Self Employed Business Loan, Vak Reports Vak Loans Calculation Of Eligibility For Business Loan Self Employed Youtube

Self employed business loan Indeed recently is being sought by users around us, perhaps one of you personally. People now are accustomed to using the net in gadgets to see video and image information for inspiration, and according to the title of this post I will talk about about Self Employed Business Loan.

- Self Employed Home Loans Explained Assurance Financial

- Self Employed Loans Finance For Freelance Business Owners

- Can Qualify For A Car Loan If You Are A Individual That Is Self Employed We Re Equally Excited About Business

- Run Your Organization Effectively With Business Loan

- Self Employed Loans We Do Finance

- Always Getting Something Out Of Our Weekly Business Meeting Check Out This New Self Employed Business Owner Loan Program It S A Bank Statement Statement Loan

Find, Read, And Discover Self Employed Business Loan, Such Us:

- Loans For The Self Employed Loans Online For Bad Credit Instant Decision Compuscience Net

- Small Business Loan For Self Employed Person Online Bad Credit Payday Loans Howtohackpokemongo Com

- Self Employed Loans Finance For Freelance Business Owners

- Participation Fund For Entrepreneurs Self Employed And Start Ups Business Loan Online Loans No Credit Checks

- Self Employed Here Is How You Get A Loan Emartspider

If you are looking for Self Employed Quickbooks Support you've arrived at the ideal location. We have 100 images about self employed quickbooks support including images, photos, photographs, backgrounds, and much more. In such web page, we also have number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

The forgiven amount of the ppp loan is not subject to income tax or technically a reduction of costs eligible to be expensed for tax purposes as it was never claimed as a business expense.

/cdn.vox-cdn.com/uploads/chorus_asset/file/19867695/smallbusiness.jpg)

