Self Employed Pension Contribution Calculator, Bagaimana Cara Menghitung Iuran Bpjs Ketenagakerjaan Karyawan

Self employed pension contribution calculator Indeed recently has been sought by users around us, perhaps one of you. People now are accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of this article I will discuss about Self Employed Pension Contribution Calculator.

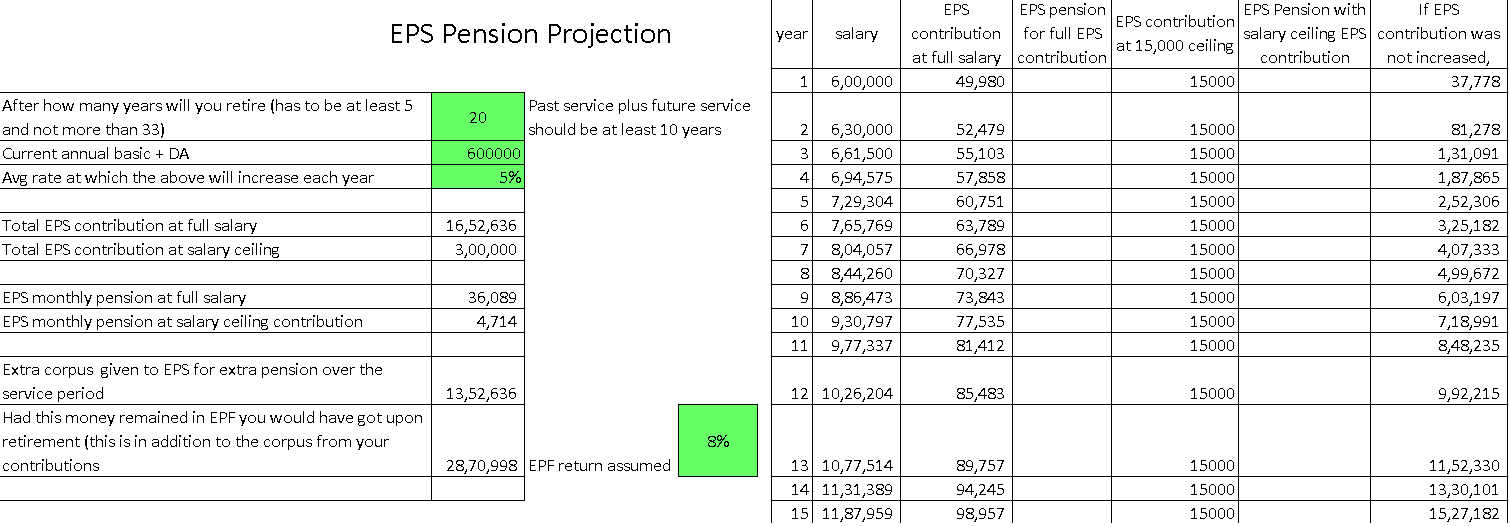

- Download Employee Provident Fund Calculator Excel Template Exceldatapro

- National Pension System 日本年金機構

- Budget 2020 Threshold For Pension Tax Relief To Rise To 200 000

- Home Triginta Self Employed Tax Calculator

- 2

- How To Calculate An Employee S Payroll In China Hrone

Find, Read, And Discover Self Employed Pension Contribution Calculator, Such Us:

- Pension Basic Calculation And Trivia Questions Quiz Proprofs Quiz

- Contributions Social Security Board Belize

- Income Tax Calculator Calculate Taxes Online Fy 2019 20

- Pension Tax Relief Calculator Taxscouts

- How To Calculate Solo 401k Contribution Limits Above The Canopy

If you re looking for Government Employee Id Government Of Gujarat Identity Card you've come to the right place. We have 104 graphics about government employee id government of gujarat identity card including images, photos, pictures, wallpapers, and more. In these page, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

What Pension Can I Get If I M Self Employed Pensionbee Government Employee Id Government Of Gujarat Identity Card

If you are self employed a sole proprietor or a working partner in a partnership or limited liability company you must use a special rule to calculate retirement plan contributions for yourself.

Government employee id government of gujarat identity card. Earned income net profit 12 of self employment tax contribution. Enter your name age and income and then click calculate the result will show a comparison of how much could be contributed into a self employed 401k sep ira defined benefit plan or simple ira based on your income and age. Answer 5 simple questions then adjust your contribution percentage to model different scenarios and compare plans.

It is important to stress that an online pension calculator can only provide indicative information. Our employed and self employed calculator gives you an estimated income and national insurance tax bill based on your annual gross salary self employment income self employment expenses and pension contributions. When youre self employed it can be difficult to decide what percentage you should contribute to a sep ira or a self employed 401k plan or a profit sharing plan.

Simple to use and easy to play around with this is a great calculator to start off with and comes with lots of tips for boosting your pot. This calculator from pension bee allows you to reduce the employer monthly contribution toggle to zero which is handy if youre self employed and not receiving anything from an employer. For example you might decide to contribute 10 of each participants compensation to your sep plan.

Use the self employed 401k calculator to estimate the potential contribution that can be made to an individual 401k compared to profit sharing simple or sep plans for 2008. Self employed retirement plan maximum contribution calculator compensation for a self employed individual sole proprietor or partner is that persons earned income the starting point to determine the individuals earned income is the net profit amount from the schedule c or schedule k 1 for a partnership. Retirement plan contributions are often calculated based on participant compensation.

Online pension calculators are usually very flexible and allow you to change information freely in order to produce different examples. That way you can plan your finances with more confidence.

Https Ec Europa Eu Social Blobservlet Docid 10403 Langid En Government Employee Id Government Of Gujarat Identity Card

More From Government Employee Id Government Of Gujarat Identity Card

- What Happens After Furlough Scheme Ends

- Government Job Vacancies In Sri Lanka 2020

- Government Kilpauk Medical College

- Government Gateway Id Login

- What Does The New Furlough Scheme Mean

Incoming Search Terms:

- Tax On Your Private Pension Contributions Tax Relief Gov Uk What Does The New Furlough Scheme Mean,

- 1040 Generating The Sep Worksheet What Does The New Furlough Scheme Mean,

- How To Calculate Your Sss Contribution Sprout Solutions What Does The New Furlough Scheme Mean,

- Self Employed Pension Tax Relief Simple Guide To Pensions Jf Financial What Does The New Furlough Scheme Mean,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsxepptgrbso9xyfxu0rinfoptdjhlcf3dkia Guu45citsyxhm Usqp Cau What Does The New Furlough Scheme Mean,

- How Much Can I Contribute To My Self Employed 401k Plan What Does The New Furlough Scheme Mean,