Personal Loan For Self Employed Without Income Proof, 0 Emi Instant Personal Loan All In India Without Income Proof Loan Easy Loan For Self Employee Or Students Low Salaried Employee

Personal loan for self employed without income proof Indeed lately is being hunted by consumers around us, perhaps one of you. People now are accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the name of the post I will discuss about Personal Loan For Self Employed Without Income Proof.

- Personal Loan For Self Employed With No Income Proof

- 0 Emi Instant Personal Loan All In India Without Income Proof Loan Easy Loan For Self Employee Or Students Low Salaried Employee

- Without Salary Personal Loan Personal Loan For Self Employed Without Income Proof Loan Loan App Youtube

- Bounce Back Loans Help For Small Businesses And Income Support For Those Missing Out Elsewhere Eg Limited Company Directors And Self Employed

- Personal Loan Personal Loans For Salaried Self Employed Apply Online Iifl

- Get Instant Personal Loan Online No Income Proof No Salary Slip Ya E Salary Slip Get Instant Personal Loan Online No Income Proof No Salary Slip In 2020

Find, Read, And Discover Personal Loan For Self Employed Without Income Proof, Such Us:

- News On Chill News Network

- Instant Personal Loan For Self Employed Up To Inr 30 Lakhs Fullerton India

- How To Get A Loan If You Don T Have A Job Experian

- Personal Loan Without Income Proof In Bangalore

- Apply For Personal Loan For Self Employed Without Income Proof Online Kuwait Region Kuwait Free Classifieds Adpost Asia

If you are looking for What Is Furlough And How It Works you've come to the perfect place. We ve got 103 images about what is furlough and how it works including pictures, pictures, photos, wallpapers, and much more. In such web page, we also have number of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

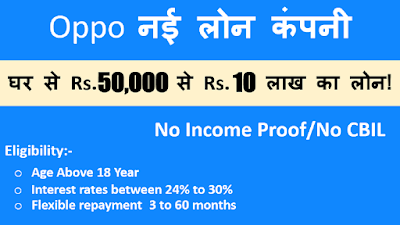

Private loan with bad credit for self employed when it comes to applying for a personal loan remember that the poor credit history can minimize your chances of getting a great loan.

