Federal Government Taxes Are Regressive While States Taxes Tend To Be Progressive, Mapped Visualizing Unequal State Tax Burdens Across America

Federal government taxes are regressive while states taxes tend to be progressive Indeed recently is being hunted by consumers around us, perhaps one of you personally. Individuals now are accustomed to using the net in gadgets to view video and image data for inspiration, and according to the title of the post I will discuss about Federal Government Taxes Are Regressive While States Taxes Tend To Be Progressive.

- What Is A Regressive Tax

- Who Pays 6th Edition Itep

- Capitol Fax Com Your Illinois News Radar Study Illinois Has 8th Most Regressive State And Local Tax System

- Is Australia S Tax And Welfare System Too Progressive Inside Story

- Pdf Who Benefits From The Hidden Welfare State The Distributional Effects Of Personal Income Tax Expenditure In Six Countries

- Who Pays The Most Taxes Rich Or Poor

Find, Read, And Discover Federal Government Taxes Are Regressive While States Taxes Tend To Be Progressive, Such Us:

- A Progressive Road Map For Soaking The Middle Class The Heritage Foundation

- How Connecticut S Tax On The Rich Ended In Middle Class Tax Hikes Lost Jobs And More Poverty Illinois Policy

- 2

- Who Pays 6th Edition Itep

- Seattle Taxes Ranked Most Unfair In Washington A State Among The Harshest On The Poor Nationwide The Seattle Times

If you re looking for Hp 246 Government Laptop Drivers For Win10 64bit you've arrived at the right place. We ve got 104 images about hp 246 government laptop drivers for win10 64bit including pictures, pictures, photos, wallpapers, and much more. In these web page, we also have number of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Is Australia S Tax And Welfare System Too Progressive Inside Story Hp 246 Government Laptop Drivers For Win10 64bit

