Self Employed National Insurance Scotland, Tax And National Insurance Contribution Rates Low Incomes Tax Reform Group

Self employed national insurance scotland Indeed lately is being sought by users around us, maybe one of you personally. Individuals are now accustomed to using the net in gadgets to view video and image data for inspiration, and according to the name of this article I will discuss about Self Employed National Insurance Scotland.

- Uk Payroll And Tax Information And Resources Activpayroll

- Guide To Sick Pay For Self Employed Business Owners Freeagent

- Salary Sacrifice The Facts

- Self Employed National Insurance Class 2 And Class 4 Rates

- Optimum Salary And Dividends 2019 20 Limited Company Directors Jf Financial

- Guide To Being A Self Employed Beauty Therapist Let Us Help You Build A Wildly Successful Salon Business

Find, Read, And Discover Self Employed National Insurance Scotland, Such Us:

- Net Pay For 20 000 Salary After Tax

- Http Researchbriefings Files Parliament Uk Documents Cbp 7918 Cbp 7918 Pdf

- How Do I Register For Tax And National Insurance Low Incomes Tax Reform Group

- East Dun Council On Twitter Own A Business Self Employed Over 9 38 Million Worth Of Support Grants Have Been Processed By East Dunbartonshire Council From More Than 1 000 Applications For The Latest Info

- Http Researchbriefings Files Parliament Uk Documents Cbp 7918 Cbp 7918 Pdf

If you re searching for What Is Furlough Staff you've reached the ideal location. We have 100 graphics about what is furlough staff including images, photos, photographs, wallpapers, and much more. In these web page, we additionally have number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Mygovscot is the place for people in scotland to access public services that are easy to find and simple to use.

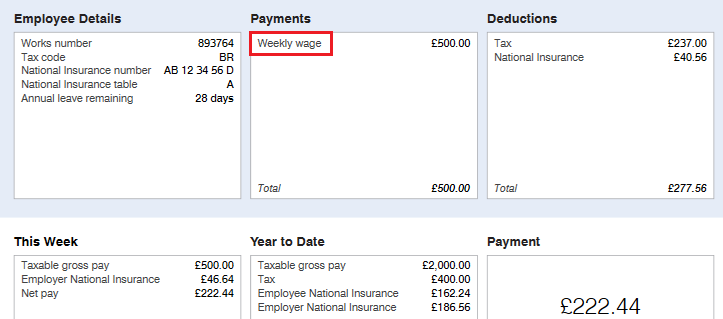

What is furlough staff. You usually pay 2 types of national insurance if youre self employed. Most people pay the contributions as part of their self assessment tax bill. If youre over this limit you will pay 3 a week or 156 a year for the 201920 tax year and 305 a week or 15860 a year for the 202021 tax year.

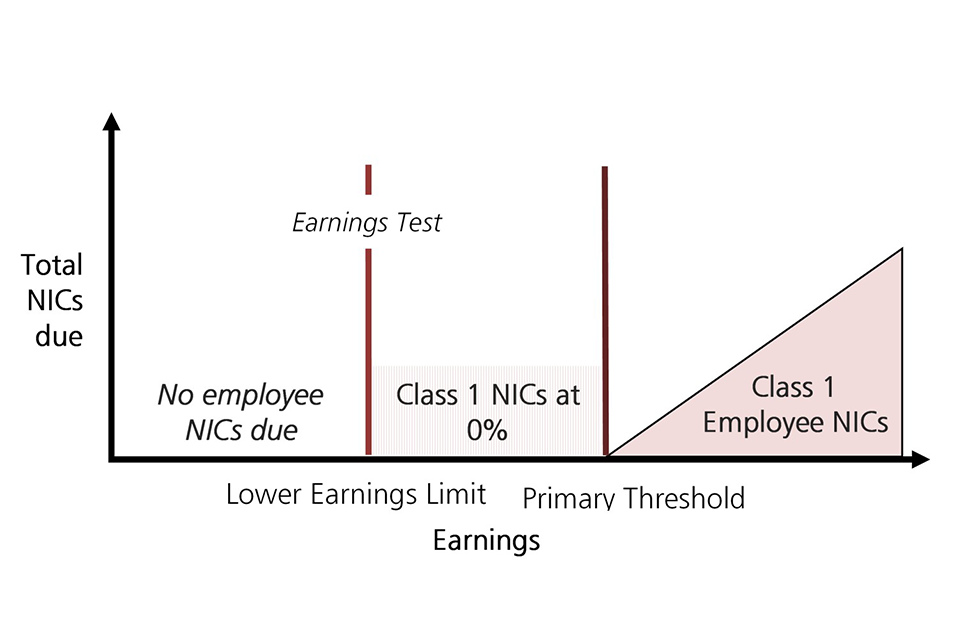

Class 2 if your profits are 6475 or more a year class 4 if your profits are 9501 or more a year. 2 of your weekly earnings above 962. The class 2 national insurance contribution is a fixed amount of 305 a week and its only charged if your annual profits are 6475 or more.

