Self Employed Definition Ireland, Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

Self employed definition ireland Indeed recently has been hunted by users around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the name of the article I will talk about about Self Employed Definition Ireland.

- Https Www Jstor Org Stable 4135292

- Are Funded Pensions Well Designed To Adapt To Non Standard Forms Of Work Pensions At A Glance 2019 Oecd And G20 Indicators Oecd Ilibrary

- What Is The Difference Between Self Employed And Sole Trader

- Https Www Jstor Org Stable 146367

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

- Self Employment And Entrepreneurship In Urban And Rural Labour Markets Sciencedirect

Find, Read, And Discover Self Employed Definition Ireland, Such Us:

- The Social Security Ireland Order 2019

- Simple Paye Taxes Guide Tax Refund Ireland

- Taxation In The Republic Of Ireland Wikipedia

- Iza World Of Labor Ethnic Minority Self Employment

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

If you re searching for Self Employed Vs Freelance you've reached the ideal place. We have 104 images about self employed vs freelance including pictures, photos, pictures, backgrounds, and much more. In these web page, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Self employed workers are those workers who working on their own account or with one or a few partners or in cooperative hold the.

Self employed vs freelance. The issue of employment status is very complex in ireland and the terms employed and self employed are not defined in irish law. Sources of information on starting a business. From a financial view point the primary advantage of being self employed is that you are given greater flexibility in the expenses you can claim for tax purposes.

Although the precise definition of self employment varies among the us. Its highest value over the past 28 years was 2395 in 1992 while its lowest value was 1521 in 2019. Being self employed means you are carrying on your own business rather than working for an employer.

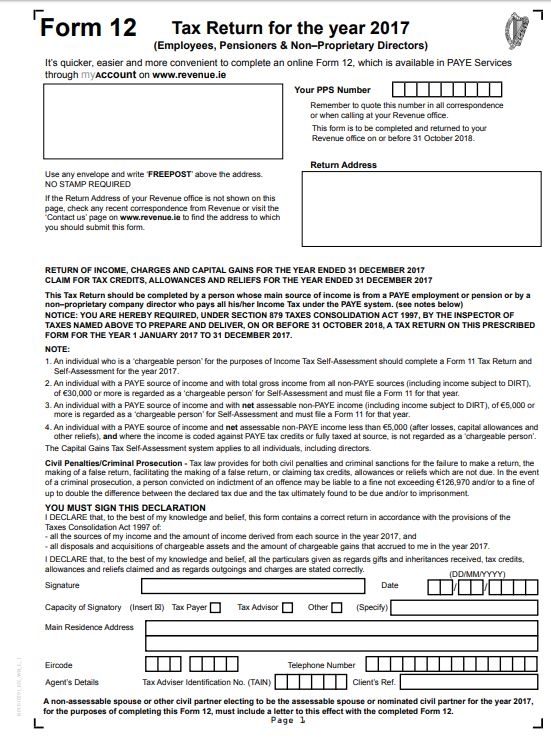

When you become self employed it means you are carrying on your own business rather than working for an employer and there are a number of things to take into consideration. If you are self employed you are responsible for the payment of your own tax and pay related social insurance prsi and universal social charge usc. If youre self employed in ireland then youre obliged to file a self assessed tax return usually by the deadline of october 31 or by the pay and file deadline of nov 10.

Bureau of labor statistics bls the internal revenue service irs and private research firms those who are. If you are an employee your employer is responsible for the collection and payment of your income tax it prsi and usc. With this there are many advantages and disadvantages.

Coming to set up a business or invest in ireland. Information for foreign nationals on the immigrant investor and entrepreneur schemes. A recent decision by the employment appeals eat eat in the matter of ben osullivan the claimant against liberty insurance limited the respondent pursuant to a claim under the unfair dismissals acts 1977 to 2015 provides some excellent guidance on the factors to be considered when determining whether an individual is to be classified as an employee or self employed.

For example it means you are in control of what you do so you can organise your own hours. Self employed total of total employment modeled ilo estimate in ireland was 1521 as of 2019. If you want to become self employed you may get help and support from a number of agencies.

You will be engaged under a relevant contract.

More From Self Employed Vs Freelance

- Self Employed Paternity Pay

- Uk Furlough Scheme Period

- Types Of Government Quiz

- Is The Furlough Scheme To Be Extended

- The Furlough Scheme Extension

Incoming Search Terms:

- Expenses You Can Claim If You Re Self Employed In Ireland The Furlough Scheme Extension,

- Https Www Jstor Org Stable 146367 The Furlough Scheme Extension,

- Self Employment Statistics Statistics Explained The Furlough Scheme Extension,

- Simple Paye Taxes Guide Tax Refund Ireland The Furlough Scheme Extension,

- Tax And Self Employment Visual Artists Ireland The Furlough Scheme Extension,

- Https Www Oecd Ilibrary Org Is Self Employment Quality Work 5jfjdfv381s4 Pdf Itemid 2fcontent 2fcomponent 2f9789264283602 12 En Mimetype Pdf The Furlough Scheme Extension,