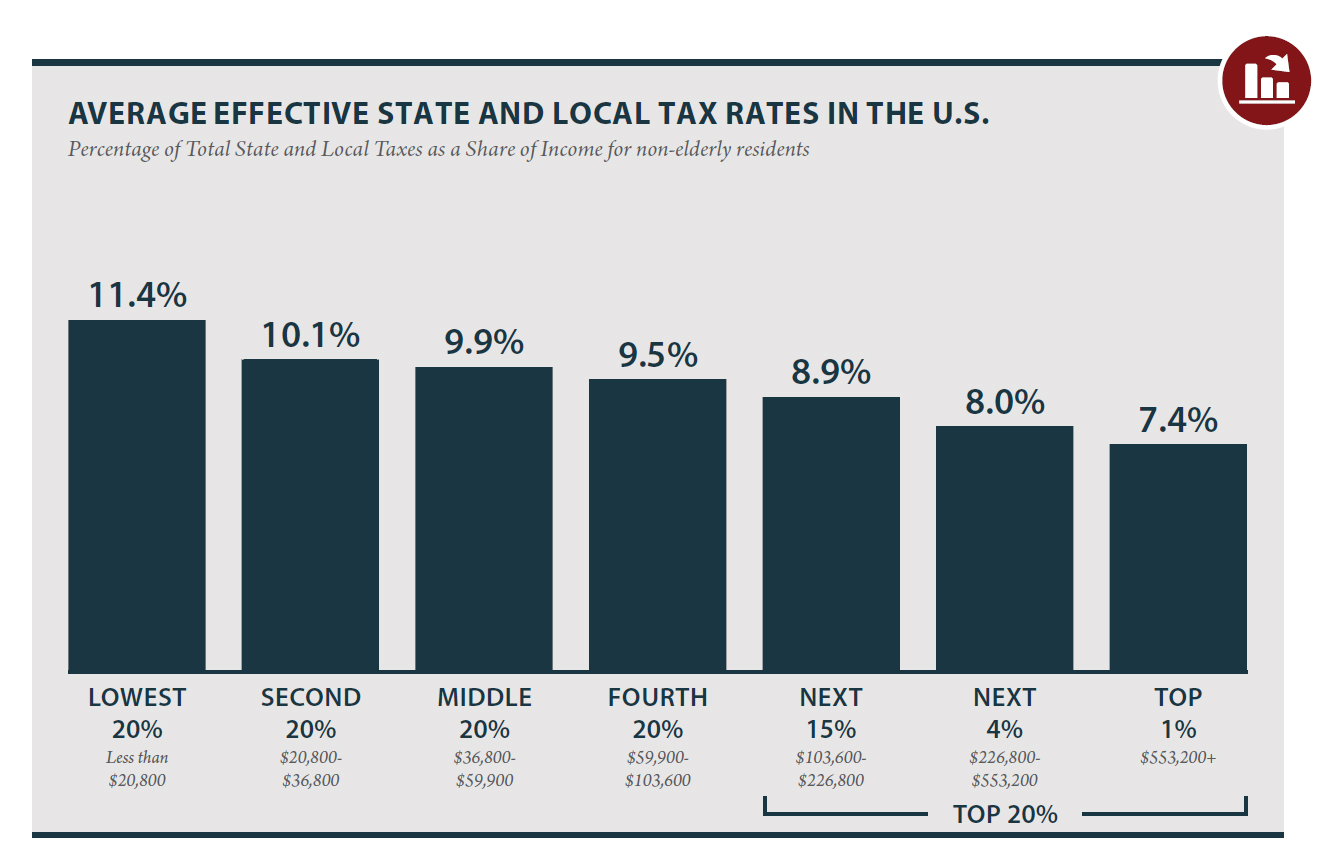

Some federal taxes are regressive as they make up a larger.

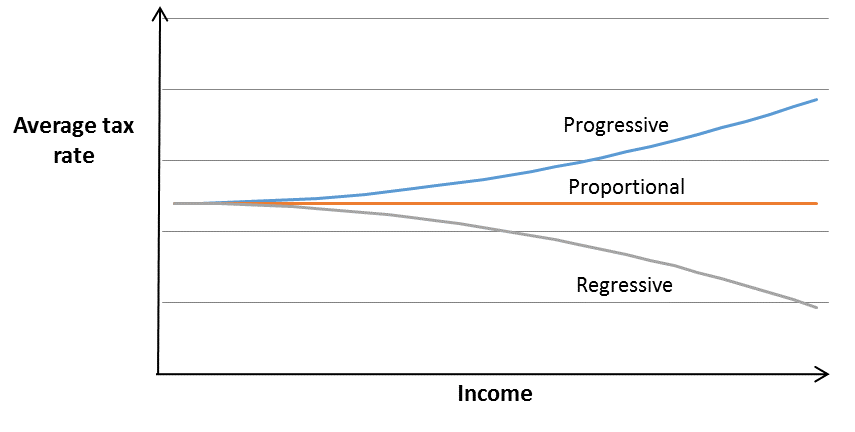

Hp 246 government laptop drivers for win10 64bit. Federal income tax isin a commentary riedl writes. The taxes that are generally considered progressive include individual income taxes and estate taxes. Not all taxes within the federal system are equally progressive.

