Self Employed Tax Form For Mortgage, Five Self Employed Irs Tax Forms For 2017 Taxact Blog

Self employed tax form for mortgage Indeed lately has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the net in gadgets to see image and video information for inspiration, and according to the name of this post I will discuss about Self Employed Tax Form For Mortgage.

- Self Employment Tax Everything You Need To Know Smartasset

- Mortgage Self Employment Analysis Mortgage Loan Facts

- Fha Loan For Self Employed In 2020 Fha Lenders

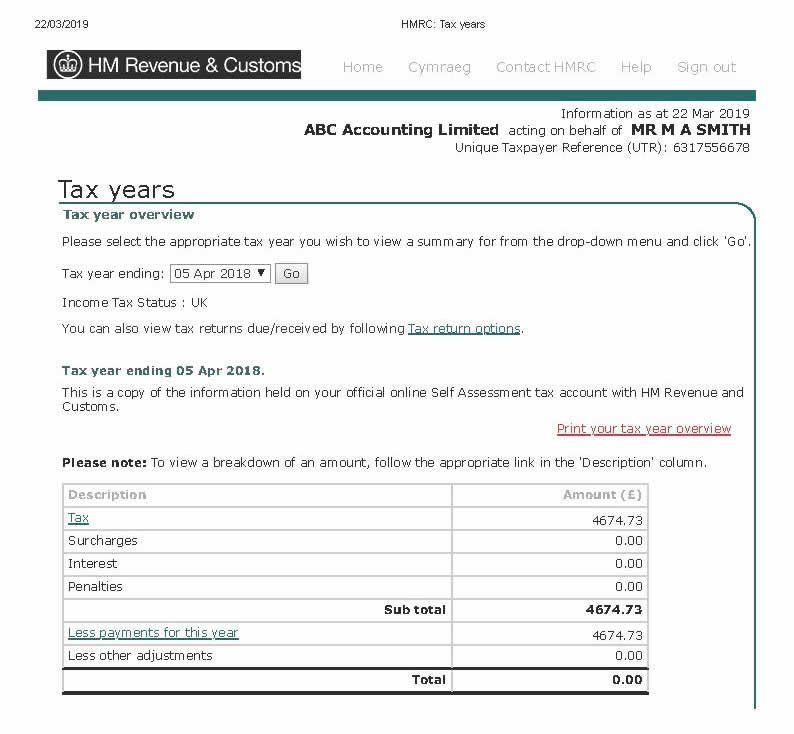

- Sa302 Data From Gov Uk Or Accountant S Software Amortgagenow

- Self Employed You Can Still Get Home Financing By Ratewinner Issuu

- Free 7 Profit And Loss Statement Forms In Pdf

Find, Read, And Discover Self Employed Tax Form For Mortgage, Such Us:

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

- Free Printable Profit And Loss Statement Template For Self Employed Bogiolo

- Mortgage Refinance Checklist Everything You Need To Refinance Your Home Pdf Mortgage Rates Mortgage News And Strategy The Mortgage Reports

- How To Get Pre Approved For A Mortgage

- Self Employed Home Office And Auto Expense List Template Roger Dean Maidment Download Printable Pdf Templateroller

If you re looking for Government Quarantine Facilities Kerala you've come to the ideal location. We ve got 104 images about government quarantine facilities kerala adding pictures, photos, photographs, backgrounds, and more. In such web page, we also have number of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Fannie mae has relaxed some of their guidelines for documenting income for the self employed.

Government quarantine facilities kerala. Business tax returns are either done on the irs form 1065 for partnerships and llc irs form 1120s for s corporations and llc s or form 1120 for c corporations. Personal tax returns including w 2s if youre paid through your corporation profit and loss forms which could include a schedule c form 1120s or k 1 depending on your business structure. Self employed income use this simple guide to help you upload the right evidence to support your mortgage application.

Or 2 self assessment tax forms eg. The tax year is from 6 april to 5 april the following. How to get mortgage when self employed.

2 years personal tax returns with all schedules 1099s. Evaluating corporate tax returns. Here are a few extra items youll need to provide.

If you are self employed you will have to hand over more documentation than a salaried borrower would. What happens if youve been self employed for less than two years. Stay on top of tax returns.

Required documentation for self employed borrowers. W2s from your self employed business if you pay yourself a salary schedule c. Without a regular payslip lenders rely on formal tax assessments to confirm a self employed borrowers income.

As a business accountant i get asked this question a lot is my house mortgage tax deductible because im self employed and work from home and the answer is quite simple but likely not the answer you will be hoping forsorry spoiler alert. We need you to upload either. Sa302 plus supporting tax year overviews tyos.

Fully documenting income via prior years tax returns and financial statements increases the chances of a self employed individual being approved for a mortgage. Is a mortgage tax deductible when self employed and work from home. The self employed income analysis form 1084a or 1084b should be used to determine the borrowers share or a corporations after tax income and non cash expenses after obligations that are payable in less than one year have been deducted from the corporate tax returns.

1 santanders accountants certificate filled in by an accountant with an acceptable qualification. Typically but not always a two year average is required when calculating qualifying income for self employed individuals.

More From Government Quarantine Facilities Kerala

- Furlough Scheme Extended Until September

- Government Building Architecture

- Government Contractor Sample Capability Statement

- Furlough And Holidays Scotland

- Self Employed Van Drivers Jobs

Incoming Search Terms:

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsbv Gis4xfajpdcyz5knxtxe7gfwwtsqsi7bpoobl3gxmvccd5 Usqp Cau Self Employed Van Drivers Jobs,

- Finance For The Self Employed Self Employed Van Drivers Jobs,

- 2017 Self Employment Tax Form Inspirational 30 Beautiful 2017 Self Employment Tax And Deduction Worksheet Models Form Ideas Self Employed Van Drivers Jobs,

- Five Self Employed Irs Tax Forms For 2017 Taxact Blog Self Employed Van Drivers Jobs,

- Lending Guidelines And Submission Requirements Pdf Free Download Self Employed Van Drivers Jobs,

- Self Employment Income Statement Template Best Of Balance Sheet Template Self Employment In E Statem In 2020 Statement Template Income Statement Balance Sheet Template Self Employed Van Drivers Jobs,