Self Employed Business Loan Government, Nr Cknsswczcum

Self employed business loan government Indeed lately has been sought by consumers around us, perhaps one of you. Individuals are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of this post I will talk about about Self Employed Business Loan Government.

- Sba Disaster Loans Smart Tax Advisor

- Goypuyneoxowcm

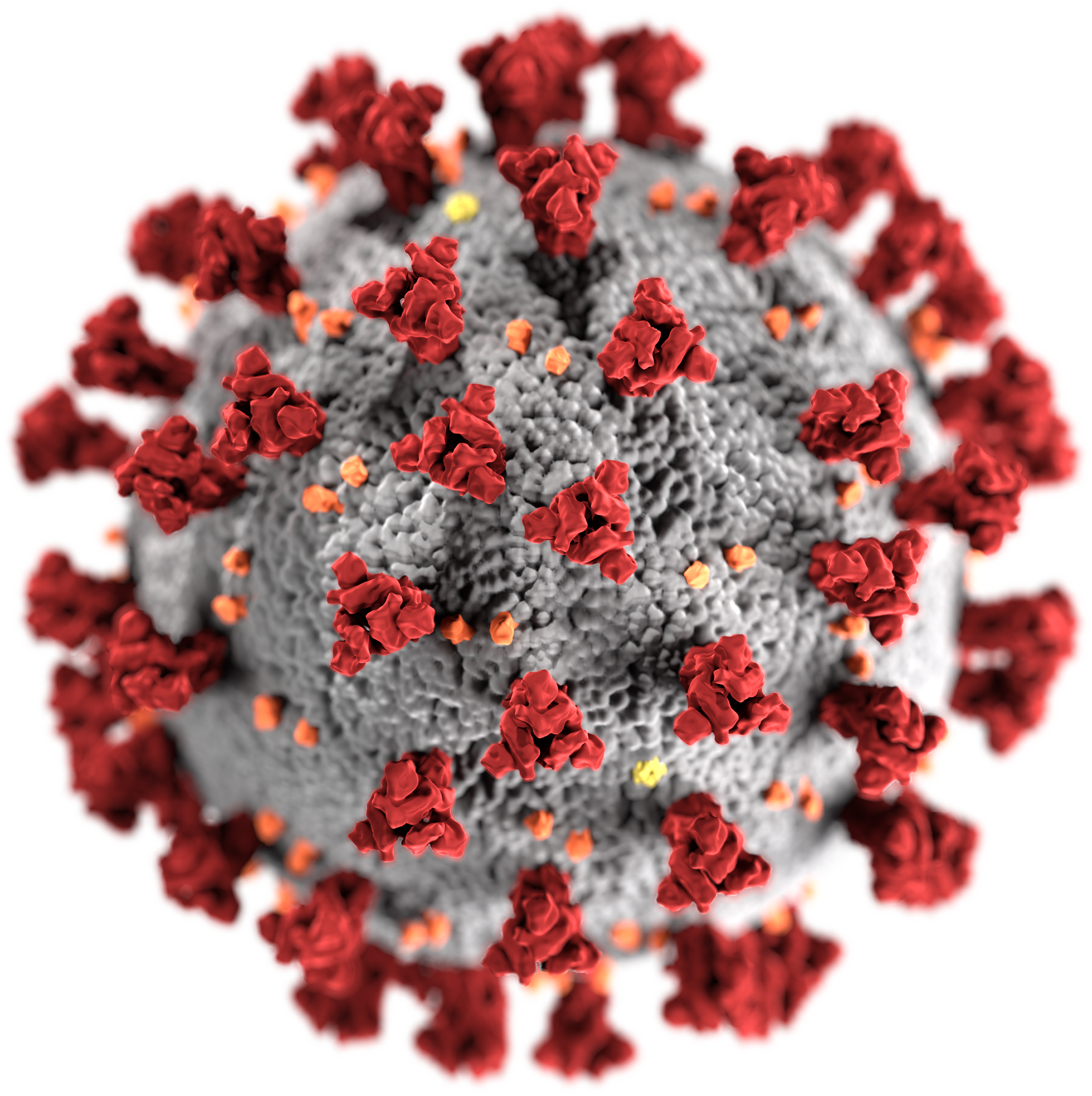

- Taxassist Accountants The Government Today Opened Its New Bounce Back Loans Scheme To Applications From Small Businesses And The Self Employed Needing Financial Help During The Coronavirus Outbreak Http Ow Ly Mkt0102eeod Facebook