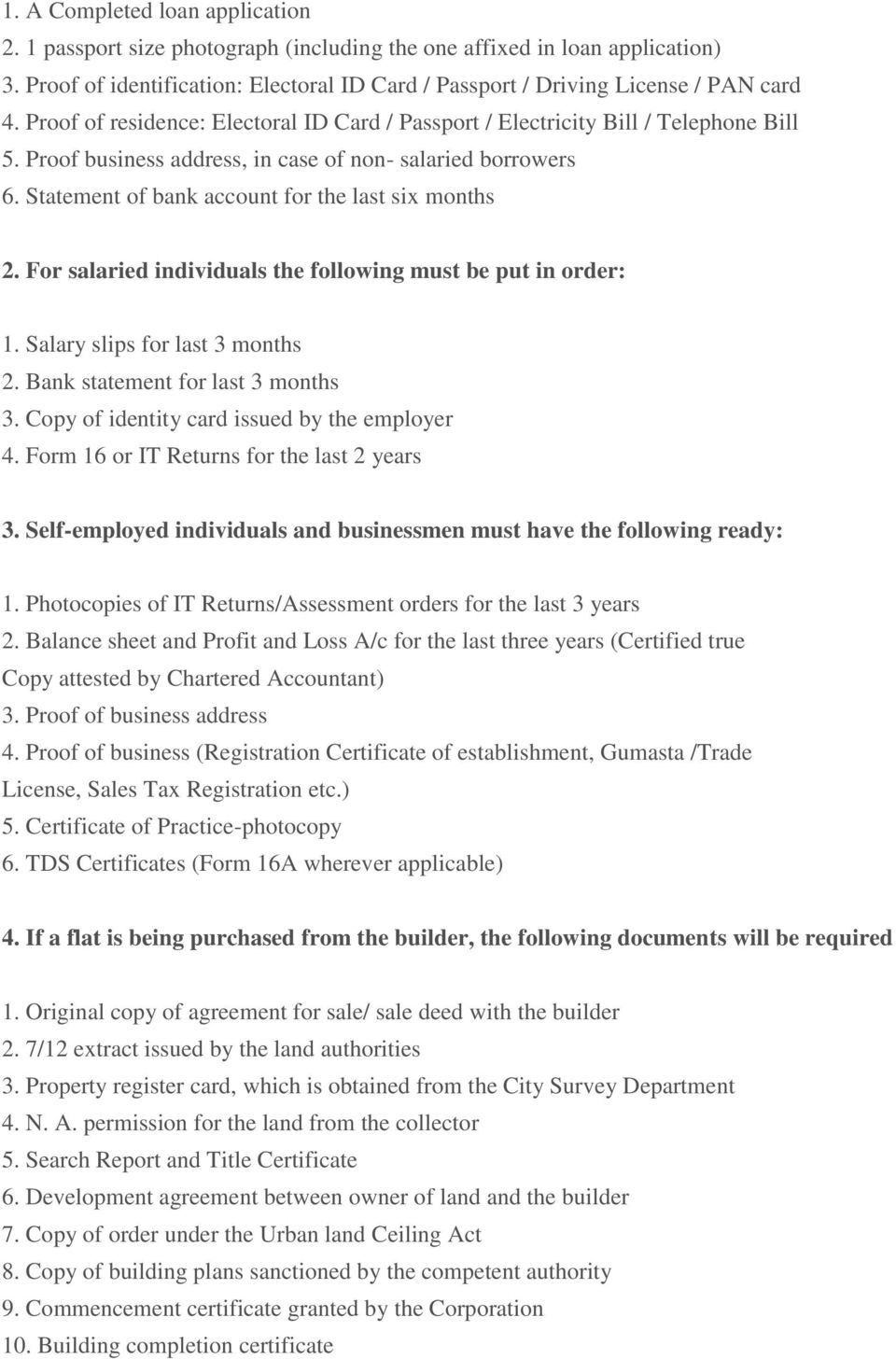

Self employed quickbooks support. Self employed loans are generally unsecured against an asset but can be secured against valuable property if requested. Business loans are the perfect financial tool to serve any short term financial and labour capital needs for self employed as well as msmes business owners or entrepreneurs. They can also come in the form of a merchant cash advance or a limited company loan.

To keep businesses afloat and employees paid small business owners and the self employed are eligible for two loan types. Because the two programs are so new detailed rules and procedures are still being created and published. Paycheck protection program and economic injury disaster loans.

Cares act created two loan programs for small businesses and the self employed. In this competitive financial business market where your business grows in every developing economy customised business loans will support you to understand any mode of. A self employed individual needs to have 3 4 years of business stability and an operational current account with hdfc to avail the loan without an income proof.

1000 to 35000 loan term. 1 to 7 years apr. Whether your business is at an initial stage or in the growth phase additional finance can help you to enhance the growth of your business.

A self employed business loan availed from flexiloans is customised loans that support businesses in understanding the different opportunities that. 129 shawbrook bank offers their business customers a range of services tailored to their companies like asset finance working capital solutions the point of sale finance and structured finance as well as commercial mortgages too. Economic injury disaster loan eidl and paycheck protection program ppp.

Self employed individuals professionals like doctors architects chartered accountants actuaries business consultants etc sole proprietorship firms. Who can take a business loan. The ppp loan forgiveness extension may help the self employed.

The self employed individuals need to have a current account with the lender and also he needs to show 3 years of itr to avail the loan. Top 5 self employed business loan providers 1. A self employed loan is a form of financing specifically designed for self employed workers freelancers and business owners.

More From Self Employed Quickbooks Support

- Work Flow Philippine Government Procurement Process Flow Chart

- Self Employed Furlough Mortgage

- Self Employed Printable Free Blank Profit And Loss Statement Pdf

- Government Official Letters In English

- Government Hospital Definition

Incoming Search Terms:

- Short Term Loan For Business And Self Employed Test Winner January 2019 Government Hospital Definition,

- Building And Getting Credit Tips For Self Employed Individuals Money Poor Rich Tax Blog Credit Card Debt Relief Loans For Poor Credit Credit Card Relief Government Hospital Definition,

- Self Employed Home Loan How To Get A Mortgage Government Hospital Definition,

- 5 Tips For Business Success After Getting A Loan For Self Employed Small Business Loan Calculator Westwoodjewellerystore Com Government Hospital Definition,

- Key Takeaways From Sba S New Guidance Issued For Self Employed Government Hospital Definition,

- Loans With Government Guarantees With An Interest Rate Of 0 25 Thecyprusnow Government Hospital Definition,