Self Employed Monthly Income Statement, Free Printable Profit And Loss Template For Self Employed Bogiolo

Self employed monthly income statement Indeed recently is being hunted by users around us, perhaps one of you personally. People are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the name of the post I will talk about about Self Employed Monthly Income Statement.

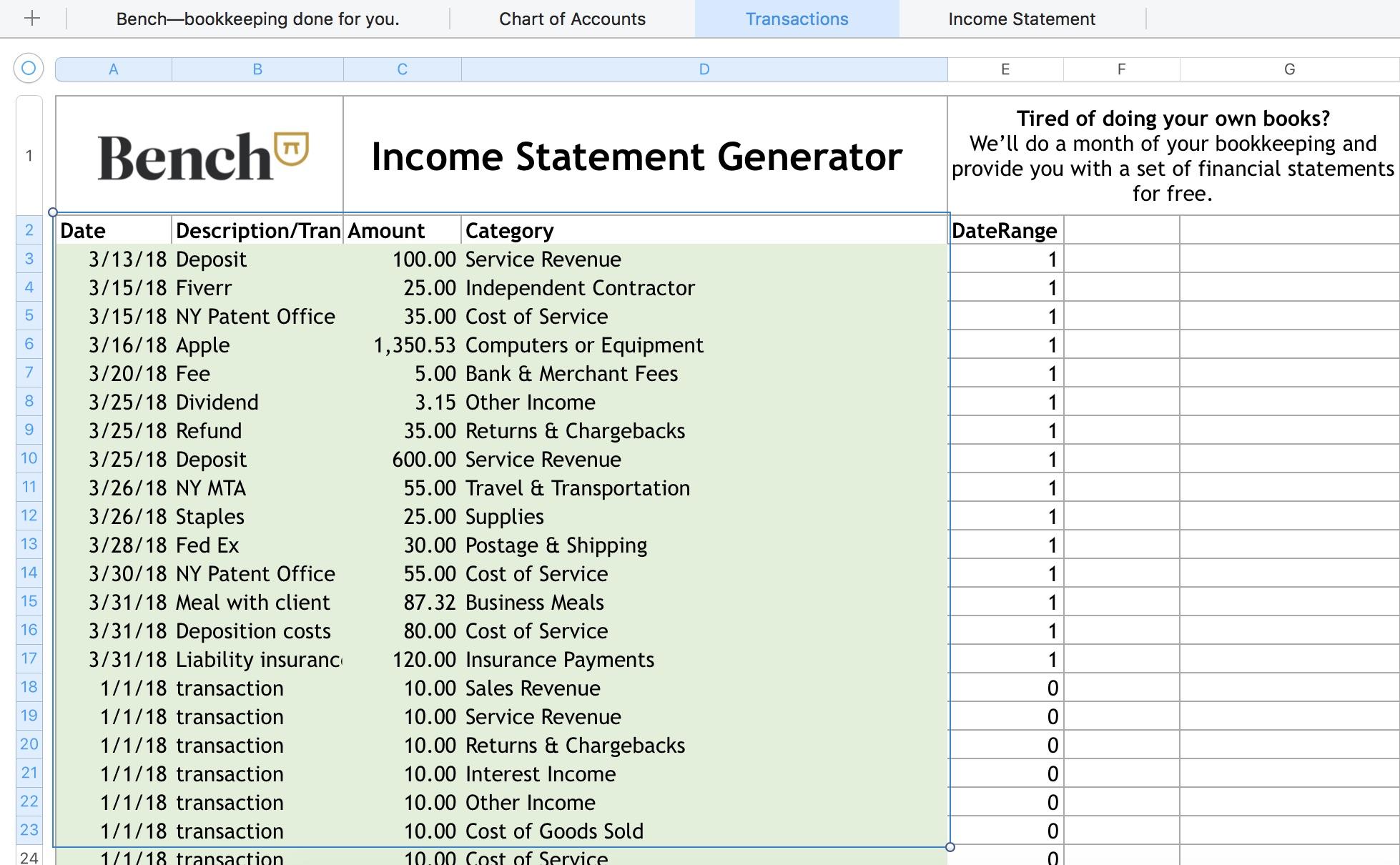

- Income Statement Excel Template Resume 2007 Free Stock Photos Hd Projected Format Sample Profit And Loss Printable Wor Golagoon

- Self Employment Ledger 40 Free Templates Examples

- Free 10 Bookkeeping Templates For Self Employed In Pdf

- The Business Spreadsheet Template For Self Employed Accounting Taxes Llcs Youtube

