Self Employed Tax Calculator Ohio, 2020 Self Employment Tax Calculator

Self employed tax calculator ohio Indeed lately is being hunted by users around us, perhaps one of you personally. People now are accustomed to using the net in gadgets to see image and video information for inspiration, and according to the name of the article I will discuss about Self Employed Tax Calculator Ohio.

- Ohio Child Support Software

- Tax Withholding For Pensions And Social Security Sensible Money

- Free Tax Estimate Excel Spreadsheet For 2019 2020 Download

- Us Tax Burden On Labor Tax Burden On Labor In The United States

- Logan County Chamber Of Commerce

- 2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Find, Read, And Discover Self Employed Tax Calculator Ohio, Such Us:

- Payroll Tax What It Is How To Calculate It Bench Accounting

- Us Tax Burden On Labor Tax Burden On Labor In The United States

- Pass Through Entities And Fiduciaries

- Pdf Estimating The Cost Of A Smoking Employee

- How To Calculate Payroll And Income Tax Deductions

If you re looking for Government To Citizen you've reached the ideal location. We ve got 101 images about government to citizen adding images, photos, pictures, wallpapers, and more. In such web page, we also provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

The self employed tax calculator is a quick tool based on internal revenue code 1401 to help a freelancer or self employed taxpayer to compute two taxes the social security tax and medicare tax.

Government to citizen. These taxes must be paid by every individual carrying on business or profession on his employment income if such an income is more is 400 or moreor heshe earns 10828 or more in income. 124 for social security tax and 29 for medicare. You are required to pay self employed tax if you earned 400 and above.

Please note that the self employment tax is 124 for the fica portion and 29 for medicare. The 1099 tax rate consists of two parts. Use this calculator to estimate your self employment taxes.

The self employment tax applies evenly to everyone regardless of your income bracket. 2018 self employed tax calculator. The provided information does not constitute financial tax or legal advice.

Normally these taxes are withheld by your employer. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self employment tax capital gains tax and the net investment tax. However if you are self employed operate a farm or are a church employee you may owe self employment taxes.

This calculator provides an estimate of the self employment tax social security and medicare and does not include income tax on the profits that your business made and any other income. We strive to make the calculator perfectly accurate. Please note that the self employment tax is 124 for the federal insurance contributions.

Rates range from 0 to 4797. To pay self employed taxes you are required to have a social security number and an individual taxpayer identification number. If youre a church worker your church employee income should be at least 10828 before you are required to file self employed tax.

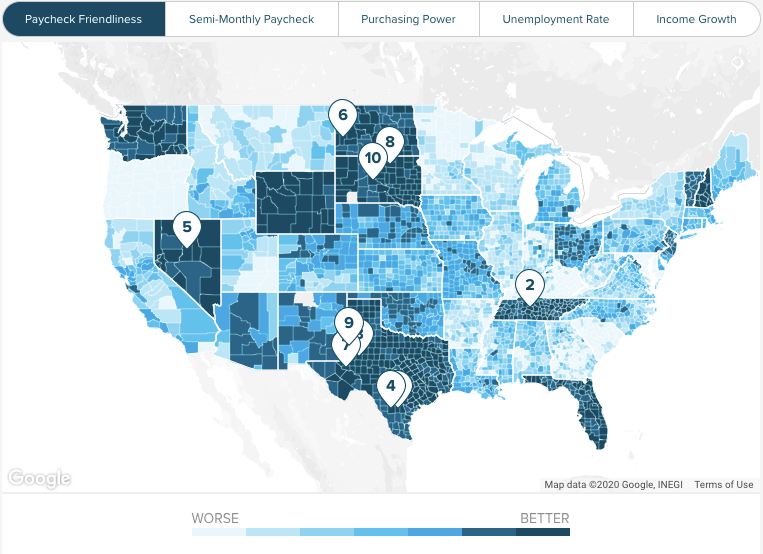

You will pay an additional 09 medicare tax on the amount that your annual income exceeds 200000 for single filers 250000 for married filing jointly. Normally these taxes are withheld by your employer. Similarly ohios statewide sales tax rate is 575 but when combined with county sales tax rates ranging from 075 up to 225 the total average rate is 717.

Alone that would place ohio at the lower end of states with an income tax but many ohio municipalities also charge income taxes some as high as 3. Overview of ohio taxes. Use this calculator to estimate your self employment taxes.

Ohio has a progressive income tax system with eight tax brackets. For all filers the lowest bracket applies to income up to 21750 and the highest bracket only applies to income above 217400. However if you are self employed operate a farm or are a church employee you may owe self employment taxes.

If you receive a form 1099 you may owe self. If you are self employed your social security tax rate is 124 percent and your medicare tax is 29 percent on those same amounts of earnings but you are able to deduct the employer portion. The biggest reason why filing a 1099 misc can catch people off guard is because of the 153 self employment tax.

More From Government To Citizen

- Highest Paid Government Jobs In India For Freshers

- Founding Fathers Quotes On Big Government

- Does The Furlough Scheme Pay Redundancy

- Self Employed Furlough Claim Form

- Government Law College Ernakulam Ernakulam Kerala

Incoming Search Terms:

- Ohio Child Support Calculator Laubacher Co Government Law College Ernakulam Ernakulam Kerala,

- Publication 54 2019 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service Government Law College Ernakulam Ernakulam Kerala,

- Do You Owe Estimated Tax Payments To The Irs Or Ohio Department Of Taxation Gudorf Tax Group Llc Government Law College Ernakulam Ernakulam Kerala,

- 2 Government Law College Ernakulam Ernakulam Kerala,

- Ohio Oh State Tax Refund Ohio Tax Brackets Taxact Blog Government Law College Ernakulam Ernakulam Kerala,

- Cleaning Business Tax Basics For Self Employed Housecleaners Government Law College Ernakulam Ernakulam Kerala,