Self Employed 1099 Forms 2019, 14 Tax Tips For The Self Employed Taxact Blog

Self employed 1099 forms 2019 Indeed recently has been sought by consumers around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of the post I will talk about about Self Employed 1099 Forms 2019.

- Publication 926 2020 Household Employer S Tax Guide Internal Revenue Service

- What Is Tax Form 1040 Schedule Se

- 1099 Misc Form Fillable Printable Download Free 2019 Instructions

- Instant Form 1099 Generator Create 1099 Easily Form Pros

- Https Www Guidestone Org Media Guidestone Corporate Ministry Tools Mintaxguide 2112 Mintaxguidesec4 Pdf La En

- Understanding Your Instacart 1099

Find, Read, And Discover Self Employed 1099 Forms 2019, Such Us:

- What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

- I Am Self Employed What Should I Keep Track Of Drive Now Network

- What Is The Self Employment Tax In 2020 Thestreet

- 1040 2019 Internal Revenue Service

- Form W 2 Understanding Your W 2 Form

If you are looking for Functions Of Rural Local Self Government you've arrived at the ideal location. We ve got 104 images about functions of rural local self government including images, photos, pictures, backgrounds, and more. In such page, we also have variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

I Am Self Employed What Should I Keep Track Of Drive Now Network Functions Of Rural Local Self Government

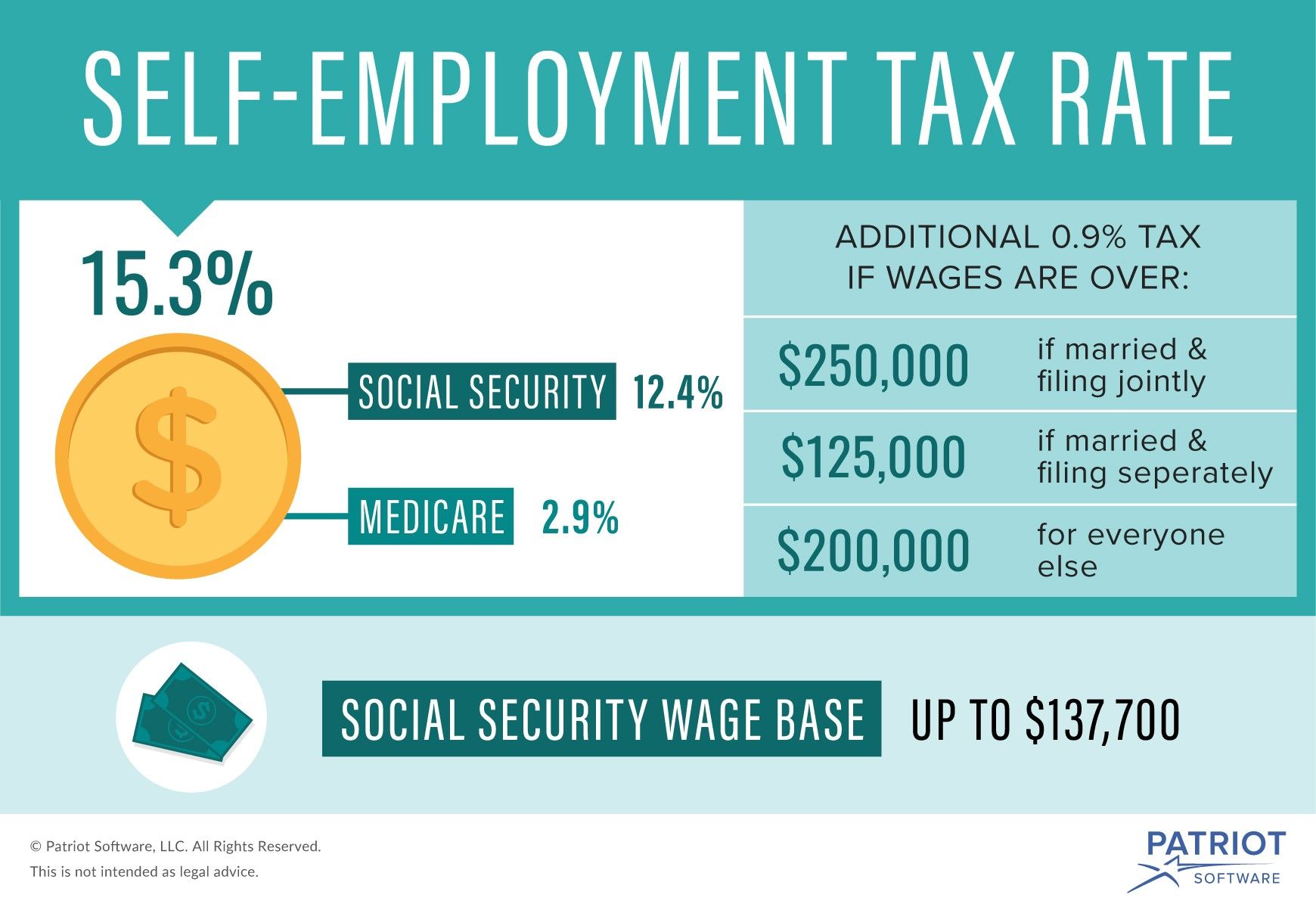

Generally your net earnings from self employment are subject to self employment tax.

