Self Employed Business Loans Coronavirus, Faq How To Get A Small Business Loan Under The New 484 Billion Coronavirus Aid Package The Washington Post

Self employed business loans coronavirus Indeed recently is being hunted by users around us, perhaps one of you personally. Individuals are now accustomed to using the net in gadgets to view image and video information for inspiration, and according to the title of this post I will talk about about Self Employed Business Loans Coronavirus.

- Small Business Loans We Have The Answers To Your Ppp Questions

- Covid 19 Latest Updates Lochaber Chamber Of Commerce

- Coronavirus Support You May Be Eligible For Loans Tax Relief And Cash Grants Scott Benton

- Covid 19 Small Business Relief La Marque Tx Official Website

- Coronavirus Covid 19 Sme Policy Responses

- Covid 19 Business Resources Orono Me

Find, Read, And Discover Self Employed Business Loans Coronavirus, Such Us:

- 2

- Self Employed Invited To Get Ready To Make Their Claims For Coronavirus Covid 19 Support Gov Uk

- Coronavirus Self Employed Grant Claims Top Two Million Bbc News

- Coronavirus Florida Self Employed Say Loans Grants Not Available To Them

- Here S How To Apply For Financial Aid During The Coronavirus Pandemic If You Re Self Employed Or A Small Business In The Arts The Art Newspaper

If you re searching for Furlough Scheme End Date Redundancy you've arrived at the right location. We ve got 100 graphics about furlough scheme end date redundancy adding images, photos, photographs, wallpapers, and much more. In these webpage, we also provide number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

You can borrow up to 25 times your average monthly income from last year up to 100000year.

Furlough scheme end date redundancy. If you are paying an advisor a percentage of your assets you are paying 5 10x too much. 1 may 2020 further education establishments are now eligible for the scheme. Alternatively you can apply for a business interruption loan.

The first grant paid 80 per cent of three months average monthly trading profits over the last three years capped at 7500. Universal credit for self employed and coronavirus. These are interest free for 12 months and no.

Banks will also be offering loans to small and medium sized businesses under the governments coronavirus business interruption loan scheme. Small business administration. Covid 19 relief for small business us.

Posted on april 5 2020 67 comments. The coronavirus business interruption loan scheme scheme will close to applications after 30 november 2020. Self employed people or independent contractors arent typically eligible for unemployment but thats all changed with the passage of the 2 trillion coronavirus relief package or cares act.

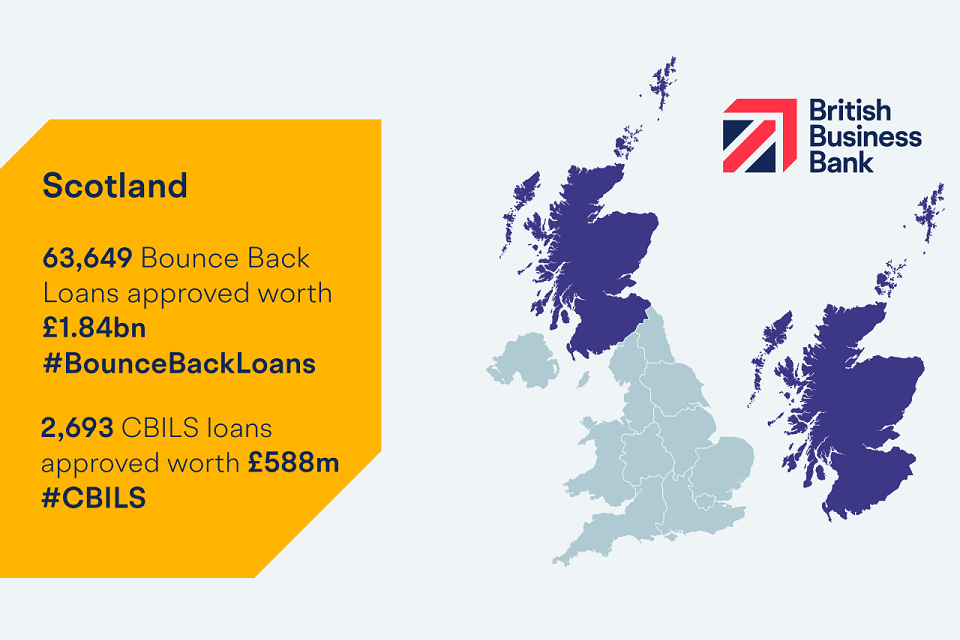

Small businesses can access loans of between 2000 and 50000 through the bounce back loan scheme. Part of support for businesses and self employed people during coronavirus guidance apply for a coronavirus bounce back loan the bounce back loan scheme bbls enables smaller businesses to access. The temporary coronavirus business interruption loan scheme is open to self employed people and offers access to loans overdrafts invoice finance and asset finance of up to 5 million for up to six years.

Say no to management fees. Covid 19 loans for self employed. Two new laws provide coronavirus relief for small businesses and the self employed including access to emergency funds loan deferment and tax benefits.

The ppp provides loans to self employed people that are potentially 100 forgivable.

Second Round Of Paycheck Protection Program Loans Set To Resume Monday For Small Businesses Independent Contractors And The Self Employed Business Greensboro Com Furlough Scheme End Date Redundancy

More From Furlough Scheme End Date Redundancy

- Three Branches Of Government Quiz Answers

- Government Monopoly In Economics

- Government Holidays In September 2020 India

- Government Lockdown Slogan

- Us Government Forms

Incoming Search Terms:

- Wc4xk 3p5q74wm Us Government Forms,

- Eures The Sure Programme Allows Up To 100bn In Eufunds For Businesses And Workers During The Coronavirus Pandemic This Is A Strong Expression Of Eusolidarity Between Member States To Us Government Forms,

- Further Guidance Concerning Forgiveness Of Paycheck Protection Program Loans Henson Efron Minneapolis Law Firm Us Government Forms,

- A Million Self Employed People Are Unable To Access Coronavirus Income Support This Is Money Us Government Forms,

- Small Businesses Boosted By Bounce Back Loans Gov Uk Us Government Forms,

- The Cares Act Paycheck Protection Program What You Need To Know Wordstream Us Government Forms,