Self Employed Income Tax Return, Prepare Uk Self Assessment Income Tax Return By Mons77

Self employed income tax return Indeed recently has been sought by consumers around us, maybe one of you personally. Individuals are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the name of this post I will talk about about Self Employed Income Tax Return.

- Self Employed And Contract Earnings How To File Your Personal Tax Return

- Iras Tax Season 2019 File Taxes Early From 1 Mar

- Understanding Tax Returns Innovative Tax Relief

- Comparison Of Estimates Of Self Employment Income For 11 Industry Download Table

- Schedule Se Self Employment Form 1040 Tax Return Preparation Youtube

- Self Assessment Tax Return And The Short Self Employed Tax Return Form

Find, Read, And Discover Self Employed Income Tax Return, Such Us:

- Schedule Se Self Employment Form 1040 Tax Return Preparation Youtube

- Calameo Turbotax 2013 2014

- Tax Guide For Photographers Fstoppers

- 3 Reasons Why A Big Income Tax Refund Is A Horrible Thing

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctzkwhchxhfj5p 7n6gvapgvn0bwqpuzua8ysf1jdflfsdn3vii Usqp Cau

If you are looking for Government Nursing Colleges Application Forms 2021 you've come to the perfect location. We ve got 104 graphics about government nursing colleges application forms 2021 adding pictures, photos, photographs, wallpapers, and more. In these webpage, we additionally provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

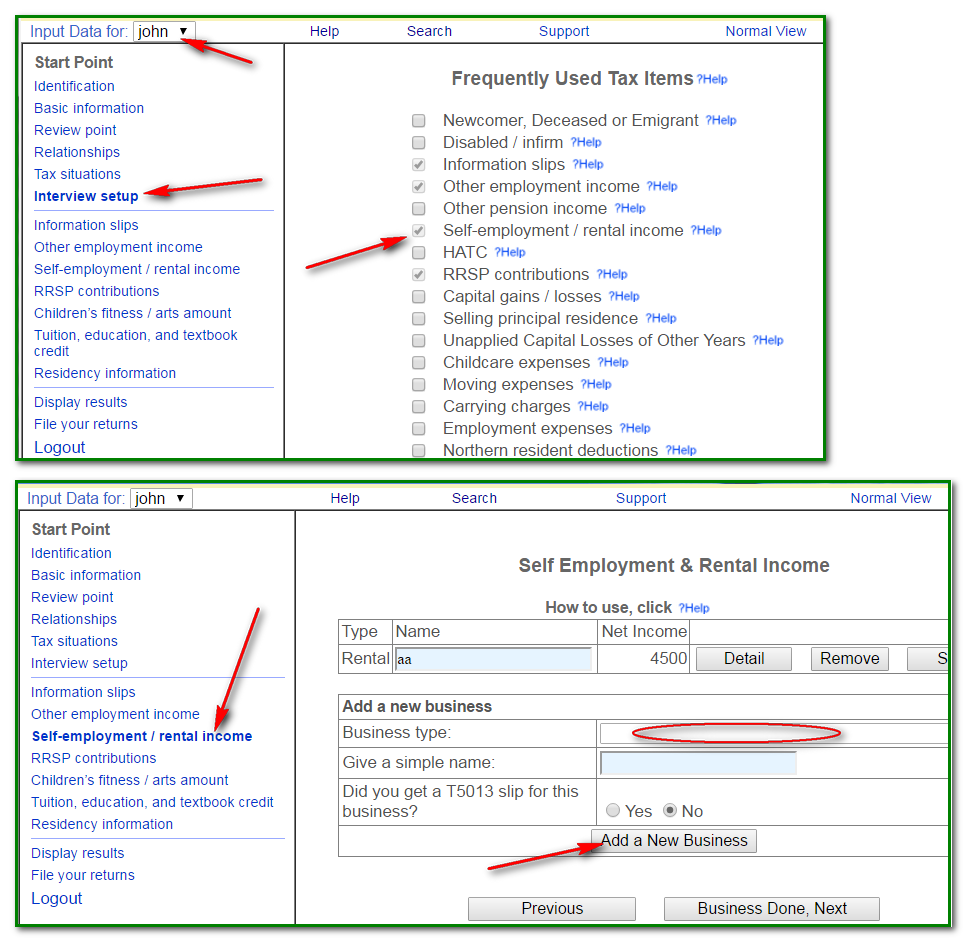

The content on these pages will help you make your 2019 income tax it return and make a self assessment.