- 005 Monthly Income Statement Template Excel Inspirational New Simple Hunecompany Com W Golagoon

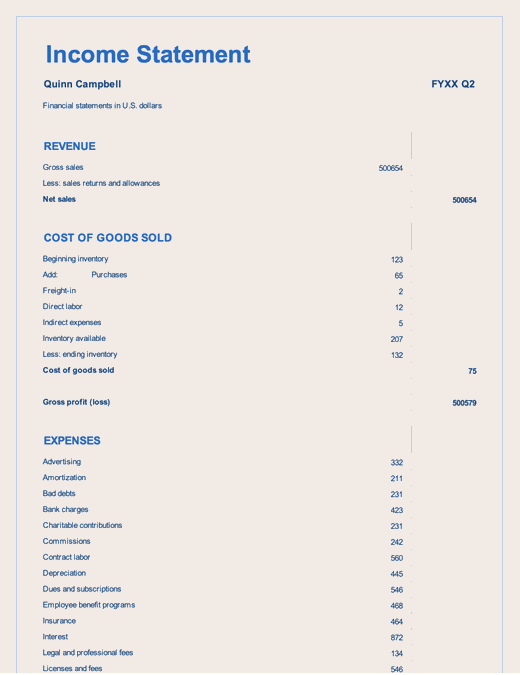

- Profit Loss Statement Example Elegant Profit And Loss Statement For Self Employed In 2020 Profit And Loss Statement Statement Template Income Statement

Find, Read, And Discover Self Employed Monthly Income Statement, Such Us:

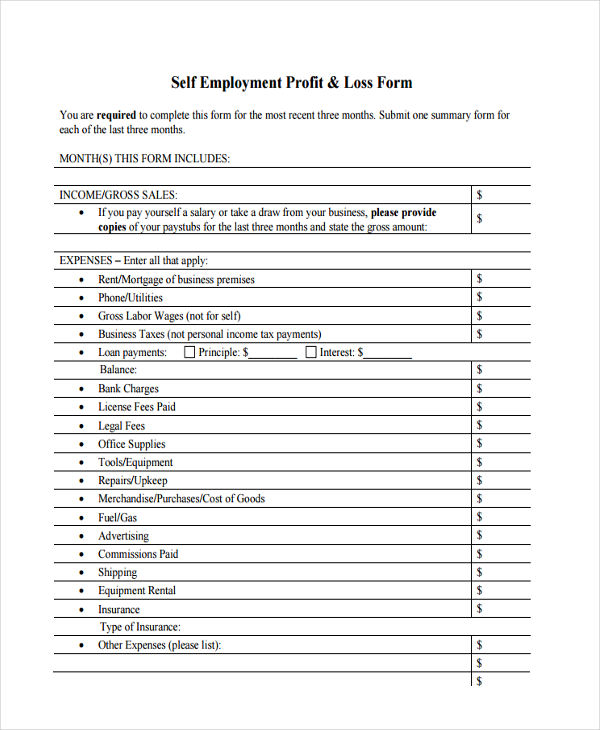

- Free Printable Profit And Loss Template For Self Employed Bogiolo

- Income Statement Excel Template Resume 2007 Free Stock Photos Hd Projected Format Sample Profit And Loss Printable Wor Golagoon

- Simple Profit And Loss Statement For The Self Employed The Spreadsheet Page

- 3

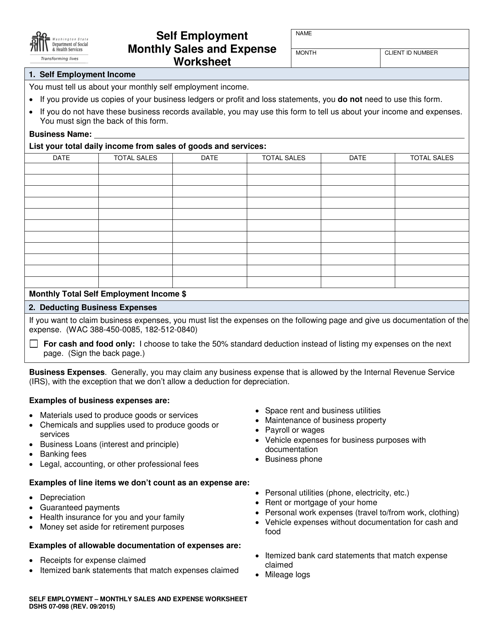

- Dshs Form 07 098 Download Printable Pdf Or Fill Online Self Employment Monthly Sales And Expense Worksheet Washington Templateroller

If you are searching for Government Procurement Card you've reached the right location. We have 104 images about government procurement card including images, photos, photographs, wallpapers, and more. In these webpage, we also provide variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

This usually comes in form of the letter written by you or an.