For the 2020 21 tax year employees must pay national insurance is they earn more than 9500 in the year. Your national insurance contributions will be taken off along with income tax before your employer pays your wages. If youre self employed there are different rates of national insurance to pay depending on your profits.

You need your 10 digit unique taxpayer reference utr from when you registered for self assessment so hmrc can link your accounts. This is up from 8632 in 2019 20 and 8424 in 2018 19. Self employed national insurance rates.

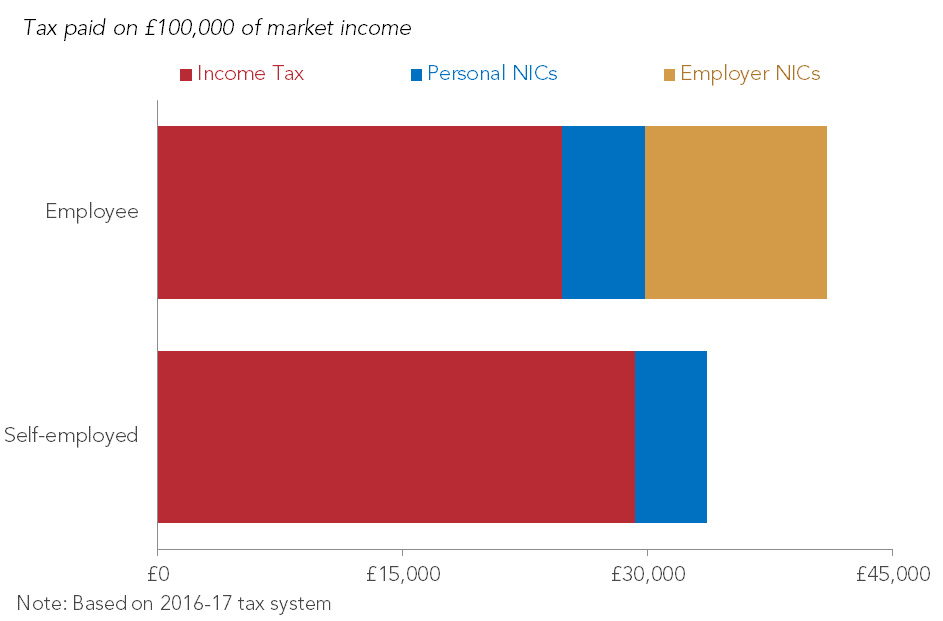

Self employed national insurance rates. Class 2 and class 4 nics are charged at different rates. The national insurance rate you pay depends on how much you earn.

You make class 2 national insurance contributions if youre self employed to qualify for benefits like the state pension. Class 4 national insurance contributions are only charged if your profits are above 9500 a yearthe rate is nine per cent of profits between 9501. You might be an employee but also do self employed work.

Do self employed workers pay national insurance. You now need to register as self employed and for class 2 national insurance using form cwf1. In this case your employer will deduct your class 1 national insurance from your wages and you may have to pay class 2 and 4 national.

Chancellor philip hammond has hit almost 25 million self employed people by an average 240 a year with a hike in national insurance contributions nics in his first budget. You can keep your existing self assessment account.

More From What Is Furlough Staff

- Furlough Extended Germany

- Government Unemployment Benefits Uk

- Government Holidays In October 2020 In Rajasthan

- What Is Furlough Law

- Government Quarters

Incoming Search Terms:

- East Dun Council On Twitter Own A Business Self Employed Over 9 38 Million Worth Of Support Grants Have Been Processed By East Dunbartonshire Council From More Than 1 000 Applications For The Latest Info Government Quarters,

- National Insurance Rates For Self Employed People Dsr Tax Claims Ltd Government Quarters,

- How Do I Check My Coding Notice Low Incomes Tax Reform Group Government Quarters,

- Uk Payroll And Tax Information And Resources Activpayroll Government Quarters,

- Scotland S Papers Hammond Humiliated And Obscene Muirfield Bbc News Government Quarters,

- A Small And Sensible National Insurance Rise For The Self Employed Is Not The Real Strivers Tax Resolution Foundation Government Quarters,