Self Employed Profit And Loss Statement For Small Business, Https Www Pnc Com Content Dam Pnc Home Hq Pdfs Financial Hardship Assistance Documents Sample 20profit 20and 20loss 20statement Pdf

Self employed profit and loss statement for small business Indeed lately is being hunted by users around us, perhaps one of you. Individuals are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of this article I will talk about about Self Employed Profit And Loss Statement For Small Business.

- Free 7 Sample Profit And Loss Statement Forms In Pdf Excel

- What Is A Profit And Loss Statement Shared Economy Cpa

- Simple Profit And Loss Statement For The Self Employed The Spreadsheet Page

- Free 8 Sample Profit Loss Statement Templates In Pdf Excel

- Profit Loss Statement Template 13 Free Pdf Excel Documents Download Free Premium Templates

- 35 Profit And Loss Statement Templates Forms Free Template P Golagoon

Find, Read, And Discover Self Employed Profit And Loss Statement For Small Business, Such Us:

- Profit And Loss Statement Free Template For Excel

- 023 Self Employed Profit And Loss Statement Template Intended For Spreadshee Golagoon

- Profit And Loss Income Statement Templates Examples Excel Word

- Profit And Loss Template Pdf Free Of Statement For Real Estate Ag Golagoon

- Retail Sales Profit And Loss Template Excel Weekly 2007 Templates Bpeducation Co

If you are searching for What Is Furlough Employees Mean you've reached the ideal location. We ve got 104 images about what is furlough employees mean including images, photos, photographs, backgrounds, and more. In these web page, we also provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

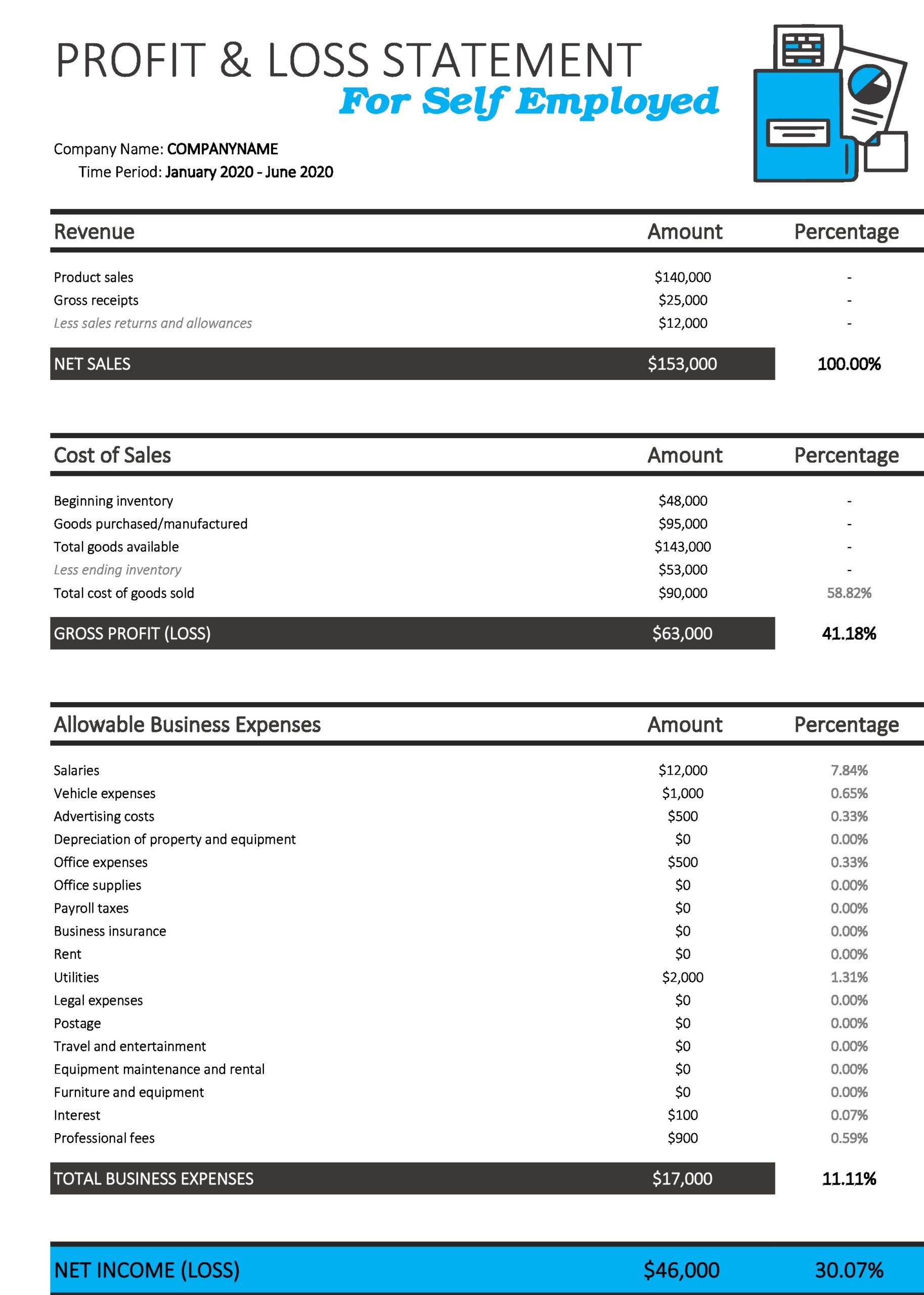

Revenue generated from the sale of goods and services.

