about the federal income tax brackets for tax year 2019 due july 15 2020 and tax year 2020 due april 15 2021. 10 12 22 24 32 35 and 37. By 1918 government revenue generated from the income tax exceeded 1 billion for the first time and topped 5 billion by 1920.

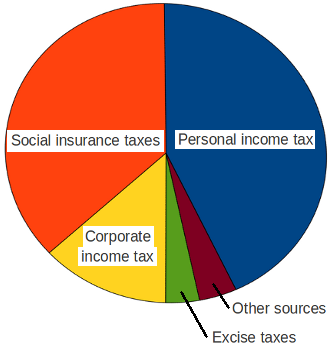

Find answers to top questions about filing federal income tax paying getting refunds and more. Employers quarterly federal tax return. Most of it is paid either through income taxes or payroll taxes.

Other 1040 schedules information about the other schedules filed with form 1040. Income taxes are the most significant form of taxation in australia and collected by the federal government through the australian taxation officeaustralian gst revenue is collected by the federal government and then paid to the states under a distribution formula determined by the commonwealth grants commission. Australia maintains a relatively low tax burden in comparison with other.

Federal tax revenue is the total tax receipts received by the federal government each year. Instructions for form 941 pdf.

More From Quickbooks Self Employed Invoice Payments

- Self Employed Netherlands Visa

- Furlough Leave July

- Government Jobs In India 2020 For 10th

- Personal Loan For Self Employed In Uae

- Government Administration Jobs Townsville

Incoming Search Terms:

- How Does The Government Get Our Money The Tobacco Tax For One Tpl Government Administration Jobs Townsville,

- Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities Government Administration Jobs Townsville,

- Who Are The Getters The Federal Workforce And Low Income States Get The Most Rockefeller Institute Of Government Government Administration Jobs Townsville,

- Ppt Chapter 22 The Public Sector Powerpoint Presentation Free Download Id 313335 Government Administration Jobs Townsville,

- Us Federal Tax Revenue By Year Government Administration Jobs Townsville,

- Bbl2014 Trimester 3 2009 2010 Government Tax Revenue Government Administration Jobs Townsville,