Does The Furlough Scheme Cover Holiday Pay, Furlough Leave And The Job Retention Scheme For Coronavirus Landau Law

Does the furlough scheme cover holiday pay Indeed lately is being sought by users around us, perhaps one of you personally. People now are accustomed to using the net in gadgets to see image and video information for inspiration, and according to the name of this article I will discuss about Does The Furlough Scheme Cover Holiday Pay.

- Coronavirus And Annual Leave

- How Will Flexible Furlough Affect Holiday Fcsa

- Holiday Pay And Annual Leave On Furlough Bm Insights Blake Morgan

- Why Today Is A Significant Day For Furlough Redundancies Your Money

- New Government Covid Scheme To Pay Up To Half Of Wages Bbc News

- Coronavirus Latest Furlough And Holiday Pay Guidance

Find, Read, And Discover Does The Furlough Scheme Cover Holiday Pay, Such Us:

- Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk

- Faqs Recording Furlough Leave In Xero Payroll Xero Blog

- Coronavirus Latest Furlough And Holiday Pay Guidance

- Furlough And Annual Leave How Accruing Holiday Works When Furloughed On The Coronavirus Job Retention Scheme

- Kllsf53i7ni2fm

If you are searching for Self Employed Profit And Loss Statement For Small Business you've reached the ideal place. We have 101 images about self employed profit and loss statement for small business adding pictures, pictures, photos, wallpapers, and much more. In such webpage, we also have variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Covid 19 Furlough Under Job Retention Scheme Faqs Make Uk Self Employed Profit And Loss Statement For Small Business

Employers can continue to claim through the job retention scheme for furloughed workers even when they are taking holiday.

Self employed profit and loss statement for small business. When an employee becomes sick while on furlough employers can choose to either keep the employee on furlough continue to pay 80 wages and claim for it via the scheme or put the employee on sickness absence and pay sick pay as appropriate. You can agree with your employer to vary holiday pay entitlement as part of the furlough agreement however almost all workers are entitled to 56 weeks of statutory paid annual leave each. In view of the two extensions to the furlough scheme the issue of what happens to holidays is important.

However as taking holiday does not break the furlough period the employer can continue to claim the 80 grant from the government to cover most of the cost of holiday pay. It is therefore important to distinguish between periods of leave taken up to 5 april 2020 and subsequently. Employers must pay er nic and pension contributions as well as topping up the employees wages so that they reach 80 for the time that theyre furloughed.

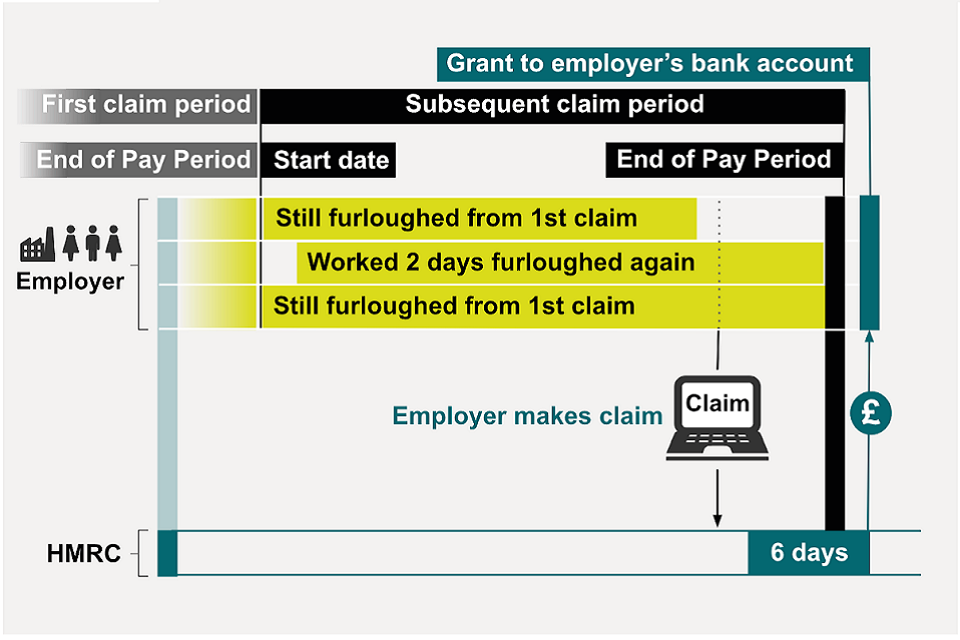

The government has extended the furlough job retention scheme until october 2020 although specific details of the scheme from august are yet to be clarified. In this case employers can still use the furlough scheme to cover 80 percent or 2500 gross if lower of holiday pay but should then be topping up workers holiday pay to 100 percent. So if an employee were to go back to work for two days a week for example their employer would pay them for the hours theyve worked and the furlough scheme would continue to pay them for the remaining three days a week when theyre on furlough.

However as taking holiday does not break the furlough period your employer can continue to claim the 80 per cent grant from the government to cover most of the cost of holiday pay. Any holiday entitlement that is taken for bank holidays or any other days must be paid based on the holiday pay regulations which changed on 6 april 2020 si 20181378. The employer is required to top up the employees gross pay when holiday is taken if the employee is entitled to higher holiday pay than their furlough pay.

In october the final month of the scheme the government will pay 60 with a cap up to 1875 for the hours the employee is on furlough. Carrying annual leave.

Furlough Scheme Changes What Are The New Part Time Rules And How Is My Pay Affected Self Employed Profit And Loss Statement For Small Business

More From Self Employed Profit And Loss Statement For Small Business

- Self Employed Payslip Template Uk

- Government Quota In Private Medical Colleges

- Government Procurement Process India

- Government Decree No 341 Of 2020 Vii 12

- Self Employed Quickbooks

Incoming Search Terms:

- Furlough How Does Furlough Affect Holiday Pay Is My Entitlement The Same Personal Finance Finance Express Co Uk Self Employed Quickbooks,

- Https Www Brabners Com Sites Default Files 2020 05 Holiday 20leave 20and 20pay 20during 20the 20coronavirus 20pandemic Pdf Self Employed Quickbooks,

- How Does The Government S Furlough Scheme Work Economics Observatory Self Employed Quickbooks,

- Holiday Pay And Annual Leave On Furlough Bm Insights Blake Morgan Self Employed Quickbooks,

- Furlough Scheme And Mortgage Holidays Extended As England Braces For New Lockdown Self Employed Quickbooks,

- United Kingdom Further Updates And Faqs On The Uk Furlough Scheme Littler Mendelson P C Self Employed Quickbooks,