What is furlough employees mean. If youre a self employed worker or business owner a profit and loss statement is an absolute necessity to. Cost of goods sold. A profit and loss statement for the self employed will help you know the exact amount of money you are earning and losing.

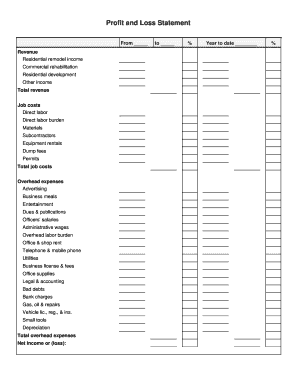

And its no secret that one key to success is having an intimate knowledge of the businesss finances but not every small business owner has an mba. The usual profit and loss statements focus on the sale of products and its prices to find out the gross margin but the service companies need a profit and loss statement to be prepared based on the key factors of all around productivity and the cost of the services. What are the benefits of these profit and loss statement templates.

The consulting service business requires a different format for its profit and loss statement. For any organization irrespective of the size maintaining a profit and loss statement is of paramount importance. Including labor and material costs.

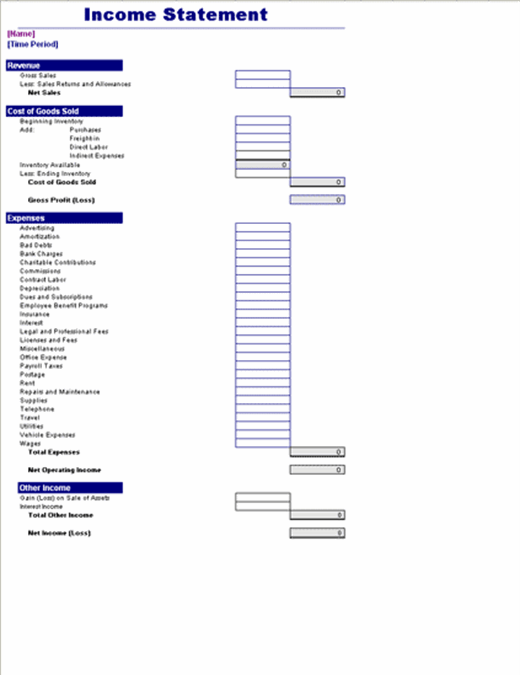

Self employed individuals or small business owners can not afford to have a full time auditor to calculate their profit and loss. Expenses accounting and legal fees. An income statement also called a profit and loss statement lists a businesss revenues expenses and overall profit or loss for a specific period of time.

426 gross profit 573800. For any organization irrespective of the size maintaining a profit and loss statement is of paramount importance. An income statement reports the following line items.

However there is one financial statement you may be required to prepare for tax purposes and that is the profit and loss statement the irs requires from sole proprietors. What are the benefits of these profit and loss statement forms. All these business expenses add up and it becomes difficult to figure out whether the business is making any profit or losing.

Every small business owner wants to be successful. Weve created our profit and loss statement for small business template for all the bakers the rental property owners the handypersons for everyone who is an expert in their field. Cost of goods sold 426200.

Reveal if your business is profitable or losing money provide the information you need to make sound business decisions and. As a self employed individual you may not have considered the need to prepare financial statements for your small business. Self employed individuals or small business owners cannot afford to have a full time auditor to calculate their profit and loss.

Total revenue 1000000.

More From What Is Furlough Employees Mean

- Self Employed Furlough Payment Application

- List Of Government Grants For Individuals

- Self Employed Labourer Insurance

- Types Of Government Quiz Quizlet

- Furlough Scheme Changes November

Incoming Search Terms:

- Dc Small Business Recovery Microgrants Coronavirus Furlough Scheme Changes November,

- Small Business Profit And Loss Account Template Furlough Scheme Changes November,

- Profit And Loss Office Com Furlough Scheme Changes November,

- Profit And Loss Statement P L Account Example And Template Furlough Scheme Changes November,

- Profit And Loss Spreadsheet Small Ess Free Template Uk Simple For Business Sarahdrydenpeterson Furlough Scheme Changes November,

- 19 Printable Profit And Loss Statement For Self Employed Template Free Forms Fillable Samples In Pdf Word To Download Pdffiller Furlough Scheme Changes November,