Government Loans For Small Business During Covid 19, Small Business Can Get More Covid 19 Aid Fort Wayne Fireworks And Festivals Planned Covid 19 Fwbusiness Com

Government loans for small business during covid 19 Indeed recently is being sought by consumers around us, perhaps one of you personally. Individuals now are accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the title of this article I will talk about about Government Loans For Small Business During Covid 19.

- What To Do If You Re A Small Business Owner During Covid 19 The Chatham News Record

- Covid 19 Better Business Loan Program Dekalb County Ga

- Covid 19 Help For Businesses Hawaii County Hi Research Development

- Government Funding Fairfield County Bank

- Welcome To The City Of Columbia

- Coronavirus Resources And Information Congresswoman Elise Stefanik

Find, Read, And Discover Government Loans For Small Business During Covid 19, Such Us:

- Rep Dave Baker Small Business Administration Loans Now Available For Businesses Impacted By Covid 19 Outbreak

- Virginia To Provide Grants Of Up To 10 000 For Small Businesses Affected By Covid 19 Business News Richmond Com

- La County Moving Forward With Covid 19 Small Business Assistance Program Supervisor Mark Ridley Thomas

- Covid 19 Cares Act Fraud Small Business Loans Fti Consulting

- State College Pa Gov Wolf Economic Injury Disaster Loans Available To Small Businesses And Non Profits Facing Losses Related To Covid 19

If you re searching for Korean Government Scholarship Program Philippines you've arrived at the ideal location. We have 100 images about korean government scholarship program philippines adding images, pictures, photos, wallpapers, and more. In such page, we also provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

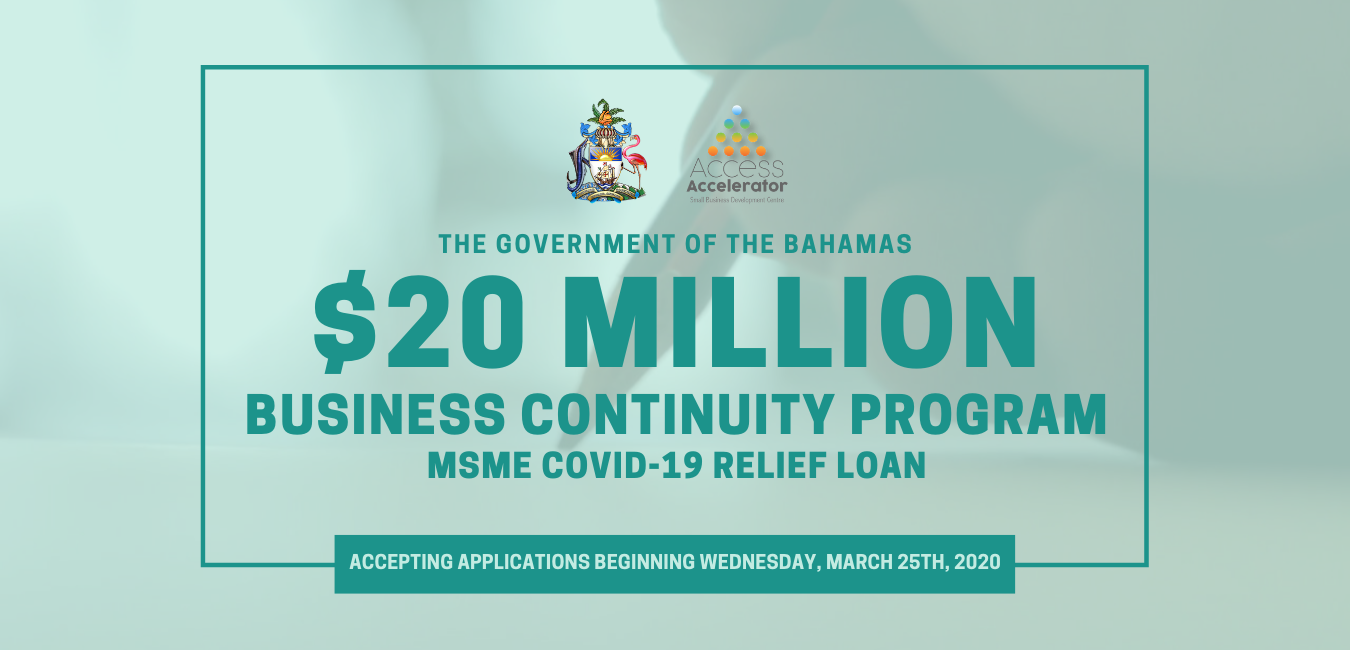

Government Provides Business Continuity Loan Program For Small Businesses Access Accelerator Sbdc Korean Government Scholarship Program Philippines

Having a partial guarantee on the funds means that lenders are able to offer loans to customers at lower.

Korean government scholarship program philippines. Employers might be eligible for financial support to pay wages. For covid 19 government backed business loans this guarantee is 50 of the funding amount. The minimum and maximum annual payroll required to access a cerb loan was recently changed to a.

Apply for the coronavirus business interruption loan scheme. Small business guidance loan resources. Financial support for businesses during coronavirus covid 19.

Small businesses are encouraged to do their part to keep their employees customers and themselves healthy. Loans tax relief and cash grants are available. March 27 2020 businesses will be able to access interest free loan of 40000 through their financial institutions and 25 of the loan up to 10000 will be eligible for forgiveness.

Coronavirus covid 19 support is available to businesses. These loans can be up to 100000 and have three year terms with a 12 year amortization. Canada emergency business account for small businesses.

Small businesses suffering economic injury during the covid 19 pandemic are able to apply for working capital loans up to 2 million to help overcome the temporary loss of revenue due to this crisis. The new bill also makes farmers and agricultural companies with fewer than 500 employees eligible for economic injury disaster loans an sba program that loans money to small businesses in crisis. The loans can range from 5000 to 25000.

Covid 19 business loans up to 25000 are available through microfinance ireland with zero repayments and zero interest for the first 6 months and the equivalent of an additional 6 months interest free subject to certain terms and conditions. Support for small and medium sized businesses.

More From Korean Government Scholarship Program Philippines

- Government Lockdown Rules Uk

- Self Employed Definition Ireland

- Government Intervention Example

- Proof Of Income Letter Self Employed Pdf

- Furlough Scheme End Date Uk

Incoming Search Terms:

- Covid 19 Help For Businesses Hawaii County Hi Research Development Furlough Scheme End Date Uk,

- Tamworth Businesses Urged To Claim Their Share Of 12million Tamworth Borough Council Furlough Scheme End Date Uk,

- Covid 19 Government Of Canada Emergency Loans For Businesses Ceba The Town Of Petawawa Furlough Scheme End Date Uk,

- Njeda Njeda Announces 50 Million Expansion Of Grant Program For Businesses Impacted By Covid 19 Furlough Scheme End Date Uk,

- 100 Public Pharma And Cmos Took Ppp Covid 19 Small Business Loans Furlough Scheme End Date Uk,

- Covid 19 Small Business Assistance Program Hampton Va Official Website Furlough Scheme End Date Uk,