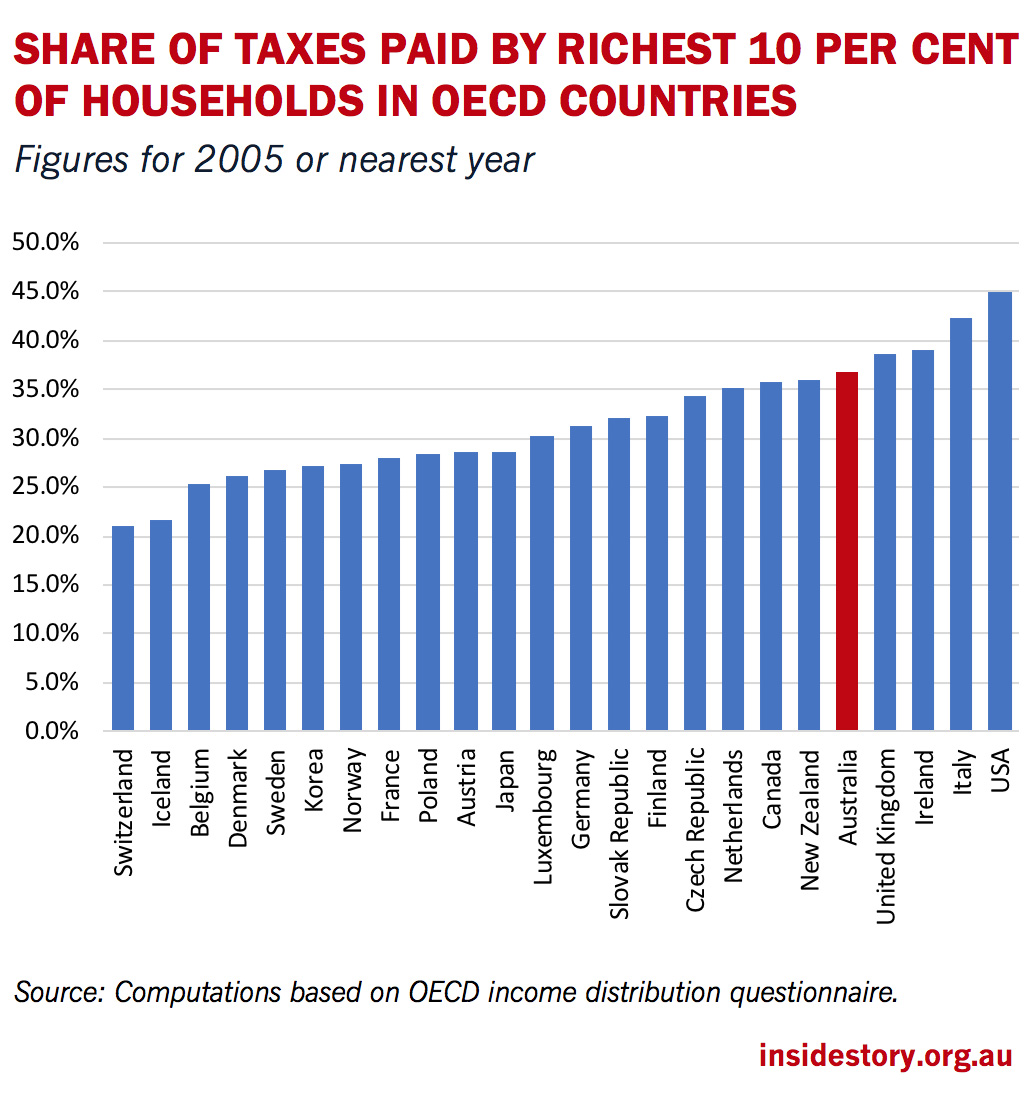

Federal taxes operate under a progressive system. Thus progressive taxes are seen as reducing inequalities in income distribution whereas regressive taxes can have the effect of increasing these inequalities. Taxes in the united states are a mix of progressive regressive and proportional taxes levied by federal state and local governments.

Heading into the 2019 legislative session were apt to be hearing more again about the need for progressive tax reform. While personal income taxes can be reduced in ways that largely benefit moderate income taxpayers by targeting credits and deductions on families with lower incomes most states nine of the 12 states with the largest income tax cuts in the years 1994 through 1997. These rate changes confirm the trend toward more regressive taxation.

Economists cant seem to agree about whether the corporate tax falls on the rich or the poor. At the state level even very progressive tax systems can appear otherwise because of interactions with federal tax policies that redefine taxable income for states or allow deductions of state taxes while state policies that allow federal taxes to be deducted also have major effects. In general the united states federal income tax is progressive as rates of tax generally increase as taxable income increases at least with respect to individuals that earn wage income.

These entities collectively impose personal and corporate income taxes social security and other social welfare taxes sales taxes inheritance taxes excise taxes real estate taxes and personal property taxes among others. The overall federal tax system is progressive with total federal tax burdens a larger percentage of income for higher income households than for lower income households. Putting a little perspective on the issue brian riedl a senior fellow at the manhattan institute reminds us of just how progressive the us.

In 2020 federal progressive tax rates are 10 12 22 24 32 35 and 37. But thats not the case for each tax. As a group the lowest earning workers especially those with dependents pay no income taxes and may actually receive a small subsidy from the federal government.

More From Hp 246 Government Laptop Drivers For Win10 64bit

- Majority And Minority Government

- Government Student Loans For Graduate School

- Government Hospital Examples

- Furlough Scheme Extended In Europe

- Furlough Rules With Holiday

Incoming Search Terms:

- Oecd Ilibrary Home Furlough Rules With Holiday,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcs4rko9 Xj3aclnjubokebqy 43xxe1rtqvb Lrhkxigmp64iac Usqp Cau Furlough Rules With Holiday,

- Sales Taxes In Countries Of The Far East Imf Staff Papers Volume 16 No 3 Furlough Rules With Holiday,

- Racial Disparities And The Income Tax System Furlough Rules With Holiday,

- Who Pays The Most Taxes Rich Or Poor Furlough Rules With Holiday,

- How Does A Progressive Income Tax System Work Furlough Rules With Holiday,