Self Employed Business Loans Covid 19, Resources For Small Businesses In Response To The Novel Coronavirus Pandemic Sba S Office Of Advocacy

Self employed business loans covid 19 Indeed lately is being sought by consumers around us, maybe one of you. Individuals are now accustomed to using the net in gadgets to view video and image data for inspiration, and according to the name of the article I will talk about about Self Employed Business Loans Covid 19.

- Small And Medium Enterprises Employment Promotion

- Help For Smes And Self Employed Workers To Alleviate The Covid 19 Crisis

- Coronavirus Covid 19 Sme Policy Responses

- Covid 19 Coperative Banks Actions Eacb News

- Updates And Resources About Covid 19 Iowaworkforcedevelopment Gov Www

- Covid Small Business Resources Page Colorado Small Business Development Center Network

Find, Read, And Discover Self Employed Business Loans Covid 19, Such Us:

- Government Supports For Covid 19 Impacted Businesses Dbei

- Second Round Of Paycheck Protection Program Loans Set To Resume Monday For Small Businesses Independent Contractors And The Self Employed Business Greensboro Com

- Briefing 14 New Wave Of Critical Covid 19 Business Support

- Bounce Back Loan Scheme Goes Live And More On Seiss In Accountancy

- A Million Self Employed People Are Unable To Access Coronavirus Income Support This Is Money

If you are looking for Furlough Extension Acas you've reached the right place. We have 100 graphics about furlough extension acas adding pictures, pictures, photos, backgrounds, and much more. In such webpage, we additionally provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Where to apply posted on april 5 2020 67 comments congress passed the cares act to mitigate the negative economic impact brought by the coronavirus pandemic.

Furlough extension acas. No if the business is not operating the income may not be used to qualify. Health and government officials are working together to maintain the safety security and health of the american people. For self employed workers the path to getting benefits for lost work due to the covid 19 pandemic is especially confusing.

Self employed individuals and contractors hurt by covid 19 are eligible for the paycheck protection program but the rollout has not exactly gone smoothly so far. Benefits for self employed workers during the coronavirus pandemic. An sba ppp or any other similar covid 19 related loans are designed to provide short term relief whereas the payroll rentmortgage payments and.

The most publicized part for individuals is the economic impact payment of 1200 per adult plus 500 per child. The borrower is self employed and owns a business that is closed due to the pandemic. If youre not eligible for statutory sick pay because youre self employed or earn below the lower earnings limit of 118 a week the government is making it easier to claim for universal credit or contributory employment and support allowance during the covid 19 outbreak.

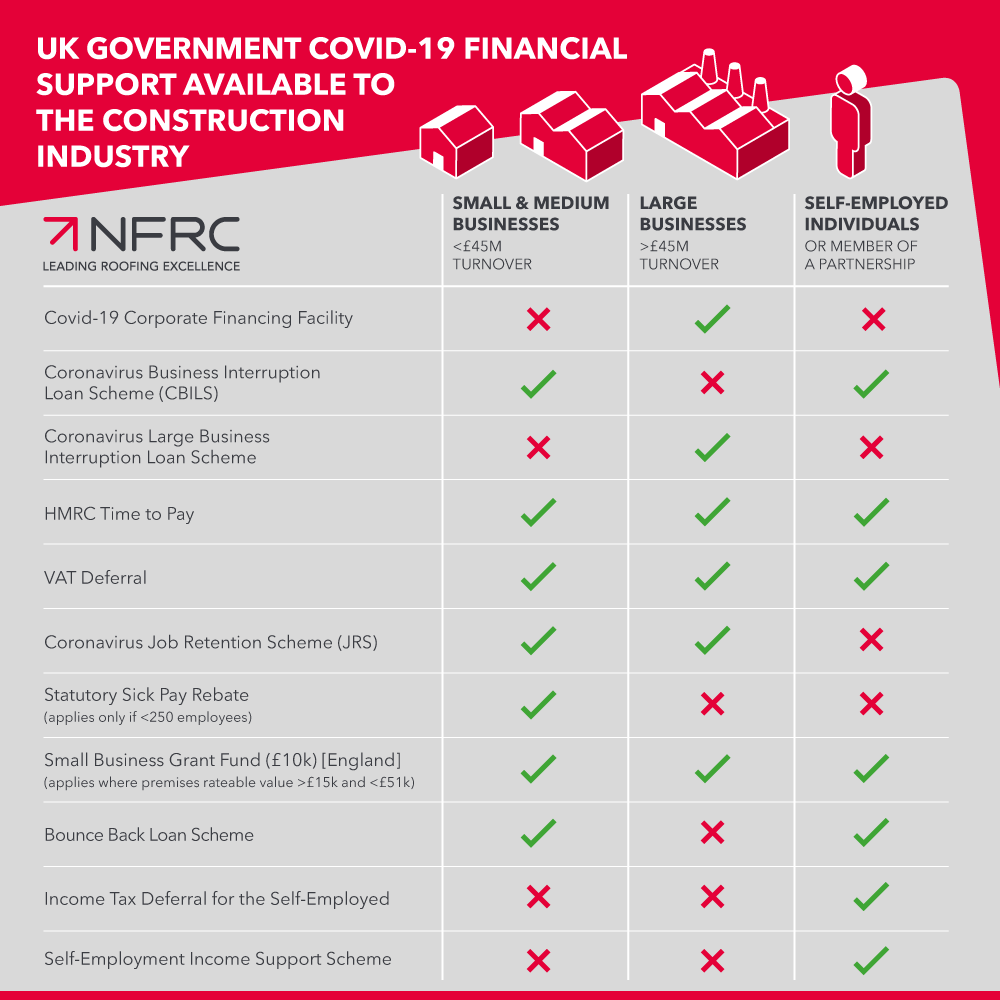

This includes people who receive income reported on federal 1099 forms. Covid 19 relief for small businesses and the self employed two laws provide covid 19 relief for small businesses and the self employed including access to forgivable loans. Chamber of commerce has issued this guide and cheat sheet to help small businesses and self employed individuals prepare to file for a loan from the cares acts paycheck protection program.

The paycheck protection program this program was created under the cares act and authorized the small business administration to provide loans to help small businesses retain employees and manage expenses during the covid 19 outbreak. Can the income be used to qualify. Resources for small businesses.

Guide to small business covid 19 emergency loans us. Covid 19 loans for self employed.

More From Furlough Extension Acas

- Register Self Employed Government Gateway

- Self Employed Quebec Immigration

- State Government Building Icon

- Government Covid Testing Locations

- Us Government Budget Deficit By Year

Incoming Search Terms:

- Small And Medium Enterprises Employment Promotion Us Government Budget Deficit By Year,

- Government Supports For Covid 19 Impacted Businesses Dbei Us Government Budget Deficit By Year,

- Small Business Entrepreneurship Council Us Government Budget Deficit By Year,

- Across Metro Areas Covid 19 Relief Loans Are Helping Some Places More Than Others Us Government Budget Deficit By Year,

- Coronavirus Covid 19 Small Business Guidance Loan Resources Delmarva Fisheries Association Inc Us Government Budget Deficit By Year,

- Guide To Small Business Covid 19 Emergency Loans U S Chamber Of Commerce Us Government Budget Deficit By Year,

/cdn.vox-cdn.com/uploads/chorus_asset/file/19867695/smallbusiness.jpg)