Self Employed Wage Subsidy Gst, How To Reconcile The Covid 19 Wage Subsidy Mbp Advisors Accountants

Self employed wage subsidy gst Indeed recently is being sought by consumers around us, perhaps one of you. People now are accustomed to using the net in gadgets to view image and video data for inspiration, and according to the title of the article I will discuss about Self Employed Wage Subsidy Gst.

- Common Gst Errors Will Impact Your Business

- Common Gst Errors Will Impact Your Business

- Claiming The 10 000 Wage Subsidy Complete Accounting Australia

- Government Support For Employees During The Covid 19 Pandemic Employment Insurance Temporary And Long Term Support Monkhouse Law

- Covid 19 Wage Subsidy Process Baker Tilly Staples Rodway

- Covid 19 Entitlements Deloitte New Zealand

Find, Read, And Discover Self Employed Wage Subsidy Gst, Such Us:

- Canada Measures In Response To Covid 19 Kpmg Global

- Faqs Mtm Accounting

- Covid 19 Business Support Cooperaitken Chartered Accountants Waikato

- Highlights Of Canada S Covid 19 Economic Response Plan Stern Cohen

- Covid 19 Tax Update New Zealand Tag Business Services

If you re searching for Domestic Affairs Definition Government you've come to the right location. We have 101 graphics about domestic affairs definition government adding images, photos, pictures, wallpapers, and much more. In such web page, we also provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Https Www Charteredaccountantsanz Com Media 8b02481e3cad41959af192c057303034 Ashx Domestic Affairs Definition Government

The subsidy funds up to 75 per cent of the first 4600 of gross monthly wages paid to each singaporean or permanent resident employee.

/Articles/Accounting-Treatment-of-the-Wage-Subsidy-%E2%80%93-Self-Em/1.png.aspx?lang=en-NZ)

Domestic affairs definition government. Work that displaces an existing employee. How to manage a wage subsidy. You could get 40 per cent of the total wage subsidy amount four weeks after hiring a new employee as long as all eligibility requirements are met and the job remains ongoing.

