Self Employed W2 Or 1099, Independent Contractor Vs Employee What S The Difference Bench Accounting

Self employed w2 or 1099 Indeed lately is being hunted by users around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to view video and image data for inspiration, and according to the title of the post I will discuss about Self Employed W2 Or 1099.

- Saving For Taxes If You Re Non W2 Employed Saving Tax Employment

- Miscellaneous Income Form 1099 Misc What Is It Do You Need It

- What Is A 1099 Employee And Should You Hire Them Employers Resource

- Self Employed Less Than A Year How To Do Your Taxes Turbotax Tax Tips Videos

- Taxes For The Self Employed And Independent Contractors

- What Is The Difference Between A W2 Employee And A 1099 Employee Az Big Media

Find, Read, And Discover Self Employed W2 Or 1099, Such Us:

- Fast Answers About 1099 Forms For Independent Workers Small Business Trends

- Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

- Freelance Taxes Made Easy 1099 Vs W2 Vs W 8ben

- 1099 Vs W 2 Napkin Finance

- W2 Vs 1099 A Breakdown Of Finances Life As A Crna

If you are searching for Sindh Government Scholarships 2020 you've reached the right place. We ve got 104 images about sindh government scholarships 2020 adding pictures, photos, pictures, backgrounds, and much more. In these web page, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

What Is A 1099 Employee And Should You Hire Them Employers Resource Sindh Government Scholarships 2020

Can I File Taxes On Self Earned Income Without A 1099 Finance Zacks Sindh Government Scholarships 2020

Its a little more complicated than that though surprise.

Sindh government scholarships 2020. The disadvantages of being a 1099 employee. An independent contractor is paid on a 1099 form. In fact its way better.

A 1099 worker is a self employed worker or independent contractor. Compare your income and tax situation when you work as a w2 employee vs 1099 contractor. Her taxes are a bit more complex because she is both the employee and the employer.

1099 workers may also be freelancers or gig workers. The forms you hear about most are the w 2 and 1099. The blueprint takes a closer look at this for employees and small business owners.

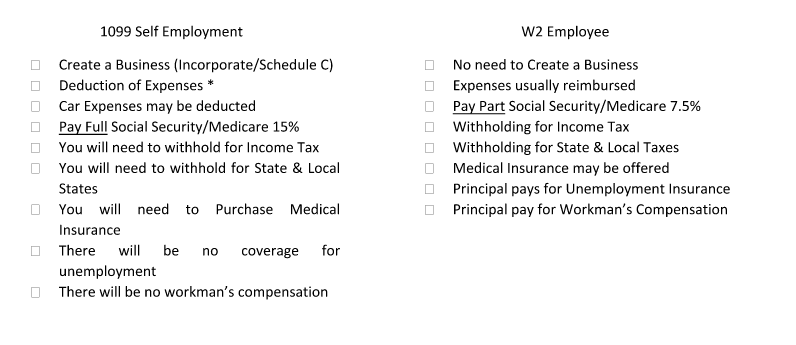

The self employment tax rate made up of social security and medicare taxes is 153 percent. Use this calculator to view the numbers side by side and compare your take home income. A 1099 contractor or self employed individual with a median salary can now save thousands of dollars in taxes with the pass through deduction.

If youre a regular employee full time or part time of a company then you earn a w 2 salary. When you hire an employee to work for you you can either pay them as a contractor or as an employee. Companies dont withhold taxes for independent contractors who are issued 1099 misc forms and the payments are considered self employment income.

First a few definitions. Pay a self employment tax because the businesses they work with dont withhold social security or medicare taxes for them. A shorthand way to consider this employment relationship is 1099 vs.

Of course self employment isnt all fun and games either. The 1099 vs w2 distinction is what separates employees from the self employed. Neither if you are reporting your self employment income on schedule c as part of your personal form 1040 filing then you will not need to give yourself either a w 2 or a form 1099 misc.

Generally businesses hire these workers to complete a specific task or work on a specific project as defined in a written contract. Now lets consider the downsides of working as a self employed independent contractor and the upsides of life as a w2 employee. C2017 2020 lifetime technology inc.

So she must pay both halves of the payroll taxes although the employer half is tax deductible. Downsides of self employment more complex taxes. A form 1099 misc will show the full gross income paid to you whereas a form w 2 will report gross wages and the taxes withheld by the employer throughout the tax year.

To succeed independently youre going to need clients.

More From Sindh Government Scholarships 2020

- Self Employed Or Limited Company Uk

- Government Quarantine Facilities List

- Federal Government Taxes Implemented On Employers In Order To Provide Unemployment Benefits

- Major Types Of Government Worksheet

- Self Employed Support Scheme August

Incoming Search Terms:

- Looking To Hire W2 Vs 1099 Which Is Best For Your Business Self Employed Support Scheme August,

- W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch Self Employed Support Scheme August,

- Publication 926 2020 Household Employer S Tax Guide Internal Revenue Service Self Employed Support Scheme August,

- 1099 Vs W 2 Employee What S The Difference And Why Does It Matter Seek Business Capital Self Employed Support Scheme August,

- 1099 Vs W2 Be Better At Business Podcast Eagle Employer Services Self Employed Support Scheme August,

- What Is A W 2 Form Turbotax Tax Tips Videos Self Employed Support Scheme August,