- Covid 19 Small Busines Grant Application Loan Sick Pay Employed Self Employed Sme Sme Business Interuption Scheme Retail Hospitality Leisure Seiss

- Sole Traders Self Employed And Small Business Now Entitled To 10 000 Government Loan

- How To Apply For Ppp Small Business Loans In The Cares Act Vox

Find, Read, And Discover Self Employed Business Loan Government, Such Us:

- Self Employed Here S How To Get A Home Loan

- Loan Schemes Kerala Financial Corporation Kfc Thiruvananthapuram Kerala India

- Small Business Start Up Loans No Credit Check Financeviewer

- Self Employed And Need A Ppp Loan You Should Wrap Up Your 2019 Taxes

- Government Will Provide Loans Of Up To 100 000 To Help Businesses Contractors Self Employed

If you re looking for Government Bonds Images you've arrived at the perfect location. We ve got 104 graphics about government bonds images including images, pictures, photos, backgrounds, and much more. In these webpage, we also have variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

The rise is up from the current 40 and will mean.

Government bonds images. You can borrow up to 25 times your average monthly income from last year up to 100000year. Income tax and vat deferred for the self employed. Read more about the self employed income support scheme.

In september 2020 the government announced that self assessment taxpayers can defer their tax payments even further. The government is also providing the following help for the self employed. Unlike a business loan this is an unsecured personal loan.

The government guarantees 80 of the finance to the lender and pays interest and. Youll get free support and guidance. You may also consider applying for the coronavirus business interruption loan scheme mentioned earlier.

The self employed will be able to claim state aid of up to 80 of profits during the month long lockdown chancellor rishi sunak has announced. The self employed individuals need to have a current account with the lender and also he needs to show 3. Apply for a government backed start up loan of 500 to 25000 to start or grow your business.

The government guarantees 100 of the loan and there wont be any fees or interest to pay for. The scheme helps small and medium sized businesses to access loans and other kinds of finance up to 5 million. Although not an ideal solution the new bounce back loan scheme bbls launched by the government offers a valuable source of cash for taxpayers who are not eligible to claim other coronavirus support such as a grant through the furlough scheme or self employed scheme.

Details of the loans include. Part of support for businesses and self employed people. Grants for businesses that pay little or no business rates business interruption loan scheme.

This includes sole traders and self employed businesses. 10000 to be provided to eligible businesses. The small business cash flow loan scheme will provide assistance of up to 100000 to businesses employing 50 or fewer full time employees.

The maximum loan available is 50000. An additional 1800 per equivalent full time employee.

More From Government Bonds Images

- Government Gazette Vidyapeeta Gazette 2020

- Self Employed Furlough Helpline

- Government Expenditure Multiplier Calculator

- Government Exams 2020 Notification

- Coronavirus Furlough Extended

Incoming Search Terms:

- How To Apply For Government N75bn Msme Survival Fund For Self Employed Transporters Artisans Etc Nigeria Business Information Coronavirus Furlough Extended,

- Emergency Loans Scheme For Three Million Excluded From Government Support Belfasttelegraph Co Uk Coronavirus Furlough Extended,

- Sole Traders Self Employed And Small Business Now Entitled To 10 000 Government Loan Coronavirus Furlough Extended,

- Business Loan Choices Covid 19 Federal Releif Programs Rms Accounting Coronavirus Furlough Extended,

- 1 Coronavirus Furlough Extended,

- The Government Announces Increased Support For The Self Employed Across The Uk Business Leader News Coronavirus Furlough Extended,