Self Employed Health Insurance Deduction 2020, Self Employed Health Insurance Daveramsey Com

Self employed health insurance deduction 2020 Indeed recently has been hunted by users around us, perhaps one of you. People are now accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of the article I will discuss about Self Employed Health Insurance Deduction 2020.

- Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

- Health Insurance Tax Deduction Fy 2019 20 Ay 2020 21 Section 80d

- Szwlvawdwg Ewm

- Https Marketplace Cms Gov Outreach And Education Household Income Data Matching Issues Pdf

- 3

- Deducting Health Expenses Self Employed Health Insurance Deduction More Stride Blog

Find, Read, And Discover Self Employed Health Insurance Deduction 2020, Such Us:

- Self Employed Health Insurance Deduction

- Breaking Down The Self Employed Health Insurance Deduction Eric Nisall

- Top 10 Tax Deductions And Expenses For Small Businesses To Claim Wave Year End Wave Blog

- Philhealth Sets New Contribution Schedule Assures Immediate Eligibility To Benefits Philhealth

- Medical Expenses May Be Deducted On A N Tax Return Chegg Com

If you re looking for The Furlough Scheme For Self Employed you've reached the ideal location. We ve got 104 graphics about the furlough scheme for self employed including images, pictures, photos, backgrounds, and more. In these page, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

You can only take the 12000.

The furlough scheme for self employed. Say you owe 15000 in self employment taxes from last years earnings. Tax deductions for self employed people in 2020 posted on december 16 2019 when you go on business on your own there are many perks you enjoy like setting your own hours taking only the jobs you want and working for the opportunity to make more money than when you are an employee. The self employment tax rate is 153 of net.

This insurance can also cover your children up to age 27 26 or younger as of the end of a tax year whether they are your dependents or not. For example if your business earned 12000 but premiums cost you 15000 you cant claim the entire 15000. It can be equal to 100 percent of what you pay in premiums and its an adjustment to income so it lowers your agi helping you to qualify for still other advantageous tax breaks.

Your self employment tax deduction. Self employment taxes as self employment tax deductions weirdly one of the most common self employment tax deductions is self employment tax itself. Youll find the deduction on your personal income tax form and you can file for it if you were self employed and showed a profit for the year.

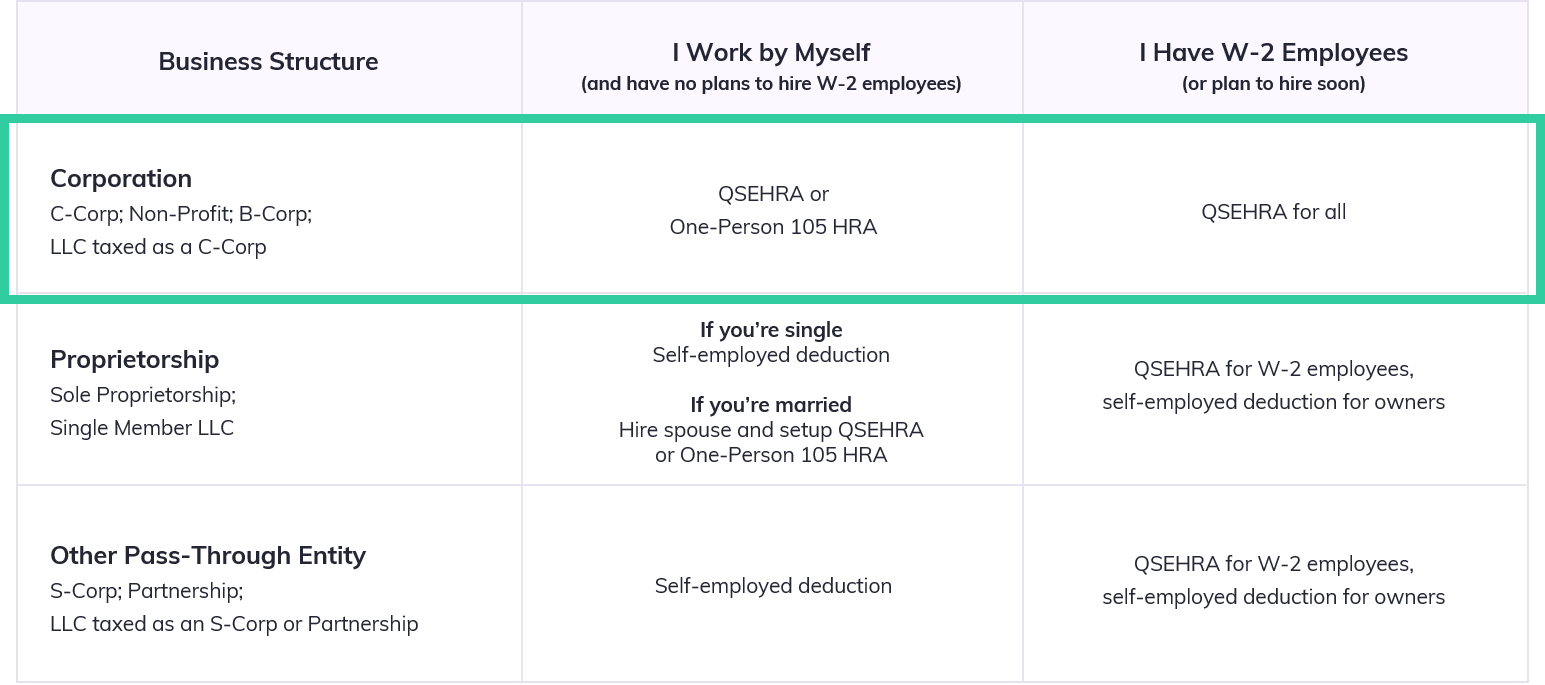

The self employed health insurance deduction applies to health insurance premiums for yourself your spouse and your dependents. Self employed health insurance deduction. This deduction reduces your taxable income by the amount of money you pay for health.

You may be able to deduct the amount you paid for health insurance for yourself your spouse and your dependents. The deduction which youll find on line 16 of schedule 1 attached to your form 1040 allows self employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year. Your self employment income is calculated on schedule c or f and it must be equal to or exceed the amount of your health insurance deduction.

Health insurance premiums for self employed individuals became 100 tax deductible in 2003 in many cases. You can deduct what would be the employers half of medicare and social security taxes. The insurance also can cover your child who was under age 27 at the end of 2019 even if the child wasnt your dependent.

This health insurance write off is entered on page 1 of form 1040 which means you benefit whether or not you itemize your deductions.

More From The Furlough Scheme For Self Employed

- Government Law College Kozhikode Admission 2020

- Government Of Canada Structure Chart

- Register Self Employed Deadline

- Self Employed Register Form

- Local Government Taxes Australia

Incoming Search Terms:

- Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2 Local Government Taxes Australia,

- The 411 On The Self Employed Health Insurance Deduction Taxact Blog Local Government Taxes Australia,

- 2 Local Government Taxes Australia,

- Self Employment Tax Deductions Reducing Your Tax Liability Local Government Taxes Australia,

- 15 Big Self Employment Tax Deductions In 2020 Nerdwallet Local Government Taxes Australia,

- Breaking Down The Self Employed Health Insurance Deduction Eric Nisall Local Government Taxes Australia,