Government procurement card. If your accounting period is 6 th april to 5 th april the best advice is to add the end of the year april figures into march. Statement of self employment income this is. Address the support section or contact our support team in the event that youve got any concerns.

The details you add to your pl provide information about your business capacity to generate profit by increasing revenues reducing expenses or both. The self employed bookkeeping template runs from april to march. Press done after you fill out the form.

Examples of such include daily monthly quarterly and annual periods. An official government record. Self employed bookkeeping template.

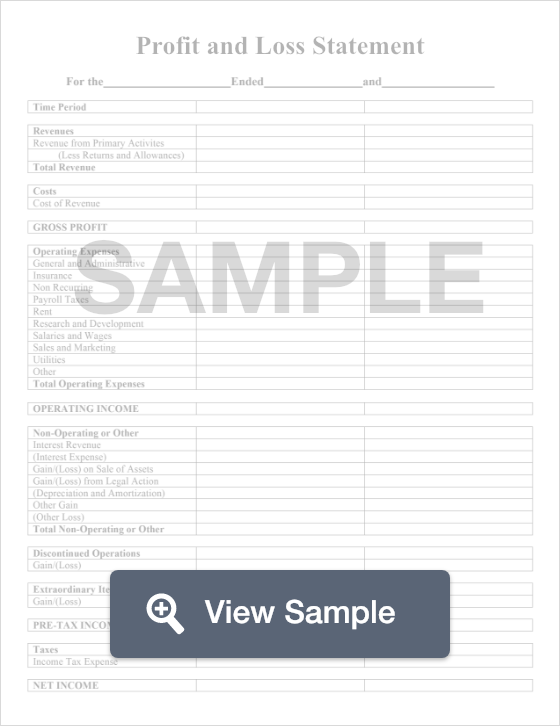

Statement of self employment income may 12th 2018 statement of self employment income this is an official government record or incomplete false information given on this form monthly income estimateprofit and loss statement. Pl is a financial document that summarizes your business revenues and expenses during a specific period of time usually a month quarter or year. A profit and loss statement aka.

Now youll be able to print download or share the document. Also referred to as an income statement or profit and loss account this is used to show the revenues and expenses of a company over a particular period. Setting up a separate account for business purposes alone is a perfect way to disassociate your personal and professional expenses and deposits.

A self employed person gets his or her income by conducting profitable actions either from trade or business that he or she operates. Writing an income verification is very usual to be asked to verify your income when inquiring about a loan rental agreement etc. A contrasting document would be a balance sheet which is meant to represent only a single moment.

Bank statements are a great resource when it comes to tracking and proving income when you are self employed. It can be easy however to misidentify certain expenses or deposits. Full instructions on using the cash book template are available here.

Self employment is an instance in which a person works for himself instead of being employed by an employer who pays on basis of salaries or wages. To write income verification letter for self employed one must hire a person or human resource to write a letter for them but if you are self employed you definitely have to write it by yourself. Or incomplete false information given on this form may result in criminal action being taken under sections 3104 and 3710 or other sections of the texas penal code.

More From Government Procurement Card

- Self Employed Tax Return Form 201819

- Self Employed Hmrc Webchat

- Uk Government Spending Pie Chart 2020

- Government Of Canada Logo Svg

- Government Shutdown 2019 Reason

Incoming Search Terms:

- 7 Profit And Loss Statement Template For Self Employed Profit And Loss Statement Statement Template Income Statement Government Shutdown 2019 Reason,

- Self Employment Income And Expense Statement Free Download Government Shutdown 2019 Reason,

- Profit And Loss Income Statement Templates Examples Excel Word Government Shutdown 2019 Reason,

- Income And Expense Statement Template Luxury 35 Profit And Loss Statement Templates Forms In 2020 Profit And Loss Statement Statement Template Income Statement Government Shutdown 2019 Reason,

- Profit And Loss Statement Template Create A P L For Free Formswift Government Shutdown 2019 Reason,

- Profit Loss Statement Template 13 Free Pdf Excel Documents Download Free Premium Templates Government Shutdown 2019 Reason,