Self Employed Health Insurance Deduction 2019 S Corp, The S Corp Shareholder Health Insurance Conundrum Kaiser Tax

Self employed health insurance deduction 2019 s corp Indeed lately is being hunted by users around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of the post I will talk about about Self Employed Health Insurance Deduction 2019 S Corp.

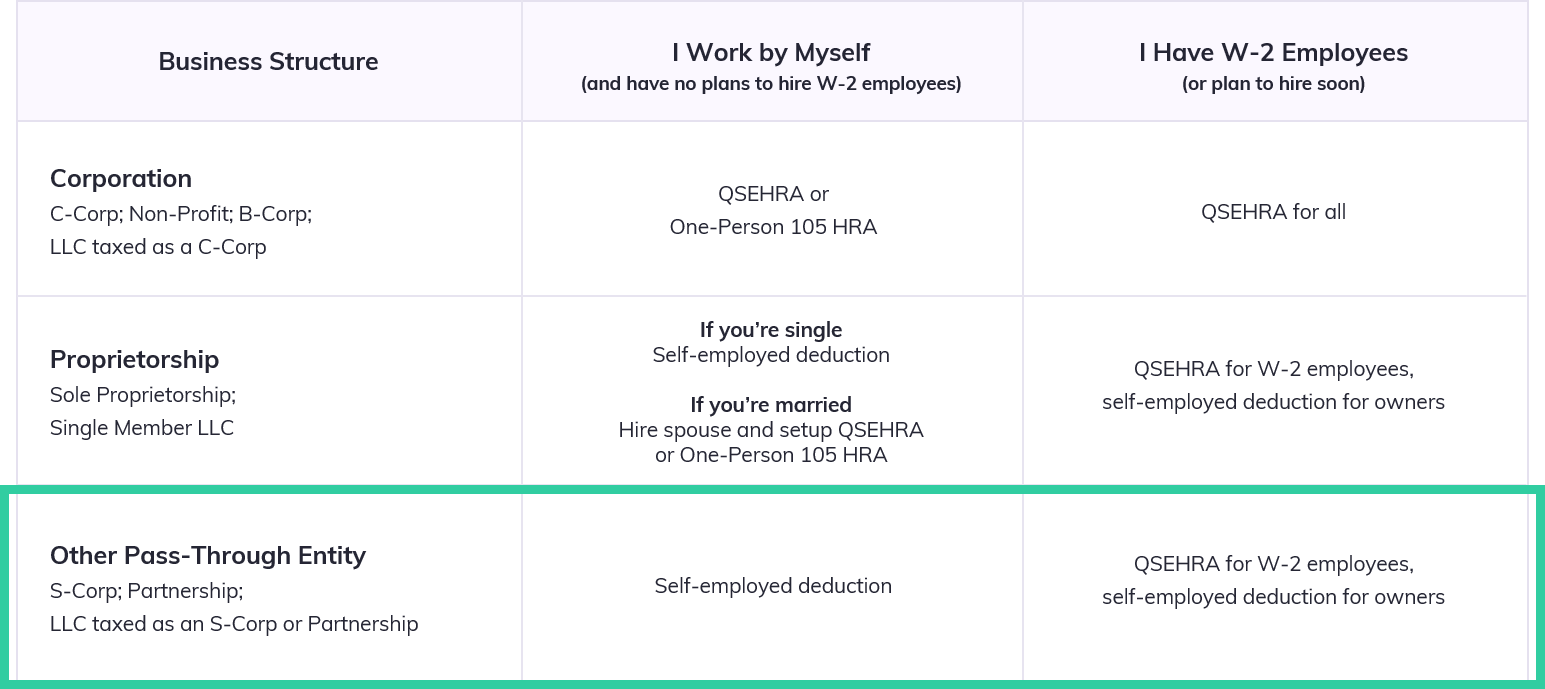

- Self Employed Health Insurance Deductions 101 Decent

- 10 Ways To Slash S Corp Taxes White Coat Investor

- S Corp Election Self Employment S Corporation Taxes Wcg Cpas

- Self Employed Health Insurance Deductions 101 Decent

- S Corporation Income Or Loss Henssler Financial

- Self Employed Health Insurance Deduction Healthinsurance Org

Find, Read, And Discover Self Employed Health Insurance Deduction 2019 S Corp, Such Us:

- Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

- Small Business Entity Choices To Maximize Section 199a Qbi Deductions

- Https Www Cumortgagedirect Com Globalresources Mortappdocs Selfemployedincome Pdf

- How The Self Employed Can Deduct Health Insurance Costs

- 16 Real Estate Tax Deductions For 2020 2020 Checklist Hurdlr

If you are looking for Uk Government Covid Alert Levels you've reached the perfect location. We have 100 images about uk government covid alert levels adding pictures, photos, photographs, wallpapers, and more. In these webpage, we additionally provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Notice 2008 1 contains the rules and examples for deducting accident and health insurance premiums by a more than 2 shareholderemployee of an s corporation.

Uk government covid alert levels. If you qualify the deduction for self employed health insurance premiums is a valuable tax break. You may be able to deduct the amount you paid for health insurance for yourself your spouse and your dependents. Under irc 1372 individuals holding 2 or more of the stock of an s corporation are treated as.

And that will help to keep you healthyand happyin 2020 and beyond. Self employed people are allowed to deduct health insurance premiums including dental and long term care coverage for themselves their spouses and their dependents. This insurance can also cover your children up to age 27 26 or younger as of the end of a tax year whether they are your dependents or not.

Every dollar you deserve. A 2 percent shareholder employee is eligible for an above the line deduction in arriving at adjusted gross income agi for amounts paid during the year for medical care premiums if the medical care coverage was established by the s corporation and the shareholder met the other self employed medical insurance deduction requirements. The insurance also can cover your child who was under age 27 at the end of 2019 even if the child wasnt your dependent.

When youre an s corporation owner with more than 2 of the company stock youre treated the same as a self employed person when it comes to deducting health insurance. Self employed health insurance deduction worksheet. Self employed health insurance deduction.

In chief counsel advice 201912001 the irs held that family members who while not directly holding shares in an s corporation are deemed to be 2 shareholders under the rules of 318 are allowed to claim the self employed health insurance deduction under irc 162l if they otherwise qualify. You need to have other wages on the w 2 which will show up in box 5 besides the health insurance wages which only show up in box 1. This includes dental and long term care coverage.

S corps have complicated issues with health insurance premiums paid for their. One drawback to the s corporation is that employeeowners cannot deduct the cost of health insurance from taxes. Deducting s corporation health insurance premiums notice 2008 1.

The self employed health insurance deduction applies to health insurance premiums for yourself your spouse and your dependents. With the rising cost of health insurance a tax deduction can help you pay at least a portion of the premium cost. S corp self employed health insurance deduction atdmertz you need to enter box 5 not the amount from box 1.

More From Uk Government Covid Alert Levels

- Hm Government Jobs Meme

- Upcoming Government Exams 2020 Full List In Telangana

- Government Guidelines On Alcohol Consumption

- New Furlough Scheme Part Time

- Government Building Clipart Png

Incoming Search Terms:

- How S Corporation Owners Can Deduct Health Insurance Expenses Government Building Clipart Png,

- Staying On Top Of Changes To The 20 Qbi Deduction 199a One Year Later Wffa Cpas Government Building Clipart Png,

- Two Percent S Corp Shareholders By Attribution May Deduct Health Insurance Costs Government Building Clipart Png,

- How To Deduct My Health Insurance Premiums With Tu Government Building Clipart Png,

- Claiming The Self Employment Health Insurance Tax Deduction Government Building Clipart Png,

- Tax Software Bake Off Self Employed Health Insurance And Aca Premium Tax Credit Government Building Clipart Png,