Quota Government Revenue, Quiz Taxation Bmme004 Eur Studeersnel

Quota government revenue Indeed recently has been sought by consumers around us, maybe one of you personally. People now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of the article I will talk about about Quota Government Revenue.

- 1

- The Comparison Of Import Tariff And Quota In Taiwan Download Table

- Tariffs Import Quotas And Customs Unions Pdf Document

- Economy Notes From An Indonesian Policy Wonk

- Government Of Pakistan Federal Board Of Revenue Manualzz

- Advanced International Economics Prof Yamin Ahmad Econ Pdf Free Download

Find, Read, And Discover Quota Government Revenue, Such Us:

- Julie S Ib Econ Blog

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrxgnxfe6q5qz9wcs2et2zuoq6h4b0d6pnl80t7nw5tymupdof2 Usqp Cau

- 4 6 Quantity Controls Principles Of Microeconomics

- Effect Of Tariffs Economics Help

- Trade Policy Tariffs Subsidies Vers Ppt Video Online Download

If you re searching for Federal Government Spending Pie Chart 2019 you've come to the perfect location. We ve got 104 graphics about federal government spending pie chart 2019 adding images, photos, photographs, backgrounds, and more. In such web page, we also have number of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

One would expect that private property taken by eminent domain would become land available for public use such as parks and roads.

