Self Employed Deductions, I M Self Employed Can We Deduct My Husband S Medicare Premiums Healthinsurance Org

Self employed deductions Indeed recently has been sought by consumers around us, maybe one of you personally. Individuals now are accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the name of the article I will discuss about Self Employed Deductions.

- What Is The Self Employed Health Insurance Deduction Ask Gusto

- Self Employment Tax Deductions Taxes Us News

- Best Tax Deductions For Self Employed Stop My Irs Bill

- Tax Deductions For Freelancers And The Self Employed

- Tax Deductions For Self Employed Sushi Budget

- Tax Deductions For Self Employed Business Owners Everything To Know Freshbooks

Find, Read, And Discover Self Employed Deductions, Such Us:

- What Are Some Self Employed Tax Deductions In Canada

- 422 Tax Deductions For Businesses Self Employed Individuals Review By Hjdsttrgztsxc Issuu

- 15 Tax Deductions To Keep In Mind If You Are Self Employed Cleveland Com

- The Tax Deduction List For Self Employed Professionals Elorus Blog

- 475 Tax Deductions For Businesses And Self Employed Individuals 13th Edition By Bernard B Kamoroff Paperback Target

If you re searching for Positive Self Employed Quotes you've arrived at the perfect location. We have 104 images about positive self employed quotes including images, photos, photographs, backgrounds, and much more. In these web page, we also provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Jual 475 Tax Deductions For Businesses And Self Employed Buku Kota Depok Pustaka Bahtera Tokopedia Positive Self Employed Quotes

If youre self employed your business will have various running costs.

Positive self employed quotes. However if you have an expense for something that is used partly for business and partly for personal purposes divide the total cost between the. They swoop in lower your tax bill and save your wallet from some serious destruction. You can deduct some of these costs to work out your taxable profit as long as theyre allowable expenses.

Personal versus business expenses. Refer to chapters 7 and 8 of publication 535 business expenses. Roughly 16 million people are self employed full time in america.

You may want to itemize your deductions if it exceeds the standard deduction amount. Many more are self employed part time thanks to the explosion of the nations gig economy while being self employed is great in that it enables you to make extra money and in many ways steer your financial destiny. Self employed tax deductions are the superheroes of your business taxes.

If you are blind or aged 65 or older you may be able to qualify for a higher standard deduction. Generally you cannot deduct personal living or family expenses. But because they dont have taxes withheld from their paychecks like traditional workers they can use deductions to cover their expenses and lower their tax burden.

If youre self employed its important to take the time to fully understand self employment tax deductions so you dont miss deductions that could significantly lower your tax bill. You can elect to deduct or amortize certain business start up costs. But when it comes to self employed deductions the process certainly isnt one size fits all.

Its one of few above the line tax deductions reducing your adjusted gross income agi. Theyre found on a wide variety of different tax forms and apply in different situations. Yes the self employed can claim the standard deduction on form 1040 line 40.

Business use of your home including use by day care providers. Tax deductions for the self employed are not necessarily self evident. Your self employment tax deduction would be 7500 15000 seca tax liability x 50 deduction.

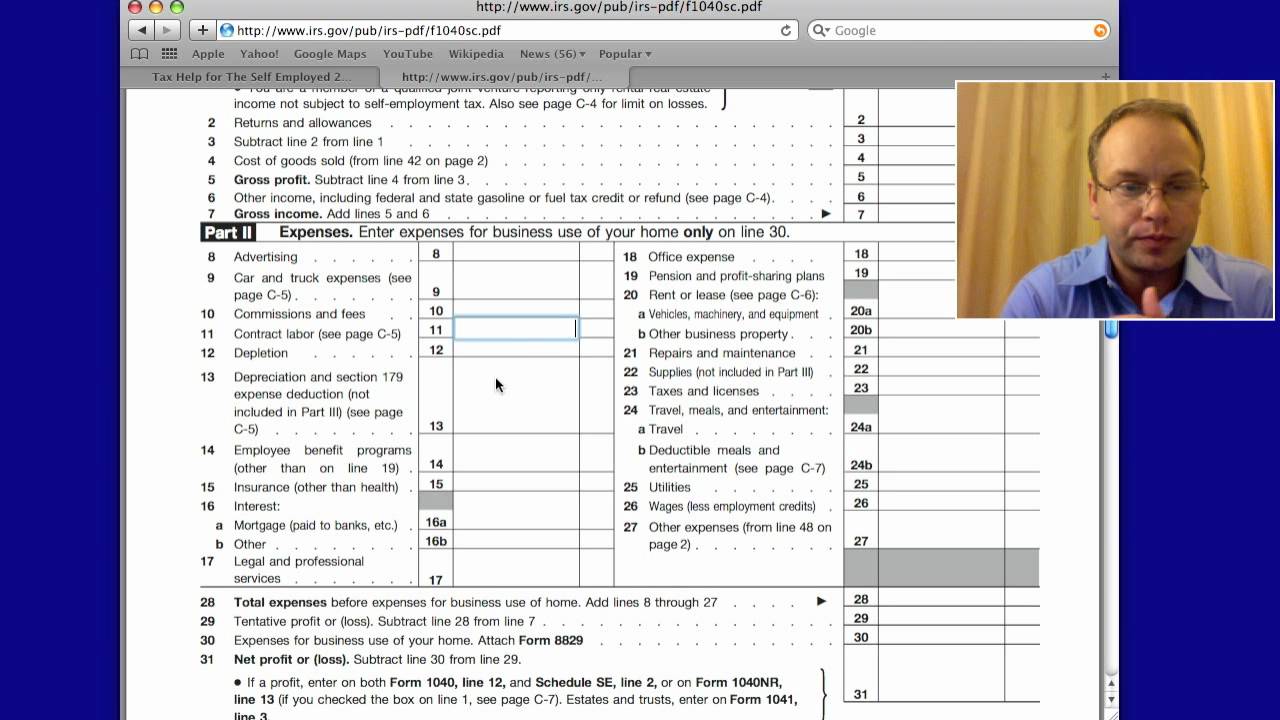

Its also important to develop a system to file and track your receipts and expenses so that you are organized when it comes to tax time. While schedule c is an important tax form for the independent contractor you should be aware of self employment deductions that you can take in other parts of your income tax return. But before you can reap the benefits of tax write offs you need to know what expenses are tax deductible if you work from home.

More From Positive Self Employed Quotes

- Government Procurement

- Government Icon Black And White

- Self Employed Tax Deductions Worksheet 2019

- Us Government Publishing Office Pueblo Distribution Center

- Self Employed Grant November 2020

Incoming Search Terms:

- Audiobook 475 Tax Deductions For Businesses And Self Employed Individ Self Employed Grant November 2020,

- Tax Deductions For Freelancers And The Self Employed Self Employed Grant November 2020,

- What Is The Self Employed Health Insurance Deduction Ask Gusto Self Employed Grant November 2020,

- What Are Some Self Employed Tax Deductions In Canada Self Employed Grant November 2020,

- Your Accounting Firm In Miami On Self Employed Tax Deductions Moa Accounting Self Employed Grant November 2020,

- Tax Deductions For Self Employed Business Owners Everything To Know Freshbooks Self Employed Grant November 2020,