Self Employed Deductions Uk, Expenses You Can Claim If You Re Self Employed In The Uk

Self employed deductions uk Indeed recently is being sought by users around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about Self Employed Deductions Uk.

- Self Assessment Tax Return Spreadsheet Te Free Tes Australia Download Sales Excel Template Deduction Uk Sarahdrydenpeterson

- Your Bullsh T Free Guide To Income Tax In The Uk

- Sole Trader Tax A Guide For Start Ups The Newly Self Employed Bytestart

- Motor Expenses You Can Claim If You Re Self Employed Money Donut

- Self Employed Expenses Which Allowable Expenses Can I Claim With List

- Uk Income Reporting Tq Help

Find, Read, And Discover Self Employed Deductions Uk, Such Us:

- What Are Allowable Expenses When Self Employed

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqkcoxuhiko3kvi Rgxc6nx9wtcnvigajkt5ju Lgzbpsazj2jd Usqp Cau

- What Expenses Can You Claim As Self Employed On Your Tax Return Bookkeeping Business Self Tax Deductions

- Self Employment Wikipedia

- Self Employed Expense Tracker Zoho Expense

If you re looking for Government Employee Id Card you've come to the ideal location. We ve got 104 images about government employee id card including pictures, photos, pictures, wallpapers, and much more. In such webpage, we additionally have variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

For the tax year 202021 the simplified flat rate is 20 pence per mile for bicycles.

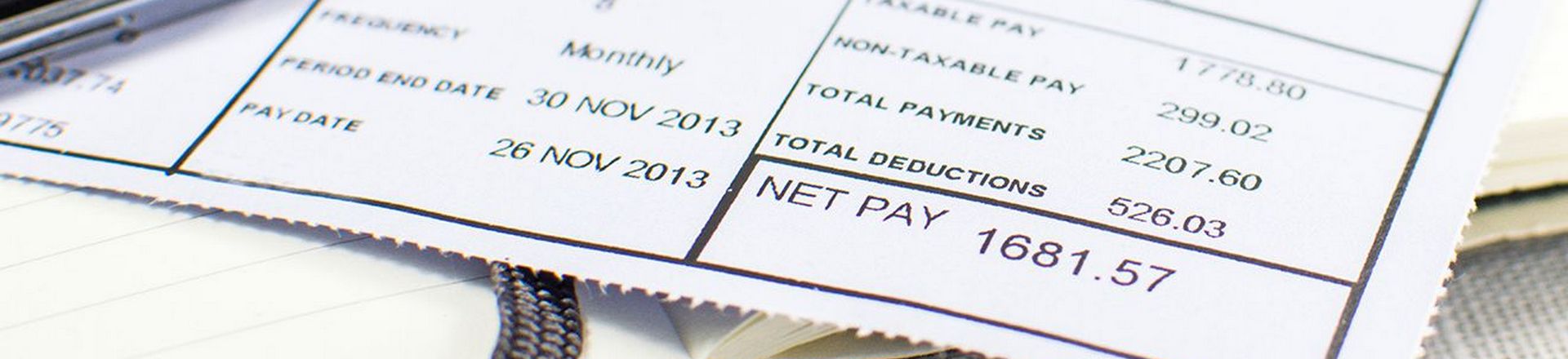

Government employee id card. This is another good reason to make sure you claim all allowable expenses. You can deduct some of these costs to work out your taxable profit as long as theyre allowable expenses. Note that without these expenses your taxable income would be 47500 in this example which would push you into the higher rate tax bracket.

You can claim costs for. Business expenses you can claim if youre self employed. Here is a list of the most common allowable expenses that you can claim against your.

Simplified expenses if youre self employed skip to contents of guide. List of allowable expenses for the self employed. The easiest way is to use simplified expenses to claim for the cost of using your bicycle.

Your business earns 25000 in a tax year but your allowable expenses add up to 5000. To help us improve govuk wed like to know more about your visit. Claiming a tax deduction for your bicycle if youre self employed.

Tax allowable expenses if youre self employed there are certain business expenses you are allowed to deduct from your tax bill. Expenses if youre self employed skip to contents of guide. To help us improve govuk we.

You can claim a flat amount for each mile you cycle on your bike. Self employed allowable expenses list. This guide explains the expenses you can and cant claim with hmrc when youre self employed.

Include these amounts in the total for your expenses in your self assessment tax return. If you are a self employed sole trader then you have probably wondered what you can and cant claim as an allowable expense so weve put together a quick guide covering some of the most common allowable expenses for the self employed. Expenses if youre self employed skip to contents of guide.

Hiring of accountants solicitors surveyors and architects for business reasons. Understanding which of your self employed expenses are allowable and calculating your profit accurately is important for making sure you pay the right amount of tax. Accountancy legal and other professional fees can count as allowable business expenses.

Expenses Readsheet Self Employed Ipad Seld Pdf Template Budget Wedding Spreadsheet Uk Business For Small Sarahdrydenpeterson Government Employee Id Card

More From Government Employee Id Card

- Has Furlough Been Extended After October

- English Formal Letter To Government Malaysia

- Government Shutdown 2020 December

- Central Government Jobs List Pdf

- Government Help To Buy Scheme Scotland Not New Build

Incoming Search Terms:

- Can Umbrella Companies Deduct Employer S Ni Lawfully Government Help To Buy Scheme Scotland Not New Build,

- Uk Income Reporting Tq Help Government Help To Buy Scheme Scotland Not New Build,

- 422 Tax Deductions For Businesses Self Employed Individuals 422 Tax Deductions For Businesses And Self Employed Individuals Amazon Co Uk Kamoroff Bernard B 9780917510311 Books Government Help To Buy Scheme Scotland Not New Build,

- Can I Write My Health Insurance Off As A Business Expense Finance Zacks Government Help To Buy Scheme Scotland Not New Build,

- Self Employed Expense Tracker Zoho Expense Government Help To Buy Scheme Scotland Not New Build,

- 2 Government Help To Buy Scheme Scotland Not New Build,