Furlough Extension Employer Contribution, Furlough Scheme Extended Until March 2021 Law At Work

Furlough extension employer contribution Indeed lately has been sought by consumers around us, perhaps one of you. Individuals now are accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of this post I will talk about about Furlough Extension Employer Contribution.

- Changes To The Coronavirus Job Retention Scheme From 1 July 2020 Charity Tax Group

- Update To Furlough What You Need To Know Fsb The Federation Of Small Businesses

- Cjrs Update New Rules Announced For The Furlough Scheme Extension Lexology

- Argentina Extension Of Prohibition Of Dismissals And Furloughs Coronavirus In A Flash

- D0z8lml6ucfr7m

- Uk Furlough Scheme Faqs News Views

Find, Read, And Discover Furlough Extension Employer Contribution, Such Us:

- B7s8xyuw8owl8m

- Mann Abbott Job Support Scheme 1k Job Retention Bonus

- Altimi Audx9gm

- Gvttaaxwiuf9zm

- Https Www Squirepattonboggs Com Media Files Insights Publications 2020 03 Coronavirus Job Retention Scheme Uk Government Issues Further Guidance Coronavirusjobretentionschemeukgovernmentissuesfurtherguidance Pdf

If you are looking for Government Quarters In Chennai you've arrived at the right place. We ve got 100 images about government quarters in chennai including images, pictures, photos, backgrounds, and more. In such page, we also have number of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

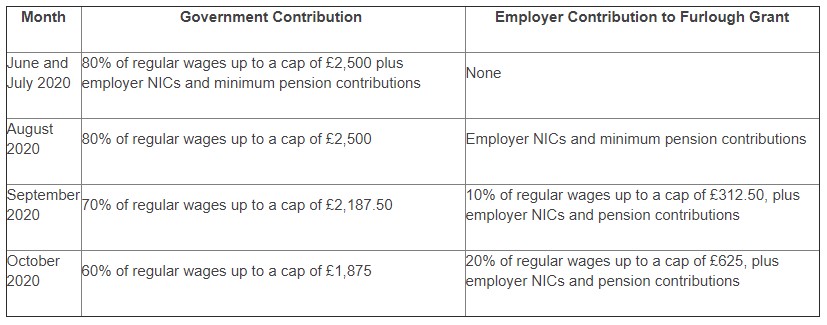

Employers will be able to bring back furloughed employees part time from july 2020 and be responsible for paying this proportion of their wages.

Government quarters in chennai. The extension is open to any employee who was on the payroll and for whom a paye return. September 2020 employers must pay 10 of wages for furloughed employees. The government will continue to pay 80 of wages up to 2500 a month for those unable.

There will be no employer contribution to wages for hours. Employers will now have to pay the ni and pension contributions. Furthermore from september 2020 the government will begin to phase out the furlough scheme by decreasing payments by 10 and decreasing the maximum payment by 313.

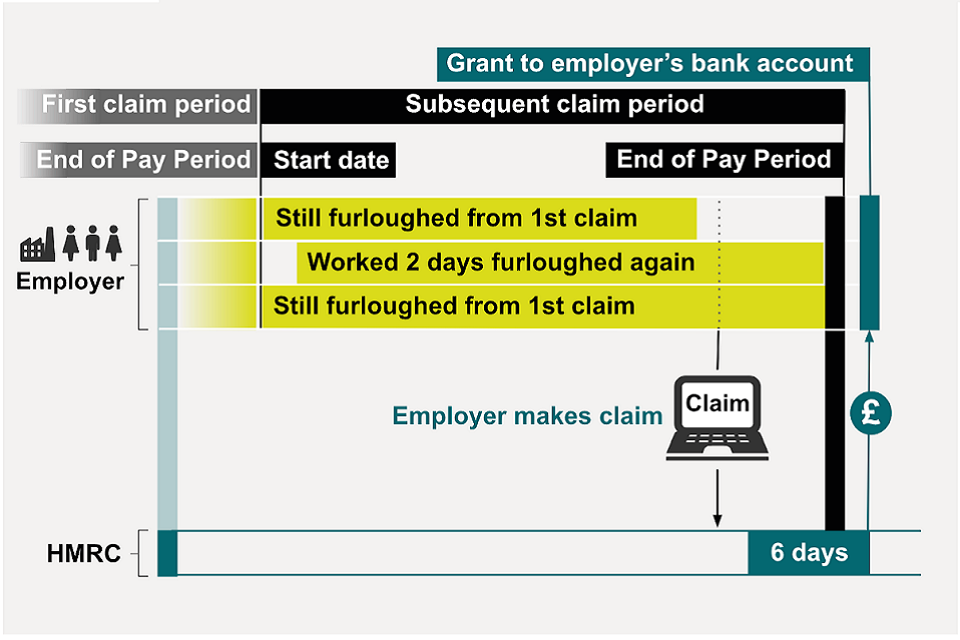

The coronavirus job retention scheme has been extended for a month with employees receiving 80 of their current salary for hours not worked and further economic support announced. This means that employers will be able to claim a grant of 80 of employees normal wages up to a cap of 2500 however employers will be required to pay employer national insurance and pension contributions. Will i be able to flexibly furlough staff or must they be on full furlough.

It is also better than the last two months of the furlough scheme where employers had to make an additional contribution of 10 or 20 of pay the furlough extension takes us back to the rules which applied in august with one important change. To be eligible for being furloughed under the extended furlough scheme employees must have been on their employers paye payroll by 2359 on 30 october 2020. It will be primarily based on the same rules as the flexible furlough scheme introduced from 1 july with employees continuing to receive 80 per cent of their current wages up to a maximum of 2500 pro rated but with the cost to employers being limited to employer national insurance contributions and pension contributions.

Employers need not have used the cjrs before now and the scheme is open to all employers with a paye scheme and a uk bank account. Further to our earlier post on the month long extension of the furlough scheme until december link below rishi sunak has announced today 5 november 2020 that the furlough scheme will now be available for companies until next spring.

More From Government Quarters In Chennai

- Self Employed Women Quotes

- Us Government Agency Symbols

- India Government Spending Pie Chart 2019

- Self Employed Tax Form For Mortgage

- Government Accounting Jobs Los Angeles

Incoming Search Terms:

- Mxwyjjccbyxaam Government Accounting Jobs Los Angeles,

- Four Things Employers Need To Know About The Furlough Scheme Extension Business Shows Group Government Accounting Jobs Los Angeles,

- J4pepq7uqzglwm Government Accounting Jobs Los Angeles,

- Extension To The Furlough Scheme Employment Law Moorcrofts Government Accounting Jobs Los Angeles,

- Furlough Extended Everything You Need To Know Aberdein Considine Government Accounting Jobs Los Angeles,

- Covid 19 Coronavirus Business Impact 10 June Deadline For Placing Employees On Furlough For The First Time Government Accounting Jobs Los Angeles,