Government nursing colleges application forms 2021. It is similar to the social security and medicare taxes withheld from the pay of most wage earners. There are help videos on. You can view your auto included information in the income deductions and reliefs statement idrs at mytax portal.

Opening a pre populated form 11. It is intended to benefit self employed people who were profitable in 2019 but as a result of the covid 19 pandemic will make a loss in 2020. Se tax is a social security and medicare tax primarily for individuals who work for themselves.

You will still have to file a tax return if you received a notification to file. Rental income etc in your tax return. Included with all turbotax deluxe premier self employed turbotax live or prior year plus benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312021.

Self assessment is a system hm revenue and customs hmrc uses to collect income taxtax is usually deducted automatically from wages pensions and savings. Also included with turbotax free edition after filing your 2019 tax return. People and businesses with other income.

Yet most adults do need to file an annual income tax return each year. Not everybody has to file a federal income tax return each year. Completing the self employed income section in the form 11 including information for farmers completing the rental income section in the form 11.

Income tax loss relief for self employed on 23 july 2020 the government announced the introduction of a new once off income tax relief measure. Some 730000 were expected to file a tax return last year according to taxback. You will need to declare other sources of income eg.

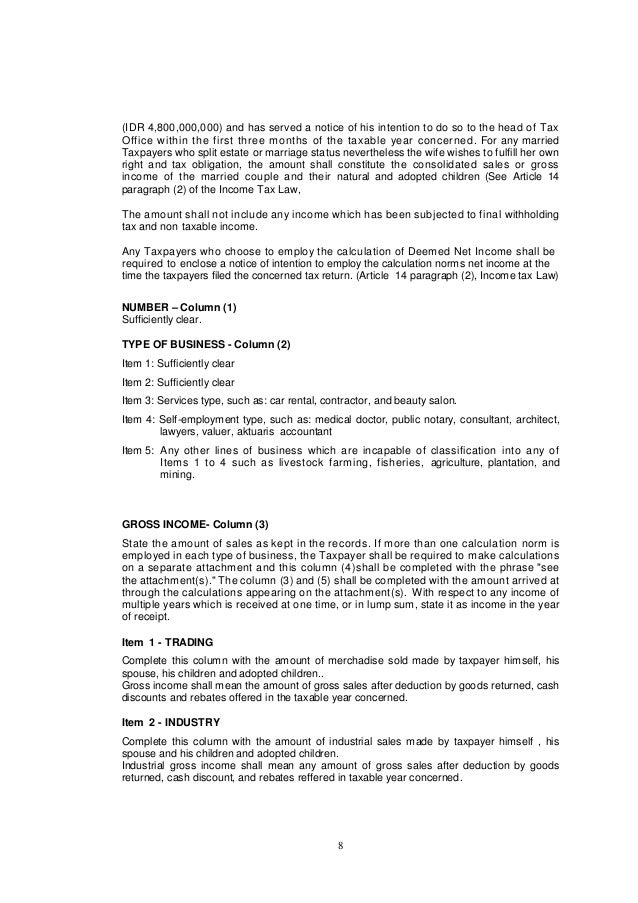

In general anytime the wording self employment tax. Self employed individuals generally must pay self employment tax se tax as well as income tax. Information about schedule se form 1040 or 1040 sr self employment tax including recent updates related forms and instructions on how to file.

For example you dont have to file a return if youre self employed and earn less than 400 in profit during the year.

More From Government Nursing Colleges Application Forms 2021

- What Is The Current Furlough Scheme

- Furlough Scheme Uk Explained

- Self Employed Grant Second Payment How To Claim

- Government Regulation Definition Economics Quizlet

- Government Official Letter Format For Request

Incoming Search Terms:

- Turbotax Self Employed Review 2020 Features Pricing The Blueprint Government Official Letter Format For Request,

- Self Employed And Contract Earnings How To File Your Personal Tax Return Government Official Letter Format For Request,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctw7rwjhqvgpuzhoimbk04bp1 H 6gjv1nh Btkch8o6odh0gpz Usqp Cau Government Official Letter Format For Request,

- Do I Have To File Taxes Government Official Letter Format For Request,

- Gig Workers Self Employed Disregarded Llc Government Official Letter Format For Request,

- Income Tax What Businessmen Or Self Employed Need To Know While Filing Income Tax Returns The Economic Times Government Official Letter Format For Request,