Tariff Government Revenue Graph, 4 9 Tariffs Principles Of Microeconomics

Tariff government revenue graph Indeed lately is being sought by users around us, maybe one of you personally. Individuals are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the title of the post I will discuss about Tariff Government Revenue Graph.

- 1

- Tariff Wikipedia

- Solved The Following Graph Shows The Effect On Consumer Surplus Producer 1 Answer Transtutors

- Econowaugh Ap 2012 Microeconomics Exam Frq 3

- Barriers To Trade Boundless Economics

- Trade Creation And Trade Diversion Revisionguru

Find, Read, And Discover Tariff Government Revenue Graph, Such Us:

- The Basics Of Tariffs And Trade Barriers

- Tariffs Production And Consumption With Diagram

- Basic Analysis Of A Tariff

- Barriers To Trade Boundless Economics

- Import Tariffs Small Country Welfare Effects

If you are searching for Government Law College Trichy Admission 2019 you've reached the ideal place. We ve got 104 images about government law college trichy admission 2019 adding pictures, photos, pictures, backgrounds, and much more. In these webpage, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Sample Free Response Question Frq On Tariffs And Trade Video Khan Academy Government Law College Trichy Admission 2019

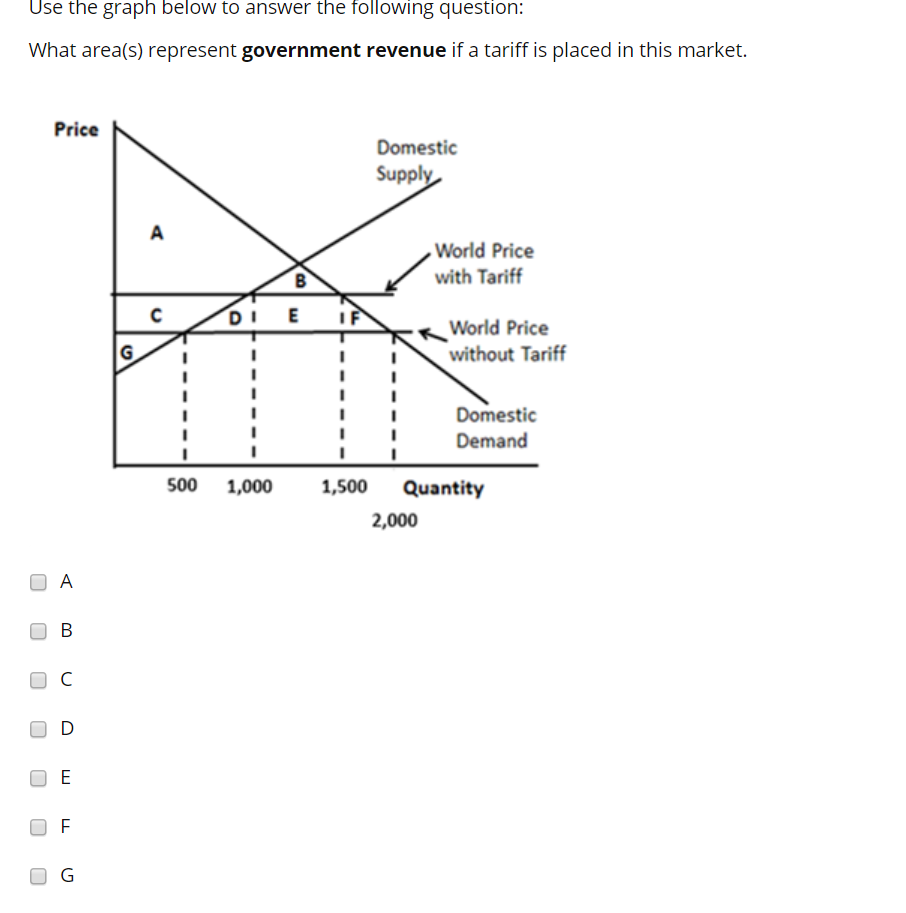

If a tariff of 10 per unit is introduced in the market then the deadweight loss will equal.

Government law college trichy admission 2019. How does a tariff impact efficiency. Governments revenue has increased since it is now levying its unchanged tariff t on increased imports. With no trade equilibrium market price in the country will exist at.

The benefits of tariffs are uneven. A shift to the right in the foreign supply curve more imports of the good supplied at each price. Tariffs which are taxes or duties on imported goods designed to raise the price to the level of or above the existing domestic price and non tariff barriers which include all other barriers such as.

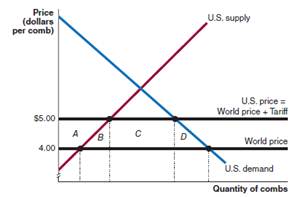

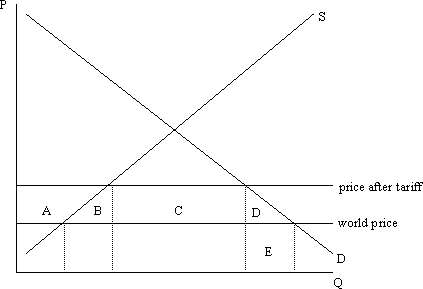

Tariff revenues always equal the amount of duty times the quantity of goods imported under it. A tariff is not considered efficient as a result. This represents that part of the loss in consumer surplus which is transferred to the government in the form of money the revenue effect a tariff.

These funds help support diverse government spending programs. The tariff will increase producer surplus and will bring in tax revenue for the government perhaps to produce public goods but consumers will have to pay a higher price and their consumer surplus will be reduced. D none of the above.