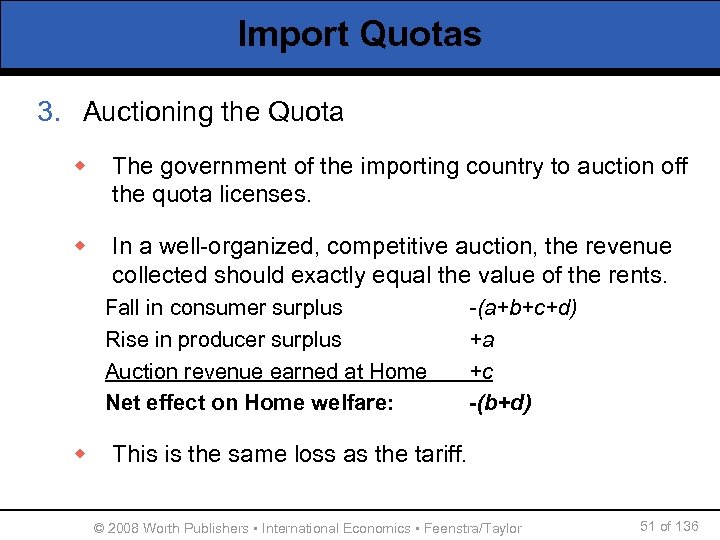

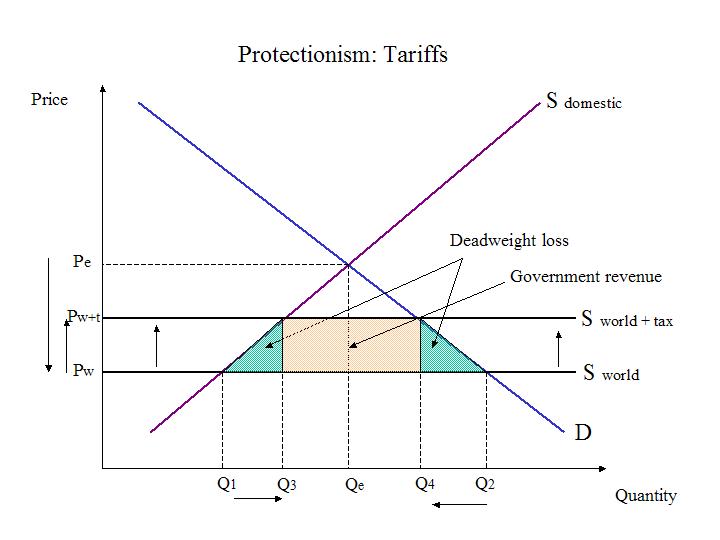

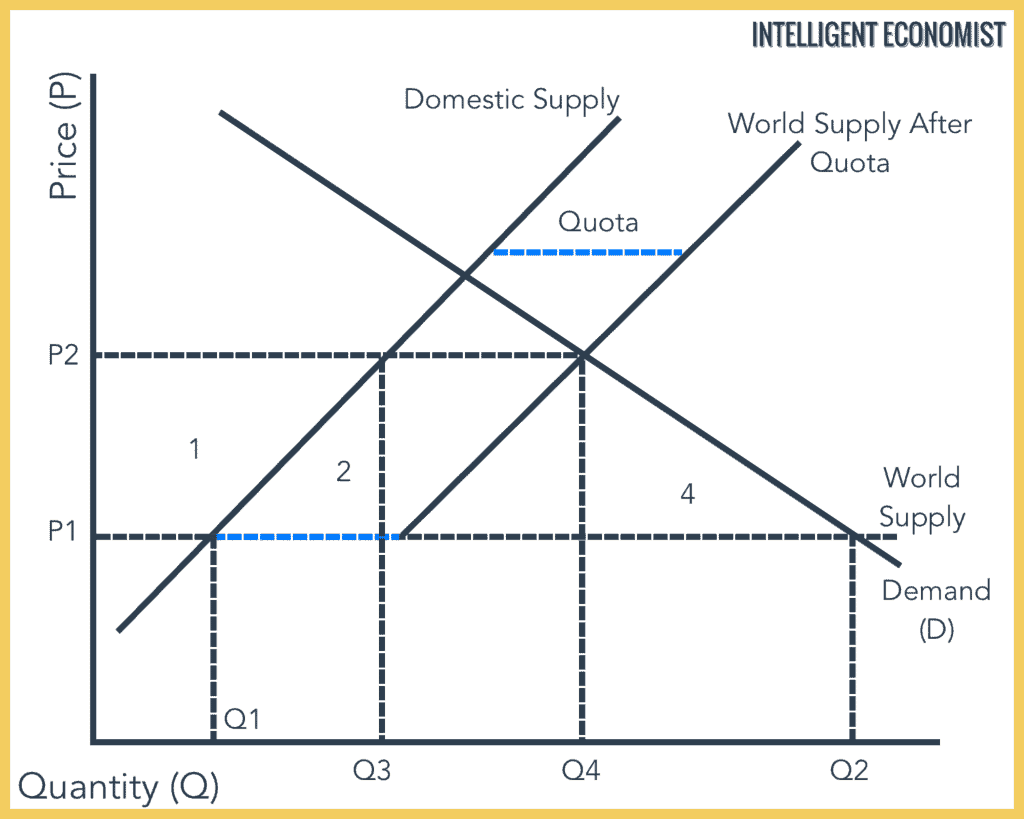

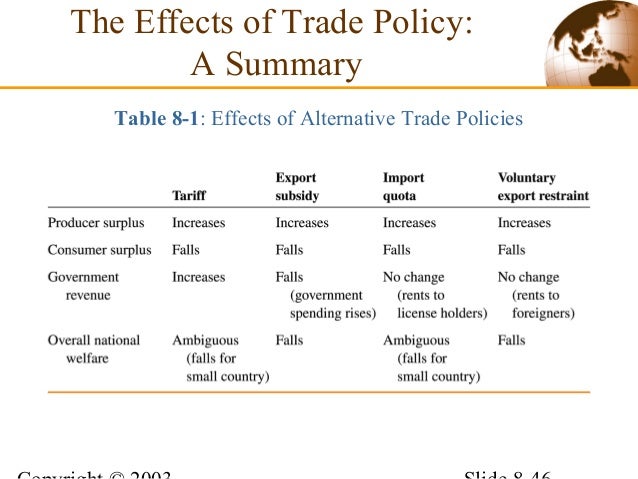

Federal government spending pie chart 2019. Hm revenue and customs. A quota generates no revenue for the government. One of the key differences between a tariff and a quota is that the welfare loss associated with a quota may be greater because there is no tax revenue earned by a government.

Central tariff quota unit. The amount imported falls to the quota level. E does not result in an efficiency loss.

This notice explains tariff quotas. Unfortunately this decision creates a loophole for government to manipulate the definition of public use simply to generate greater tax revenue. A quota which is a type of trade barrier is a restriction on the quantity that can be imported into a countryquotas and tariffs are effectively the same except that governments collect revenue from tariffs while exporting firms can collect extra revenue from quotas as seen below in box 3.

Under this situation the tariff. Government collected 286 billion in tariff revenue. D results in costs to consumers that exceed the benefits to sugar producers.

In 2011 for instance the us. However if the government auctions the right to import under a quota to the highest bidder then quotas are similar to a tariff. Quotas generate no revenue for the government.

Usually officials charged with the allocation of import licences are likely to be exposed to bribery. This is revenue that would be lost to the government unless their import quota system charged a licensing fee on importers. It is this price rise that provides an incentive for less efficient domestic firms to increase their output.

Quotas are different from tariffs or customs which place taxes on imports or exports. Usually officials charged with the allocation of import licences are likely to be exposed to bribery. However if the government auctions the right to import under a quota to the highest bidder only then quotas are similar to tariff.

The government revenue increases with an increase in tariff as it is a direct source of revenue for the government and hence an increase in gdp. But a quota leads to corruption. B results in net welfare benefits to the us.

Sugar quota a generates government revenue. Governments impose both quotas and tariffs as protective measures to try to control trade. C results in benefits to sugar producers that exceed the cost to consumers.

Under this situation tariff is. A quota increases the firms export revenues.

More From Federal Government Spending Pie Chart 2019

- Free Market Economy Government Involvement

- Furlough Rules Early Years

- What Is Furlough Violation

- Hm Government Logo Svg

- Government Key Worker List

Incoming Search Terms:

- Nnpc Monitoring Oil Production And Revenue Generation Joint Venture Petroleum Government Key Worker List,

- The Instruments Of Trade Policy Online Presentation Government Key Worker List,

- Julie S Ib Econ Blog Government Key Worker List,

- Class Notes 5 Stephen Buckles Econ1010 Vandy Studocu Government Key Worker List,

- Free Trade Leading International Business Bu5012 Chester Studocu Government Key Worker List,

- Government Of Pakistan Federal Board Of Revenue Manualzz Government Key Worker List,