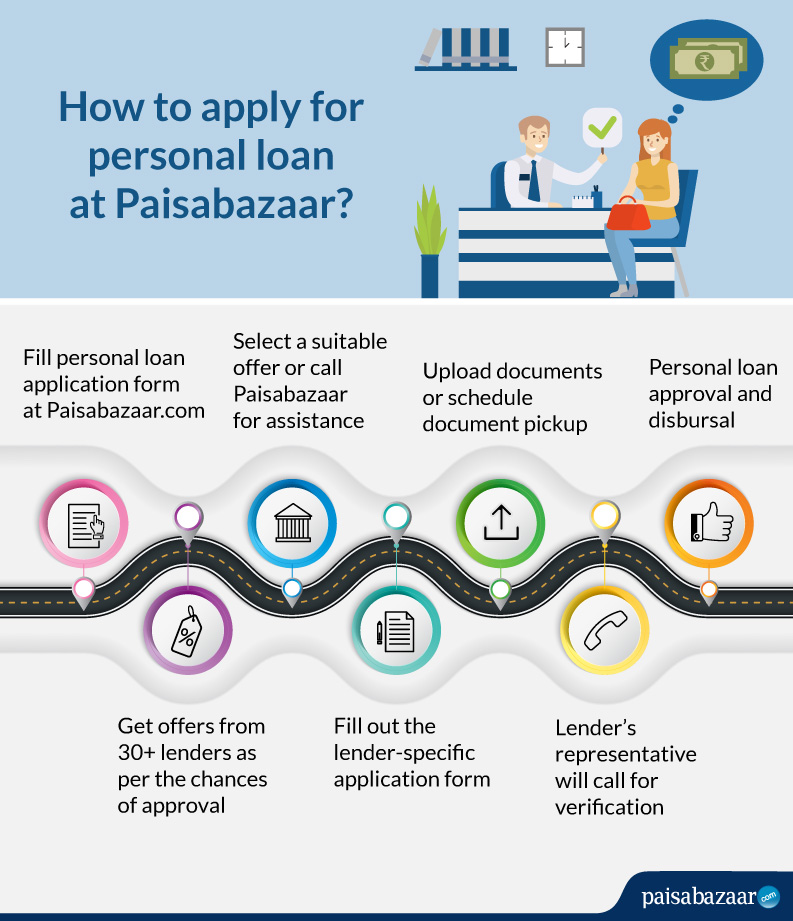

What is furlough and how it works. Interest rates varied from 1350 to 2200 per annum. Showing proof of income is often required for loans taxation laws and insurance purposes. Sofi offers various kinds of loans without any income verification.

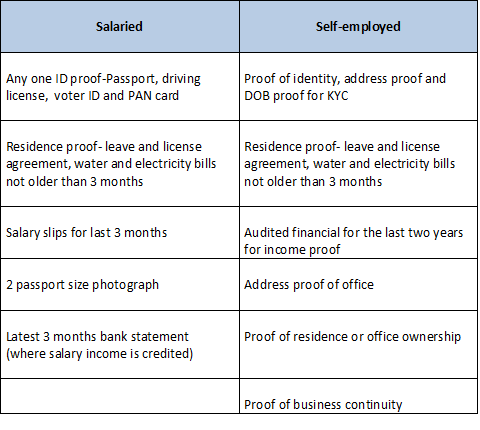

244 trillion in fy 2018s first 10 months alone. It has become a common myth amongst self employed individuals that availing a personal loan without income proof is not possible. A self employed individual needs to have 3 4 years of business stability and an operational current account with hdfc to avail the loan without an income proof.

Learn your options to still get approved. Personal loan for self employed with no income proof eligibility and interest rates explained december 2 2019 december 2 2019 rahul pandey as per reports from business standard non food credit in india grew by rs. You enjoy a flexible schedule and work that you like doing.

Personal loan for self employed offered by most of the banks but the interest rates charges are little on higher side than salaried personal loans borrowers. If you run a business then the banks will need you to provide some documentation showing how much the business earns and if you are able to pay back. Get a short term loan when you work for yourself.

The company also offers no income verification loans to self employed people. I recommended taking time to speak to someone first before rushing into any financing commitments or personal loans. Being self employed means employment on your terms.

You can get loans of up to 100. The creditors can self certify the income certificate to apply for the loan purpose. On average 10000 with no income proof loans that are self employed.

Self employment doesnt mean you can forget about your credit responsibilities however. The self employed individuals need to have a current account with the lender and also he needs to show 3. The major confusion arises when the borrower is a self employed person and does not have any formal income statement.

Take a look below to know which banks offer a personal loan to self employed with no income proof. You only need to follow the laid down procedures to apply. Personal loan for self employed with no income proof at lowest interest rates 59186 views.

Income proof assures the lender that you can afford to pay back the amount in time. Self employed loans get a personal loan to help get your bank account back in the black even with no proof of income. Loans from 500 5000.

This may seem daunting for self employed individuals.

More From What Is Furlough And How It Works

- Government Jobs Near Me Indeed

- Government Expenditure Formula

- Furlough Scheme Extension Date

- Government Administration Jobs Sydney

- Government Unemployment Stimulus End Date

Incoming Search Terms:

- Self Employed Home Loans Explained Assurance Financial Government Unemployment Stimulus End Date,

- Personal Loan For Self Employed Without Salary Slip Loan Without Bank Statement Loan Loan Apps Youtube Government Unemployment Stimulus End Date,

- Wisekredit Instant Personal Loan Rs 10 000 To 60 000 Without Income Proof Or Salary Slip Government Unemployment Stimulus End Date,

- Personal Loan With Low Income All You Need To Know Abc Of Money Government Unemployment Stimulus End Date,

- Bounce Back Loans Help For Small Businesses And Income Support For Those Missing Out Elsewhere Eg Limited Company Directors And Self Employed Government Unemployment Stimulus End Date,

- Emirates Nbd Personal Loan In Uae Check Interest Rate Benefits Government Unemployment Stimulus End Date,