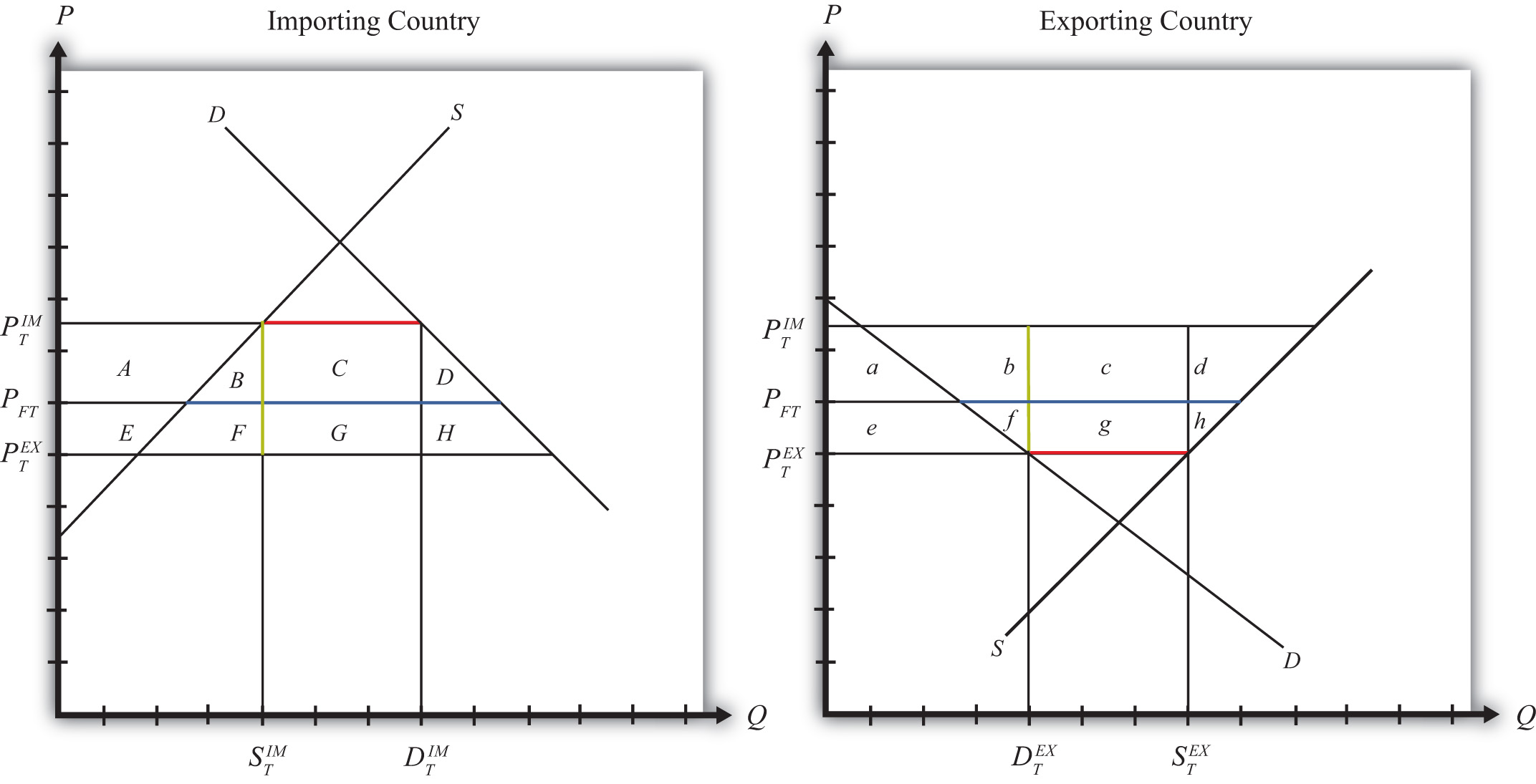

There are two types of protection. Formally the governments revenue changes from fg j to cdghi. Because a tariff is a tax the government will see increased revenue as imports enter the domestic market.

The governments 300 million gain more than offsets the 175 million of lost consumer surplus. Areas b and d are deadweight losses surplus formerly captured by consumers that now is lost to all parties. Government however has gained quite a lot in the form of tariff revenue 300 million in this case the cross hatched area.

Therefore someone within the country will be the likely recipient of these benefits. A quota is a limit to the quantity coming into a country. The tariff will also create deadweight loss.

If a tariff of 10 per unit is introduced in the market then the government will raise in tariff revenue. Who will benefit from the revenue depends on how the government spends it. Hence here the revenue collected equals p 1 p 2 xq 3 q 4 the area r in the figure.

Domestic industries also benefit from a reduction in. Government tax revenue is the import quantity c2 q2 times the tariff price pw pt shown as area c.

More From Government Law College Trichy Admission 2019

- Government Laptop Keyboard

- Self Employed Job Letter Sample

- Self Employed Jobs Near Me

- State Government Administration Jobs

- Government Role In Market Economy

Incoming Search Terms:

- Trade Chapter 90 11 Welfare Effects Of A Tariff Small Country Government Role In Market Economy,

- Https Scholars Unh Edu Cgi Viewcontent Cgi Article 1465 Context Honors Government Role In Market Economy,

- Export Taxes Large Country Welfare Effects Government Role In Market Economy,

- Difference Between Tariff And Quotas With Diagram Government Role In Market Economy,

- Basic Analysis Of A Tariff Government Role In Market Economy,

- 1 Government Role In Market Economy,

:max_bytes(150000):strip_icc()/TariffsAffectPrices1_2-e3858c9eddb649a8b3ffc70af1f9938b.png)