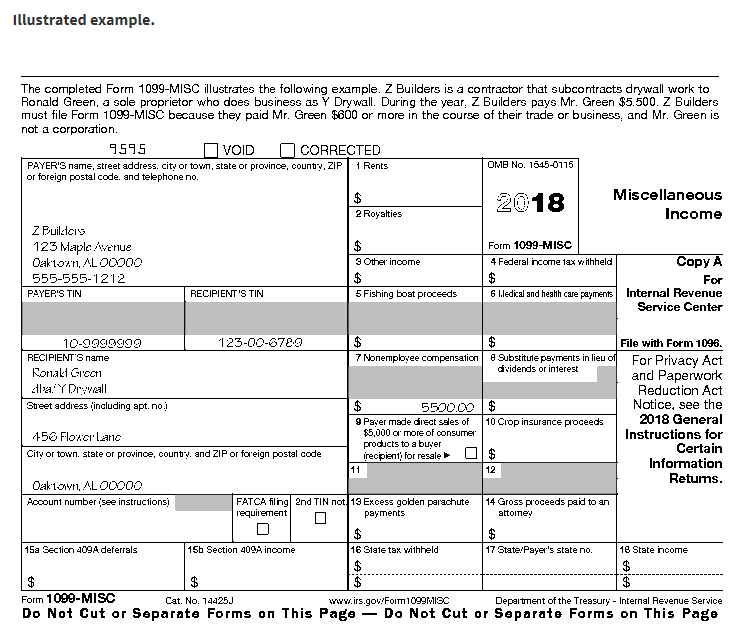

Functions of rural local self government. If your net income from self employment is 400 or more you must file a return and. You dont necessarily have to have a business for payments for your services to be reported on form 1099 misc. You also may have a filing requirement.

April 15 is due date. If the income is reported in box 3 other income include the information on this 1099 misc on line 7a other income. A 1099 form shows dividends government payments income from self employment earnings.

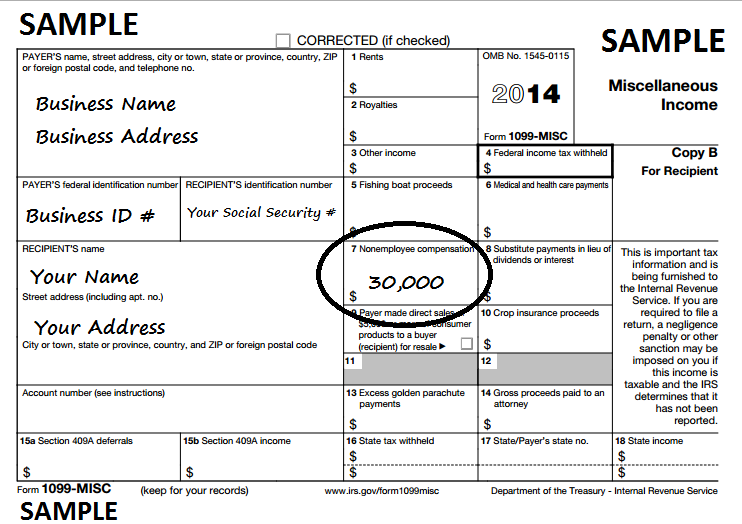

Aside from reporting self employed earnings the 1099 2019 tax forms also register such revenue types as government benefits various types of awards rental payments etc. Payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. If you are a worker earning a salary or wage your employer reports your annual earnings at year end on form w 2however if you are an independent contractor or self employed you should receive a form 1099 nec 1099 misc in prior years from each business client that pays you at least 600 during the tax year.