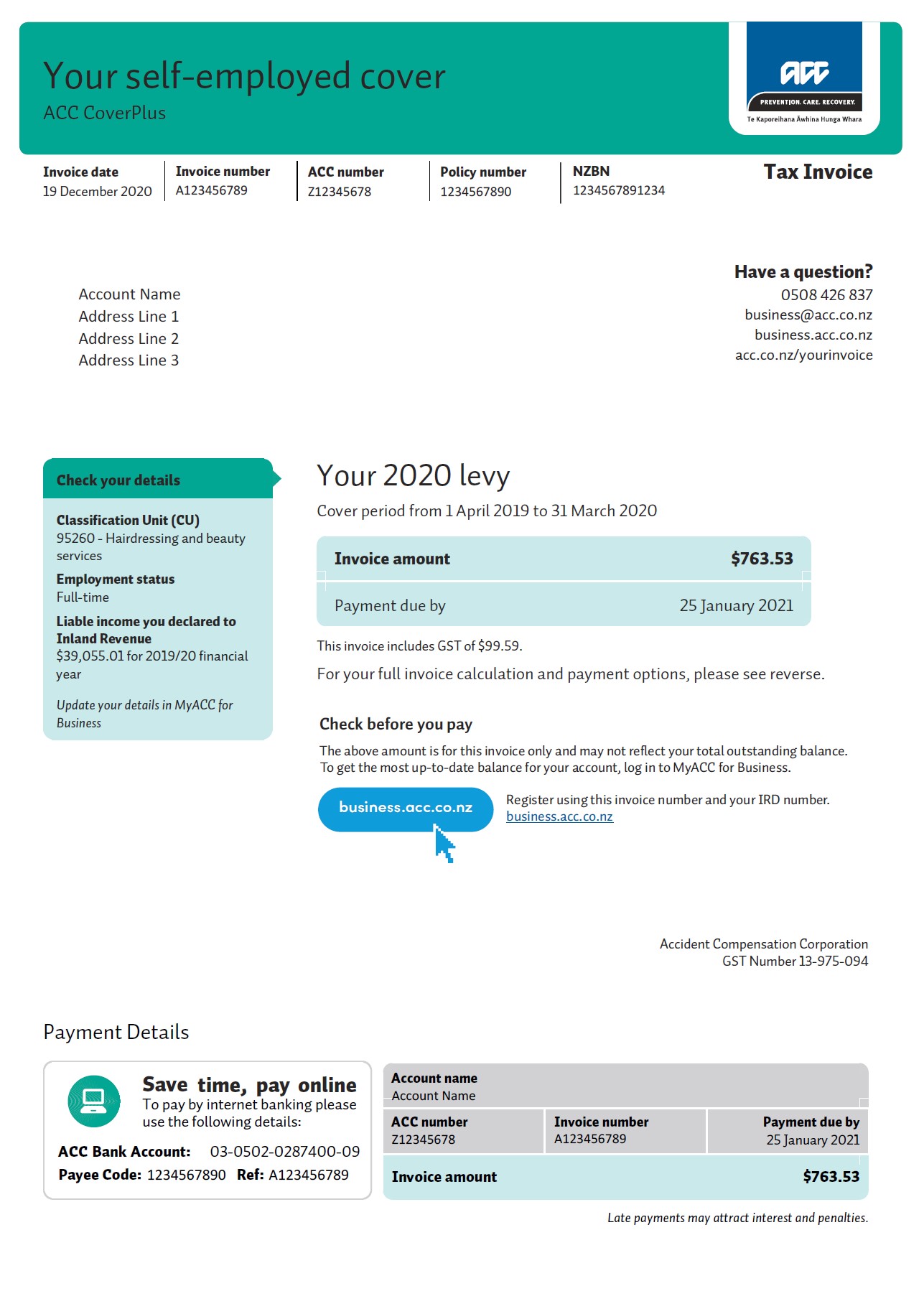

Inland revenues position is that these payments qualify as compensation for the purposes of section cg 5b and can therefore be returned in the income year which the income being replaced would have been derived. Employers including sole traders and the self employed may be eligible for a wage subsidy paid by the msd if they have been affected by covid 19. Jun 29 2020.

There are no gst implications in relation to the wage subsidy it is exempt from gst. It was is a wage subsidy my understanding was you used it to pay wages and therefore were paying paye etc on it. 58580 gross per week for full time employees where full time is 20 hours or more per week 35000 gross per week for part time employees where part time is less than 20 hours per week.

We certainly havent paid gst on it. It is included as part of their normal wages and subject to paye student loan kiwisaver deductions etc wage subsidy paid for self employed it is not subject to gst. In their case however the subsidy is 75 of the actual amount of salary paid after march 15 rather than what it was prior to march 15.

Wage subsidies for employers can be up to 10000 gst inclusive to help your business hire new staff. Your accountant will code it to the correct financial year if applicable. Commission based subcontracting or self employment positions and.

Self employed individuals who are incorporated and have been treated as employees of the corporation and paid a salary are eligible. Start date jun 29 2020. The wage subsidy when received by a self employed person is not liable for acc under section 14 of the acc act 2001.

The wage subsidy rates are. Therefore if the employment contract permits it an employees salary may be cut to 75 of what it was prior to march 15 and the subsidy will fully cover what is paid up to 847 per week. There is an issue about whether the wage subsidy received by a self employed person is taxable in the year it is received or spread over the 12 week period.

Work for an immediate family member. The wage subsidy is taxable income to a self employed person. A wage subsidy consists of a head agreement and individual schedules for each new employee.

Code the full lump sum payment to misc income andor sundry income. Some jobs are not eligible for a wage subsidy including.

More From Domestic Affairs Definition Government

- Government Jobs In India 2020 For 10th

- Self Employed National Insurance Scotland

- Hermes Self Employed Courier Interview

- Self Employed Courier Jobs Nottingham

- List Of Government Universities In Lahore For Bs

Incoming Search Terms:

- Covid 19 Tax Update New Zealand Tag Business Services List Of Government Universities In Lahore For Bs,

- Mackenzie Gray On Twitter Here Are Some More Details From The Pmjt Announcement Cdnpoli 75 Wage Subsidy Is For Up To 3 Months Retroactive From Mar 15 Hst Gst List Of Government Universities In Lahore For Bs,

- If Only Singaporeans Stopped To Think How The Govt Is Helping Singaporeans To Weather The Coronavirus Crisis List Of Government Universities In Lahore For Bs,

- Highlights Of Canada S Covid 19 Economic Response Plan Stern Cohen List Of Government Universities In Lahore For Bs,

- Important Government Wages Subsidy What We Know List Of Government Universities In Lahore For Bs,

- We Want To Keep You Informed On Halifax Chamber Of Commerce Facebook List Of Government Universities In Lahore For Bs,

/Articles/Accounting-Treatment-of-the-Wage-Subsidy-%E2%80%93-Self-Em/2.png.aspx?lang=en-NZ)