Furlough Bonus Scheme Rules, D1xiuhkerqurpm

Furlough bonus scheme rules Indeed recently has been hunted by users around us, perhaps one of you personally. Individuals are now accustomed to using the net in gadgets to see video and image information for inspiration, and according to the title of the post I will discuss about Furlough Bonus Scheme Rules.

- F3cksqab5jnuem

- Rishi Sunak Defends Furlough Bonus Scheme Bbc News

- Coronavirus Chancellor Rishi Sunak Unveils 30bn Plan To Save Jobs Bbc News

- Extension Of The Furlough Scheme

- Job Retention Bonus How Does It Work Finerva

- Lewis Silkin Government To Pay Bonus For Bringing Workers Back To Work From Furlough

Find, Read, And Discover Furlough Bonus Scheme Rules, Such Us:

- Covid 19 Job Retention Bonus Scheme French Duncan Professional Chartered Accountants

- Cjrs Brightpay Calculating Processing Furlough Pay In Brightpay Brightpay Documentation

- Furlough Bonus Scheme Announced Mitrefinch

- Extension Of The Furlough Scheme

- John Lewis Joins Primark In Decision Not To Claim From Sunak S Furlough Bonus Scheme

If you are searching for Government Shutdown 2018 Update you've come to the perfect location. We ve got 103 graphics about government shutdown 2018 update including images, photos, pictures, backgrounds, and much more. In such webpage, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

The government has introduced a payment to uk employers of 1000 for each furloughed employee who returns to work and remains with the business through to the end of january 2021.

Government shutdown 2018 update. An employer will be able to claim the bonus for any employees that were eligible for furlough and for whom they have claimed a grant. Chancellor rishi sunak has announced a 1000 job retention bonus for employers that bring workers back from furlough. The government has extended the furlough scheme meaning workers can get 80 of their salary paid through lockdown.

The coronavirus job retention scheme cjrs better known as the furlough scheme will be extended for another month following the announcement of a new national lockdown. Around one in three british private sector workers were put on furlough after the country went into. It comes as employers set to start contributing to the furlough scheme as staff return to work and the economy.

Employees must be earning above the lower earnings limit of 520 per month between the end of october 2020 when the furlough scheme ends and the end of january 2021. Businesses who re employ furloughed staff will get a 1000 bonus per employee from the government to help keep brits in work. The scheme was due to end on october 31 but will now run throughout november as b.

Britains finance ministry tightened the requirement for employers to receive a 1000 pound bonus for rehiring furloughed staff to exclude payments where an employee will soon be made redundant. These rules apply even if this means that fewer of your employees are eligible for the job retention bonus. The move was announced today by chancellor rishi sunak as part of an.

Employers can claim the bonus for all eligible employees who have been furloughed. Get ready to claim you cannot claim the bonus until 15 february 2021. All employers are subject to what follows below eligible for the bonus including recruitment businesses and umbrella companies.

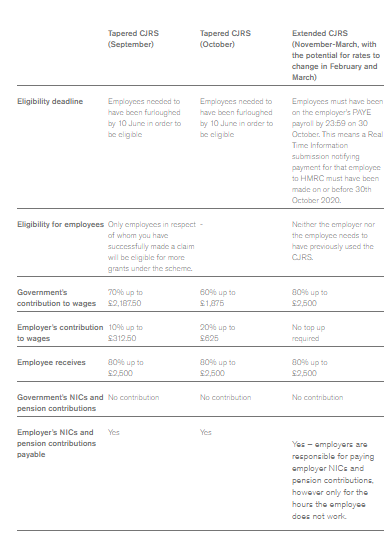

Between march and july the government paid for 80 of furloughed workers wages up to 2500 a month and it also covered employers national insurance ni and.

More From Government Shutdown 2018 Update

- Self Employed Sims 3

- Self Employed Pension Contribution Calculator

- Government Of Canada Chart Of Accounts

- Self Employed Furlough Hmrc

- Government Liquidation Inc Moonachie Nj

Incoming Search Terms:

- Cjrs Brightpay Calculating Processing Furlough Pay In Brightpay Brightpay Documentation Government Liquidation Inc Moonachie Nj,

- Extension Of The Furlough Scheme Government Liquidation Inc Moonachie Nj,

- Flexible Furlough Tips On Working Notice Periods And Bonuses Your Money Government Liquidation Inc Moonachie Nj,

- J4pepq7uqzglwm Government Liquidation Inc Moonachie Nj,

- Job Retention Bonus Paying And Qualifying For The Bonus Government Liquidation Inc Moonachie Nj,

- Job Retention Schemes During The Covid 19 Lockdown And Beyond Government Liquidation Inc Moonachie Nj,