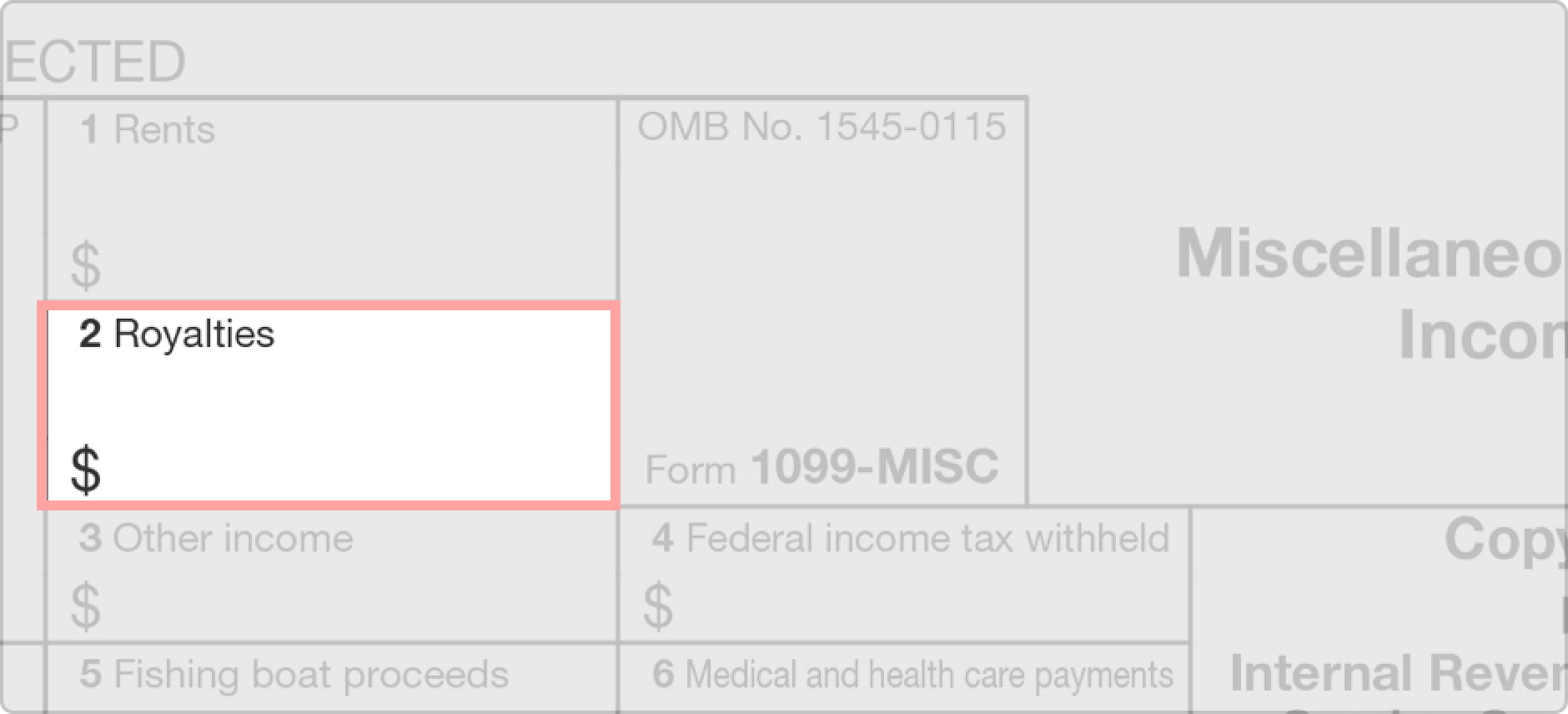

If you dont consider yourself self employed how you report this income on your personal tax return depends on where it is located on the 1099 misc form. Dont forget that now that youre here you no longer need to search for the 1099 tax form 2019 printable template. Issue a form 1099 to a payee.

1099 is taxable income on your 2020 or 2021 tax return. In the self employment section you may need to click show more next to income and expenses click start or revisit when asked did you have any self employment income or expenses select yes. If youre not self employed.

If payment for services you provided is listed in box 7 of form 1099 misc miscellaneous income the payer is treating you as a self employed worker also referred to as an independent contractor. E file form 1099 with your 2020 2021 online tax return. The form may be filed by either the business or the worker.

For example if you are a freelance writer. See the instructions for form 8938. Your net earnings from self employment excluding church employee income were 400 or more.

You must pay self employment tax and file schedule se form 1040 or 1040 sr if either of the following applies. Here you can find tax form 1099 instructions that will go you through all tax form filling routines. Use our modern editor to fill 1099 form online with helpful tips and guides.

Form 1099 step by step instructions on how to e file the form. Youll see the screen titled tell us the type of self employment work you do enter your description then continue. If after reviewing the three categories of evidence it is still unclear whether a worker is an employee or an independent contractor form ss 8 determination of worker status for purposes of federal employment taxes and income tax withholding pdf can be filed with the irs.

Form 1099 reported online to the irs by the payer or issuer.

1099 Misc Form Fillable Printable Download Free 2019 Instructions Functions Of Rural Local Self Government

More From Functions Of Rural Local Self Government

- What Is Furlough Nz

- Self Employed Register Business

- Self Employed Business Loan

- Government Intervention In The Market Always Involves An Opportunity Cost

- Central Government Scholarship 2020

Incoming Search Terms:

- 1099 Form 2019 Get 1099 Misc Printable Form Instructions Requirements What Is 1099 Tax Form Central Government Scholarship 2020,

- Need To Know Covid 19 Unemployment Benefits For The Self Employed News At Poole College Central Government Scholarship 2020,

- What Is Tax Form 1040 Schedule Se Central Government Scholarship 2020,

- 1099 Misc Form Fillable Printable Download Free 2019 Instructions Central Government Scholarship 2020,

- Https Home Treasury Gov System Files 136 How To Calculate Loan Amounts Pdf Central Government Scholarship 2020,

- Where Is My 1099 Atbs Central Government Scholarship 2020,

:max_bytes(150000):strip_icc()/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)